Introduction to Background Checks and the Timeframe for Criminal Records

When it comes to employment, housing, or even loan applications, background checks are often a key part of the decision-making process. Employers, landlords, and lenders use background checks to assess an individual’s suitability for a particular role, tenancy, or credit. However, one question that frequently arises is: how far back do background checks go? The answer is not straightforward because the timeframe for background checks can vary depending on several factors, including the type of check being performed, the specific regulations in place, and the jurisdiction where the check is conducted.

What is a Background Check?

A background check is a process used by various organizations to verify the information provided by an individual, investigate their criminal history, review their credit history, or confirm employment, educational, and residential history. Employers, landlords, banks, and other entities utilize background checks to mitigate risks and make informed decisions.

Background checks help identify whether someone has been involved in criminal activities, has a solid employment history, maintains good financial habits, and possesses the qualifications they claim. This process is critical for hiring managers, landlords, and lenders as it helps ensure safety, compliance with laws, and that applicants meet certain standards of trustworthiness and responsibility.

What Factors Influence the Timeframe of a Background Check?

The length of time a background check can go back depends on several factors. It is important to note that there are different types of background checks for different purposes, such as employment, housing, credit, and more. Each of these checks can have different timeframes and guidelines for how far back they can go.

Types of Background Checks and Their Timeframes

- Criminal Background Check: A criminal background check typically includes a search of an individual’s criminal record for convictions, arrests, and pending charges. The time period for which criminal records are reported can vary depending on the severity of the crime and the jurisdiction. For example, felony convictions might be reported indefinitely, while misdemeanors may have a shorter reporting window.

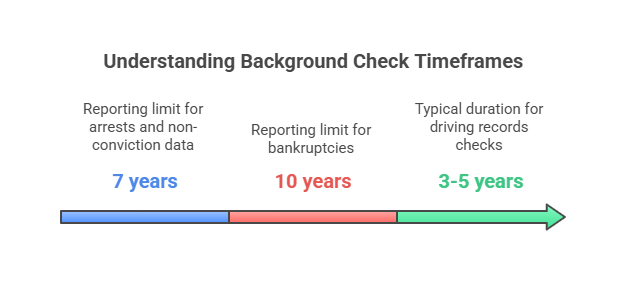

- Federal Regulations: Under the Fair Credit Reporting Act (FCRA), criminal convictions can be reported for as long as they appear in the record, but arrests and other non-conviction data can only be reported for 7 years.

- State Regulations: Different states may have their own rules regarding how far back criminal records can be reported. For instance, in some states, felony convictions can be reported indefinitely, while misdemeanors may be limited to a 7-10 year reporting window.

- Employment History Check: An employment history check typically includes verifying past employers, job titles, dates of employment, and reasons for leaving. Employers often verify this information to ensure that applicants are truthful about their work history.

- Timeframe for Verification: Employment history checks typically go back as far as an applicant’s entire career. There are no federal laws limiting how far back an employer can verify past employment. However, some employers may only look at recent work experience, generally going back 5 to 10 years, to focus on more relevant job experience.

- Credit Report Check: Credit checks are often used in the hiring process for positions that require financial responsibility or access to company funds. Credit checks include information on an individual’s credit score, bankruptcies, debt, and payment history.

- Timeframe for Credit Reporting: The FCRA dictates that credit reports can include bankruptcies for up to 10 years and other negative credit information, such as late payments or charge-offs, for up to 7 years.

- Education Verification: Education verification checks confirm the academic qualifications and certifications an applicant claims to have obtained. Employers may check the dates of attendance, degrees earned, and the institutions attended.

- Timeframe for Verification: Education verification generally goes back to the most recent degree or certification earned. There are no strict laws limiting the time frame for verifying educational history, but applicants may not be asked about older degrees if they are not relevant to the job they are applying for.

- Driving Records Check: For jobs that involve driving, employers often conduct Motor Vehicle Record (MVR) checks. These checks can reveal information such as traffic violations, accidents, DUIs, and license status.

- Timeframe for MVR: MVR checks can typically go back as far as 3 to 5 years, although certain serious offenses (such as DUIs) may appear for a longer period, depending on state regulations.

How Far Back Can a Background Check Go?

In general, a background check can go as far back as the information is available, but various state and federal laws regulate how long specific records can be reported and used in hiring decisions.

- Criminal Records: As mentioned, most criminal records can be reported for a 7-year period, but certain types of crimes, such as felonies, may be reported indefinitely.

- Employment History: Employment history checks are not limited by time and can go as far back as the applicant’s entire career.

- Credit Reports: Credit history reports are typically limited to 7-10 years, depending on the type of information.

State and Federal Laws That Influence the Timeframe

The Fair Credit Reporting Act (FCRA) governs how long certain information can be reported, including criminal convictions, bankruptcies, and credit history. However, individual states may have their own rules that are more restrictive or have different reporting windows for certain types of records.

