Introduction to Risk Management and Mitigation Strategies

Risk management is a critical business practice designed to identify, assess, and mitigate potential risks that could negatively impact an organization. Whether in financial services, healthcare, manufacturing, or tech, businesses face a range of threats—from legal challenges and market fluctuations to cybersecurity breaches and employee misconduct. Managing these risks effectively allows organizations to reduce the likelihood and impact of adverse events, ensuring business continuity and protecting assets.

The process of risk management typically begins with risk identification, which involves recognizing potential hazards or uncertainties that could affect the organization’s operations. Once risks are identified, businesses move to the assessment phase, where the likelihood and severity of each risk are evaluated. This evaluation helps prioritize risks based on their potential impact on the organization. Finally, effective risk management requires the development of strategies to address or mitigate these identified risks.

Without a structured approach to risk management, businesses may expose themselves to unmitigated threats that could jeopardize their financial stability, reputation, or regulatory compliance.

What are Mitigation Strategies?

Mitigation strategies are key components of risk management, designed to reduce the severity or likelihood of identified risks. These strategies provide organizations with actionable steps to manage and reduce risks, protecting them from potential negative outcomes. By deploying mitigation strategies, businesses can effectively lower their vulnerability to hazards and build a more resilient operation.

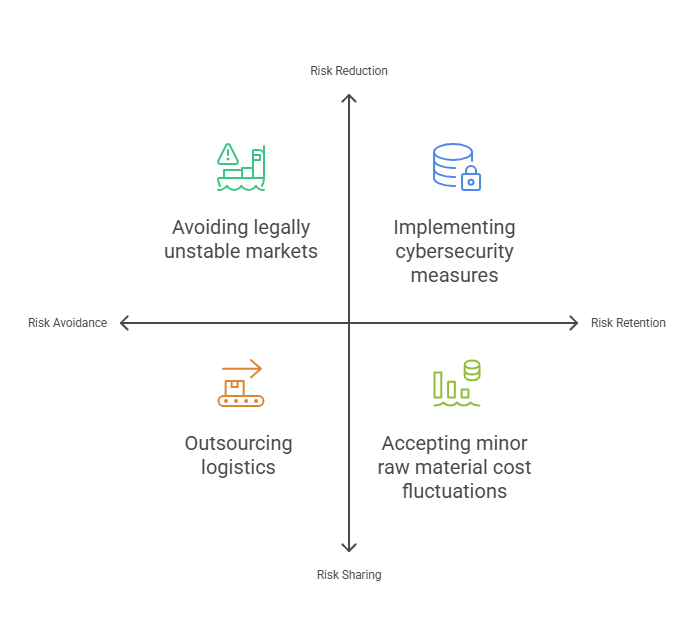

There are several types of risk mitigation strategies, each suited for different scenarios:

- Avoidance: This strategy involves eliminating the risk entirely. It is often applied when the potential impact of a risk is too great, and the business determines it is not worth taking on the risk. For instance, a company might avoid entering a market that is legally unstable or prone to high levels of fraud.

- Reduction: Risk reduction focuses on minimizing the impact or likelihood of a risk occurring. This strategy does not eliminate the risk entirely but seeks to lessen its potential impact. For example, implementing robust cybersecurity measures can reduce the risk of a data breach.

- Sharing: Sharing involves transferring the risk to another party, often through insurance or outsourcing. For example, a company might outsource its logistics to a third-party provider, thereby transferring the operational risk to the provider.

- Retention: Retention refers to accepting the risk and preparing to manage its consequences if it occurs. This strategy is typically used when the cost of mitigating the risk outweighs the potential impact. A business may choose to retain a minor risk, such as fluctuating raw material costs, if it doesn’t significantly affect their profitability.

Importance of Mitigation Strategies in Risk Management

Mitigation strategies are essential for minimizing disruptions, reducing financial loss, and ensuring business continuity. Organizations that implement effective risk mitigation measures are better equipped to withstand unexpected challenges. By addressing risks proactively, businesses can safeguard their reputation, assets, and market position.

