Table of Contents

ToggleWhat is Form 1028 Employment Verification and Why is It Important?

Form 1028 Employment Verification is a crucial document used to confirm an individual’s employment status, job title, work history, and other related details for various purposes. This form serves as an essential tool for employers, employees, and other institutions that require official proof of employment information. Whether it’s for securing a loan, applying for a mortgage, or ensuring that someone meets qualifications for a specific job, Form 1028 helps verify employment details in a standardized manner.

What is Form 1028?

Form 1028 is an employment verification form typically used to verify an employee’s job status and work history. The document may be used by employers, government agencies, or third parties to confirm an individual’s employment details. It is often requested by landlords, lenders, or other parties that need to assess a person’s ability to pay rent or manage financial obligations. It may also be required by certain government entities when evaluating applicants for social benefits or public assistance programs.

In its simplest form, this document serves as a way for employers to authenticate the information provided by employees or job applicants, ensuring that the claimed employment details are accurate. The form can contain several fields to input details such as the employee’s full name, job title, dates of employment, and salary. It serves as a proof of employment for all parties involved.

Importance of Form 1028 in the Employment Verification Process

Form 1028 plays an important role in various sectors by streamlining the verification process for employment information. For employers, it’s a convenient and standardized way to provide proof of employment when required by external entities. For employees or job seekers, it offers an official document that confirms their employment status, which can be necessary in securing loans, applying for rental properties, or proving their eligibility for government assistance programs.

The significance of Form 1028 cannot be overstated in industries like real estate, finance, and government, where verifying a person’s employment is often a critical step before making decisions related to loan approval, housing applications, or eligibility for benefits.

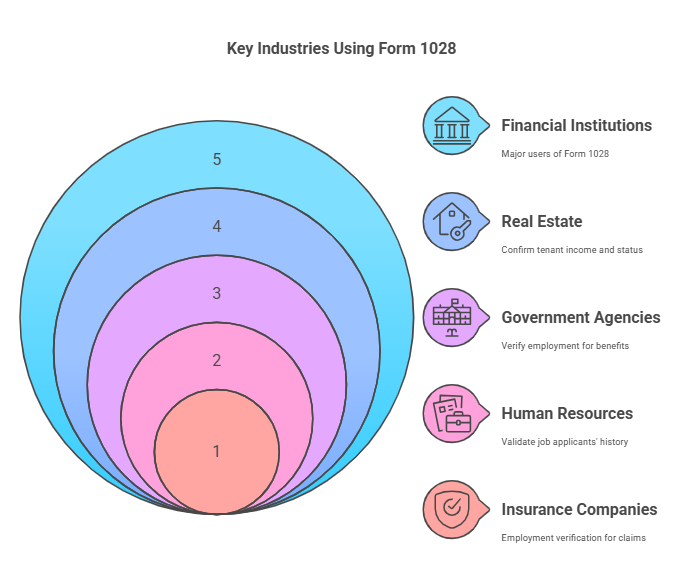

Key Industries Using Form 1028

Form 1028 is used across several industries and sectors. Here’s a breakdown of how different sectors rely on this form:

- Financial Institutions and Lenders: When applying for loans, mortgages, or credit, financial institutions frequently request proof of employment. Form 1028 is used to verify an applicant’s income and job stability, which helps lenders assess the applicant’s ability to repay loans.

- Real Estate and Property Management: Landlords and property managers often request Form 1028 to confirm the employment status and income of prospective tenants. This helps ensure that applicants can meet monthly rent payments.

- Government Agencies: Form 1028 can also be used by government agencies to verify employment for programs such as unemployment benefits, public housing assistance, or social security.

- Human Resources and Recruitment: Companies may use Form 1028 during the recruitment process to verify job applicants’ previous employment. It ensures that applicants are truthful about their past work experience.

- Insurance Companies: Insurance firms may also request employment verification when processing claims, especially when applicants are applying for disability or life insurance policies.

Key Benefits of Form 1028

- Ensures Accuracy: By providing standardized proof of employment, Form 1028 ensures that all employment-related details are verified and accurate, minimizing the risk of fraud or misinformation.

- Streamlines the Verification Process: The form helps streamline and expedite the verification process, saving time for employers, employees, and third parties.

- Protects Employers and Employees: Using a standardized verification form protects both parties by documenting the employment relationship and confirming essential details such as salary and dates of employment.

- Legally Recognized: In many cases, Form 1028 is legally recognized and accepted by agencies, banks, and landlords, making it a reliable source of proof.

- Reduces Errors: With a clear and structured format, Form 1028 reduces the chances of errors or omissions that might arise with informal forms of employment verification.

Why You Should Check Your Form 1028

Checking your Form 1028 is important to ensure that all information is correct before it is submitted to an employer, government agency, or financial institution. Misinformation on this form can lead to delays, denials, or even legal complications, especially when it concerns important matters like loan approval or housing.