- Ban the Box Laws: Many states and localities have enacted “Ban the Box” laws, which prevent employers from asking about criminal convictions on job applications. These laws often require that criminal history only be considered later in the hiring process, ensuring applicants are not automatically disqualified.

- State-Specific Regulations: Some states have enacted their own restrictions on how far back criminal records can be reported. For example, in California, employers cannot consider most criminal records older than 7 years unless the applicant is applying for a position with a salary above a certain threshold.

How the 7-Year Rule Works

One of the most important regulations that governs the timeframe for background checks is the 7-year rule. This rule limits how far back certain types of information, such as criminal convictions, can be reported on background checks. The 7-year rule applies primarily to misdemeanor convictions but can also apply to felonies in some cases, depending on the state.

- Exceptions to the 7-Year Rule: Some crimes, such as violent offenses or those related to financial fraud, may not be subject to the 7-year rule and can be reported indefinitely.

The Role of Background Check Agencies

Background check agencies play an important role in ensuring that background checks comply with federal and state laws. These agencies are responsible for collecting, verifying, and reporting information while also ensuring that they do not overstep legal boundaries.

Background check providers like Rapid Hire Solutions can help employers navigate the complexities of the 7-year rule and other regulations. They assist businesses in conducting thorough, compliant background checks that comply with the FCRA and any relevant state-specific regulations.

Factors That Affect How Far Back a Background Check Goes and the Role of the FCRA

When conducting background checks, it’s essential to understand the various factors that influence how far back a background check can go. The timeframe for a background check is not universally fixed, and several elements can impact the extent of the check, such as the type of background check, applicable federal and state regulations, and the nature of the information being reviewed.

The Role of Federal and State Laws

The length of time for which certain information can be reported is governed by both federal and state laws. Among these, the Fair Credit Reporting Act (FCRA) plays a crucial role in setting limits on how long certain information can be included in background checks.

- Fair Credit Reporting Act (FCRA): The FCRA is a federal law designed to protect consumers from unfair reporting practices in background checks. It establishes guidelines on what information can be included in reports and for how long. Here are the key provisions of the FCRA that impact how far back a background check can go:

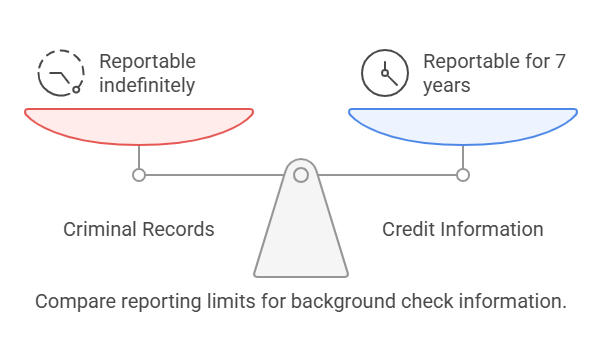

- Criminal History: Under the FCRA, criminal convictions can be reported indefinitely. However, arrests that did not lead to convictions or other non-conviction data can only be reported for 7 years.

- Bankruptcies: Bankruptcies can appear on background checks for up to 10 years from the date of filing.

- Credit Information: Negative credit information, such as late payments, charge-offs, and defaults, can be reported for 7 years.

While the FCRA imposes these federal limitations, individual states can impose more restrictive reporting regulations, particularly when it comes to criminal history. For example, some states may limit reporting on certain types of convictions, such as misdemeanors, after a period of 7 years, while others may allow reporting on convictions without time restrictions.

- State-Specific Regulations: States often have their own regulations regarding how far back certain information can be included in background checks. For example:

- California: California’s laws prevent employers from considering most criminal convictions that are older than 7 years, except for certain high-level positions, such as those requiring a high salary.

- New York: New York’s laws also have a 7-year limit on reporting most criminal convictions, although it may apply differently to certain industries (e.g., healthcare, finance).

- Texas: In Texas, criminal records, particularly felonies, may be reported for longer than 7 years if the crime was particularly serious or if the applicant is applying for positions related to law enforcement or financial roles.

These laws can vary significantly across states, so employers and background check providers must ensure that they are compliant with state-specific regulations.

Types of Background Checks and Their Reporting Timeframes

As mentioned in the timeframe for a background check varies depending on the type of check being conducted. Below is a breakdown of how far back different types of background checks typically go:

| Type of Background Check | Typical Reporting Timeframe | Key Considerations |

|---|---|---|

| Criminal History Check | Up to 7 years for non-conviction data, indefinitely for convictions | Felony convictions can be reported indefinitely. Misdemeanors and arrests without convictions generally have a 7-year reporting limit under the FCRA. |

| Employment History Check | No limit | Employment history can be verified for as long as the applicant has worked. There is no limit to how far back this check can go. |

| Credit History Check | 7 years for negative information | Negative credit items, including bankruptcies, defaults, and late payments, are reportable for up to 7 years under the FCRA. |

| Education Verification | No limit | Education verification can go back as long as the degree is relevant to the position, with no federal law limiting its timeframe. |

| Driving Records Check (MVR) | 3-5 years, but serious violations may appear longer | MVR checks typically cover the last 3-5 years, but DUIs and reckless driving violations may appear for a longer period depending on the state. |

Key Factors That Affect the Reporting Timeframe

Several factors can affect the length of time a background check covers. These include the type of crime, the severity of the offense, the state where the check is being conducted, and the nature of the position being applied for.

- Severity of the Crime:

- Felonies: Felony convictions are considered more severe offenses and may be reported indefinitely, depending on the state. For example, felony convictions for violent crimes or major financial fraud may remain on a person’s criminal record permanently.

- Misdemeanors: Misdemeanors are generally less severe than felonies and may be reported for 7 years, but this timeframe can vary by jurisdiction. In some states, misdemeanors may only be reported for a shorter period.

- State-Specific Reporting Rules:

- In California, as part of the Ban the Box initiative, employers cannot inquire about an applicant’s criminal record until after a conditional offer of employment has been made. Furthermore, only convictions that are 7 years old or less can be considered for most roles.

- States like New York and Michigan also impose 7-year limitations on reporting criminal convictions, which impacts employers who are conducting background checks for job applicants in these states.

- Nature of the Job:

- High-level positions, such as those in law enforcement, finance, or healthcare, may require background checks that go further back to ensure candidates meet certain security and regulatory standards. For example, an employer may conduct a background check going back 10 years for financial crimes when hiring for a banking role.

- Driving-Related Jobs: For positions that involve driving, an employer may check the applicant’s driving history for 3-5 years to assess their driving behavior. Serious offenses like DUIs may appear for a longer period.

- Ban the Box Laws: Some jurisdictions have enacted Ban the Box laws, which prevent employers from asking about criminal history on job applications. These laws often mandate that criminal history be considered only later in the hiring process and that older convictions (typically more than 7 years old) not be considered at all.

How Rapid Hire Solutions Helps with Compliance

Employers must ensure their background checks comply with both federal and state laws. This is where companies like Rapid Hire Solutions come into play. Rapid Hire Solutions specializes in conducting thorough and legally compliant background checks that adhere to the FCRA and any state-specific regulations.

They help businesses streamline the background check process by providing access to the most up-to-date and accurate information available. Rapid Hire Solutions ensures that criminal records, employment history, credit reports, and other essential data are reported within legal timeframes and that the information used for hiring decisions is fair, accurate, and compliant with the law.

Legal Aspects, FAQs, and Key Takeaways

When conducting background checks, understanding the legal framework that governs how far back certain information can be reported is critical. Legal compliance is not just about adhering to regulations but also about ensuring that your background checks are fair, non-discriminatory, and protect both employers and applicants. In this section, we will explore the legal implications of conducting background checks, answer frequently asked questions (FAQs) related to how far back a background check can go, and conclude with key takeaways on maintaining legal and fair practices during the hiring process.

The Legal Implications of Background Checks

There are several federal and state laws that regulate the use of background checks in hiring decisions. Understanding these laws is key to ensuring that an employer’s hiring practices are legally sound and that they respect the rights of job applicants. Here, we break down the most significant legal considerations surrounding the background check process.

Fair Credit Reporting Act (FCRA)

The Fair Credit Reporting Act (FCRA) is the federal law that governs how employers and other entities can use background check information. The law provides guidelines for how long certain types of information can be reported and dictates the process by which an individual’s background can be checked. The FCRA limits the following:

- Criminal Records: As previously mentioned, criminal convictions can be reported indefinitely, while arrests and non-convictions may only be reported for 7 years. However, states may impose stricter regulations on how far back criminal records can go.

- Credit Information: Negative credit information, including bankruptcies, collections, and charge-offs, is reportable for 7 years.

- Employment and Education: Employment and education verifications typically do not have any time limit, though most employers will only verify the last 5-10 years of work history, especially if they are related to the position being applied for.

The FCRA also mandates that an employer obtain written consent from an applicant before conducting a background check and that the applicant is notified if a decision to hire is made based on information found in the report.

Ban the Box Laws and Equal Employment Opportunity (EEO)

In recent years, many states and localities have enacted Ban the Box laws to help ensure that individuals with criminal records are not automatically excluded from the hiring process. These laws typically prohibit employers from asking about criminal history on the initial job application. This is particularly important because it ensures that applicants are evaluated based on their qualifications first, without the bias of past criminal history.

Ban the Box laws vary from state to state, but the general principle is that employers cannot inquire about criminal history until after an initial interview or after a conditional offer of employment is made. Additionally, these laws typically limit the reporting of criminal history that is older than 7 years.