For employees or job seekers, knowing what information is included in the verification process and confirming its accuracy beforehand can help prevent issues that might arise later on. Ensuring that your form is correct is critical for a smooth verification process, whether you’re applying for a job, a mortgage, or benefits.

How to Complete and Submit Form 1028 for Employment Verification

Filling out and submitting Form 1028 for employment verification may seem like a straightforward task, but it requires attention to detail to ensure that all information is accurate and complete. This section will guide you through the necessary steps to complete the form, common mistakes to avoid, and how to use services like www.rapidhiresolutions.com to streamline the process.

Step-by-Step Guide on How to Complete Form 1028

To successfully complete Form 1028, both the employee and employer need to provide specific information. Here’s a step-by-step guide on how to fill out the form correctly:

1. Employee Information

- Full Name: The employee’s full legal name should be listed as it appears on their official documents. This includes first, middle, and last names.

- Social Security Number (SSN): The employee’s SSN is typically requested to verify their identity and work history. Make sure the number is entered without any errors.

- Date of Birth: The employee’s date of birth may also be required to help verify their identity.

2. Employer Information

- Employer’s Business Name: The full name of the business or company the employee works for should be listed. This information can be found on company documents such as contracts or pay stubs.

- Employer’s Address: Provide the employer’s full business address, including street address, city, state, and zip code.

- Employer’s Contact Information: The contact number and email address of the employer’s human resources department or the person in charge of verification should be included.

3. Employment Details

- Position or Job Title: The employee’s current job title or position within the company should be listed clearly.

- Employment Dates: This includes both the start date and, if applicable, the end date of employment. Be sure to check that the dates are accurate, as incorrect dates could lead to discrepancies in the verification process.

- Salary Information: Include the employee’s current salary, which may include both base pay and bonuses or commissions. This section can sometimes be optional, depending on the requirements of the verification process.

4. Additional Information

- Employment Status: The employee’s status should be indicated, such as full-time, part-time, or temporary. Make sure to clarify any unique circumstances, such as leaves of absence or short-term assignments.

- Signature: The employee must sign and date the form to verify the accuracy of the information provided. The employer may also need to sign the document, depending on the request.

5. Verification Process

- Once the form is completed, it should be submitted to the requesting party, which may be a lender, landlord, government agency, or other third-party verifier. The employer may be required to submit the form directly, or it may be sent by the employee.

Common Mistakes to Avoid When Completing Form 1028

- Incorrect Personal Information: Always double-check the employee’s name, SSN, and date of birth to ensure they match official records. Even small errors can lead to delays or denials.

- Missing Employment Dates: Ensure that the start and end dates of employment are correct. Mistakes here can raise questions about the validity of the employment.

- Unclear Salary Information: If the employee’s salary is a combination of different pay types, ensure that it’s broken down clearly and correctly.

- Leaving Out Contact Information: Make sure the employer’s contact information is provided clearly. This allows the requesting party to reach out quickly if needed.

- No Signatures: Ensure both the employee and employer sign and date the form. An unsigned form is typically not considered valid.

How to Submit Form 1028

Form 1028 can typically be submitted in several ways, depending on the requirements of the requesting party:

- Electronic Submission: If the form needs to be submitted electronically, both the employee and employer may need to send it via email or through a secure online portal. Make sure that any electronic submission includes the proper security measures, such as password protection or encryption, to protect sensitive personal data.

- Postal Submission: In some cases, the form may need to be mailed to the requesting agency or company. Be sure to send it through a secure mailing service to ensure that the form arrives safely and in a timely manner.

- In-Person Submission: In some cases, submitting the form in person may be an option. This may be required by some agencies or for certain government applications.

How www.rapidhiresolutions.com Can Help with Form 1028

Rapid Hire Solutions is a reliable service provider for employment verification needs, offering streamlined assistance for individuals and companies that need help with Form 1028. Whether you’re an employer looking to verify employee details quickly or an employee who needs to submit Form 1028 to verify your job status, Rapid Hire Solutions provides fast, accurate, and secure services for all types of employment verification.

Here’s how Rapid Hire Solutions can help:

- Efficient Processing: Their team assists in completing and submitting the Form 1028 correctly to ensure no delays in verification.

- Secure Services: With a focus on security, Rapid Hire Solutions ensures that all personal and employment information is handled with care and protected from unauthorized access.

- Expert Assistance: Whether you’re unfamiliar with the form or need help with complex employment details, Rapid Hire Solutions offers expert guidance to make sure the form is filled out accurately.

Using a service like www.rapidhiresolutions.com can save time and reduce the stress involved in completing and submitting Form 1028. By ensuring that the form is filled out correctly and securely submitted, you can avoid common pitfalls and ensure that your employment verification goes smoothly.