Employers must also ensure that they comply with Equal Employment Opportunity (EEO) laws to avoid discrimination. Employers are prohibited from considering criminal records in a way that disproportionately impacts certain groups based on race, ethnicity, or national origin. If an employer uses background checks in the hiring process, it’s essential to ensure that the process is not discriminatory and that it’s applied equally to all applicants.

State-Specific Laws

While the FCRA provides a federal framework, state laws can impose additional restrictions on how far back a background check can go. These laws vary by state, and employers must be familiar with the regulations in the state where they operate. Some states limit reporting on criminal records to 7 years, while others may have exceptions for more serious crimes.

In addition to the FCRA and Ban the Box laws, many states have adopted laws that regulate how background checks are conducted, especially when it comes to criminal history. For example, in California, employers are restricted from considering most criminal convictions older than 7 years, except for certain serious crimes. Similarly, New York imposes a 7-year reporting limit for criminal convictions but allows employers to consider more recent offenses.

Employers should be mindful of the specific laws in their state and industry to avoid potential legal issues. For example, jobs in financial institutions or law enforcement may have different rules regarding criminal record reporting compared to other industries.

Frequently Asked Questions (FAQs)

Now that we have covered the general legal framework for background checks, let’s address some of the most commonly asked questions related to how far back background checks go and the legal implications of conducting them.

How far back does an employment background check typically go?

The time period for which an employment background check can go back depends on the type of check and the laws in the employer’s state. Generally, employment history can be verified for as long as the applicant has worked, with no specific time limit. For criminal history, most employers will only consider convictions that are 7 years old or less, unless the crime is particularly serious or the applicant is applying for a high-level role.

Can an employer check my entire criminal history, even if the conviction is over 10 years old?

In most cases, an employer cannot check your entire criminal history if the conviction is over 7 years old, unless you are applying for a role in a high-security position, law enforcement, or the financial sector. Under the FCRA, employers are only allowed to report certain criminal convictions for up to 7 years unless there are exceptions in the state’s law.

How far back does a credit check go when applying for a job?

A credit check will typically look at 7 years of financial history, including defaults, bankruptcies, late payments, and other negative marks. Positive financial history, such as paying off debt or maintaining a stable credit score, may be included indefinitely.

Do landlords have the same regulations for background checks as employers?

While there are some similarities between employment and tenant background checks, the laws vary. For instance, in most states, a landlord can check an applicant’s criminal history but is usually restricted from considering criminal convictions that are older than 7 years. However, the specifics depend on local and state laws. Additionally, the Fair Housing Act (FHA) prohibits landlords from discriminating against tenants based on race, color, national origin, religion, sex, familial status, or disability.

What should I do if my background check contains outdated or incorrect information?

If you find outdated or incorrect information on your background check, you have the right to dispute it. Under the FCRA, you can contact the background check agency and the company that provided the information. They are required to investigate your dispute within 30 days and correct any inaccuracies. If the dispute is not resolved, you can escalate it to the Consumer Financial Protection Bureau (CFPB) or your state’s attorney general’s office.

How far back does an employment background check typically go?

The time period for which an employment background check can go back depends on the type of check and the laws in the employer’s state. Generally, employment history can be verified for as long as the applicant has worked, with no specific time limit. For criminal history, most employers will only consider convictions that are 7 years old or less, unless the crime is particularly serious or the applicant is applying for a high-level role.

Can an employer check my entire criminal history, even if the conviction is over 10 years old?

In most cases, an employer cannot check your entire criminal history if the conviction is over 7 years old, unless you are applying for a role in a high-security position, law enforcement, or the financial sector. Under the FCRA, employers are only allowed to report certain criminal convictions for up to 7 years unless there are exceptions in the state’s law.

How far back does a credit check go when applying for a job?

A credit check will typically look at 7 years of financial history, including defaults, bankruptcies, late payments, and other negative marks. Positive financial history, such as paying off debt or maintaining a stable credit score, may be included indefinitely.

Do landlords have the same regulations for background checks as employers?

While there are some similarities between employment and tenant background checks, the laws vary. For instance, in most states, a landlord can check an applicant’s criminal history but is usually restricted from considering criminal convictions that are older than 7 years. However, the specifics depend on local and state laws. Additionally, the Fair Housing Act (FHA) prohibits landlords from discriminating against tenants based on race, color, national origin, religion, sex, familial status, or disability.

What should I do if my background check contains outdated or incorrect information?

If you find outdated or incorrect information on your background check, you have the right to dispute it. Under the FCRA, you can contact the background check agency and the company that provided the information. They are required to investigate your dispute within 30 days and correct any inaccuracies. If the dispute is not resolved, you can escalate it to the Consumer Financial Protection Bureau (CFPB) or your state’s attorney general’s office.