Table: Key Sections of Form 1028 and What Information Is Needed

| Section | Required Information |

|---|---|

| Employee Information | Full name, Social Security Number (SSN), date of birth. |

| Employer Information | Employer’s business name, address, contact number, and email. |

| Employment Details | Job title, start date, end date (if applicable), salary (optional). |

| Verification Process | Signature and date from both the employee and employer. |

| Submission Method | Electronic, postal, or in-person submission depending on the requesting party’s requirements. |

Frequently Asked Questions, Common Issues, and Conclusion on Form 1028 Employment Verification

Form 1028 is an essential tool for employment verification, and understanding its nuances can help streamline the process for both employers and employees. In this section, we’ll answer common questions, address potential issues, and wrap up the key takeaways, emphasizing how reliable services like www.rapidhiresolutions.com can help ensure a smooth and efficient verification process.

Frequently Asked Questions About Form 1028

When is Form 1028 required?

Form 1028 is typically requested when a third party needs to verify an individual's employment status. This could include employers conducting background checks for potential employees, government agencies for public assistance programs, or landlords reviewing rental applications. Additionally, certain financial institutions may require employment verification when processing loans or mortgages.

Who can submit Form 1028?

The form is generally submitted by either the employee or the employer, depending on the situation. In most cases, the employer will submit the form directly to the requesting party. However, the employee may need to assist in providing necessary information or authorizing the submission.

How long does it take to process Form 1028?

The processing time for Form 1028 varies depending on the employer and the requesting party. In some cases, it may take just a few days if the employer responds promptly. However, more complex verification requests could take longer. If there are delays, it’s essential to follow up with the employer or the party requesting the verification.

Can I check the status of my employment verification?

Yes, employees can check the status of their employment verification by contacting the requesting party or employer. If the employer submitted the form, they may also have information on whether it was processed successfully.

What should I do if there’s an error on the Form 1028?

If you notice any inaccuracies on Form 1028 after submission, it’s important to address the issue as quickly as possible. Employees can contact their employer to rectify the error and resubmit the form. If the error is related to an employer's information, they should work together to ensure that all details are corrected and submitted accurately.

How often should I update my employment verification?

You should update your employment verification whenever there is a change in your job status, such as a promotion, change in salary, or employment termination. Regular updates ensure that the information you provide remains accurate and relevant for applications or background checks.

Common Issues with Form 1028 and How to Resolve Them

1. Missing or Inaccurate Information

One of the most common issues with Form 1028 is incomplete or incorrect information, such as misspelled names, incorrect Social Security numbers, or missing employment dates. To avoid this, always double-check the employee’s information before submitting the form. If there is any uncertainty, consult official records to ensure accuracy.

2. Delays in Processing

Delays can occur when the form is incomplete, when additional verification is needed, or when the employer is slow to respond. To avoid delays, ensure that all required information is filled out completely and correctly. If the form is time-sensitive, consider using expedited services like www.rapidhiresolutions.com, which offer quicker processing times and help ensure everything is submitted properly.

3. Failure to Submit or Sign the Form

Another common issue is the failure to submit the form or to sign it. Both the employee and employer should review the form before submission to confirm that all necessary signatures are in place. An unsigned form is generally not considered valid.

4. Discrepancies in Employment Details

Sometimes, discrepancies arise between the employee’s record and the information provided on the form. This could happen if the employee’s employment details are outdated or incomplete. If discrepancies occur, the employee and employer should work together to resolve them. Documentation, such as pay stubs, tax records, or contracts, can be helpful in clarifying any misunderstandings.

5. Confidentiality Concerns

Since Form 1028 involves sharing sensitive information, confidentiality is a concern for both employers and employees. Always ensure that the form is submitted securely through encryption or a trusted third-party service. Using a professional service like www.rapidhiresolutions.com ensures that all personal data is handled with the highest level of security.

Why Choose www.rapidhiresolutions.com for Form 1028 Services?

Submitting Form 1028 can be a time-sensitive and complicated task, especially if you’re unfamiliar with the process. Using a professional service like www.rapidhiresolutions.com can simplify the process and help avoid common mistakes. Here’s why choosing Rapid Hire Solutions makes sense:

- Expert Assistance: They specialize in employment verification and understand the intricacies of forms like 1028. Whether you’re an employer or an employee, they can guide you through the submission process to ensure accuracy and timeliness.

- Efficiency: Rapid Hire Solutions streamlines the process, ensuring that Form 1028 is completed and submitted as quickly as possible. This can help you avoid unnecessary delays or complications.

- Secure Submissions: With a focus on data security, www.rapidhiresolutions.com ensures that all sensitive information is handled securely and submitted safely, reducing the risk of data breaches.

- Comprehensive Services: In addition to employment verification forms, Rapid Hire Solutions offers a variety of other background check services, making them a one-stop shop for all your verification needs.

Conclusion

Form 1028 is an important document in the employment verification process, used to confirm essential information about an individual’s employment history. Understanding how to correctly fill out and submit this form can save time and avoid complications in verification. By using services like www.rapidhiresolutions.com, both employers and employees can streamline the process and ensure that all information is accurate and securely submitted. Whether you’re verifying your own employment details or assisting an employee, following the right steps and using trusted services ensures the process goes smoothly.