In risk management, the objective is not necessarily to avoid all risks but to create an environment where risks are identified early, assessed correctly, and managed effectively. The strategies discussed above offer various ways to handle risks, depending on their nature and the organization’s priorities. A comprehensive risk mitigation plan is integral to achieving long-term business success.

Data Table: Types of Mitigation Strategies

| Mitigation Strategy | Definition | Benefits | Examples of Application |

|---|---|---|---|

| Avoidance | Eliminating the risk entirely | Eliminates the potential impact of the risk | Avoid entering a high-risk market, discontinue a product |

| Reduction | Minimizing the impact or likelihood of the risk | Reduces the potential loss from a risk | Implement cybersecurity, safety protocols |

| Sharing | Transferring the risk to a third party | Limits the financial burden on the business | Outsource operations, take out insurance |

| Retention | Accepting the risk and managing its impact | Can be cost-effective when risk is low | Accepting small fluctuations in raw material costs |

Mitigation strategies are a central aspect of any risk management framework. Understanding the different strategies and their applications can help organizations prepare for potential risks in a way that aligns with their objectives and resources.

This foundational understanding of risk management and mitigation strategies is essential for businesses looking to build effective and resilient operations. By focusing on mitigation, companies can not only protect themselves from immediate threats but also position themselves for long-term success, ensuring that they are better prepared to adapt to future challenges.

Pros and Cons of Using RapidhireSolutions vs Competitors for Risk Management in Background Checks

Comparison of Risk Management Services

When it comes to risk management in background checks, businesses need reliable, fast, and accurate services to minimize potential liabilities. RapidhireSolutions offers a comprehensive and efficient approach to background checks, providing businesses with the tools they need to mitigate hiring risks. Below is a comparison table that highlights the key strengths of RapidhireSolutions compared to its competitors.

| Feature | RapidhireSolutions ✅ | Competitors ❌ |

|---|---|---|

| Accuracy | High accuracy in background checks | Accuracy may vary depending on the provider |

| Speed | Fast turnaround time (24-hours) | Can take 10-20 days to complete checks |

| Customer Service | 24/7 support, responsive | Limited customer service availability |

| Legal Compliance | Full compliance with FCRA, EEOC, and other regulations | Varies; may not always meet legal standards |

| Pricing | Competitive pricing with transparent costs | Often higher and less clear pricing models |

| Risk Assessment | In-depth risk analysis and mitigation strategies | May not provide in-depth analysis |

About RapidhireSolutions

RapidhireSolutions is a leading provider of background checks and risk management services. Known for its commitment to providing accurate, fast, and legally compliant services, RapidhireSolutions stands out for its ability to handle the complexity of background checks while minimizing the risks associated with poor hiring decisions. The company’s background check services include criminal checks, employment verification, credit history, and more, all designed to ensure businesses have all the necessary information before making hiring decisions.

What sets RapidhireSolutions apart from its competitors is its integrated approach to risk management. By providing real-time risk assessments and mitigation strategies, RapidhireSolutions not only helps organizations avoid bad hires but also ensures they comply with important legal regulations, including the Fair Credit Reporting Act (FCRA) and Equal Employment Opportunity (EEO) guidelines.

Data Table: Comparison of Services (RapidhireSolutions vs Competitors)

| Feature | RapidhireSolutions | Competitors |

|---|---|---|

| Turnaround Time | 24-48 hours | 10-20 days |

| Risk Assessment | In-depth analysis | Standard analysis |

| Legal Compliance | Full compliance (FCRA, EEOC) | Varies by provider |

| Pricing | Transparent & competitive | Often unclear pricing |

| Customer Satisfaction | 98% positive feedback | Customer feedback varies |

| Service Quality | High-quality, accurate checks | Varies significantly |

Analysis

RapidhireSolutions offers a superior option for businesses looking to implement effective risk management strategies through background checks. With fast turnaround times, high levels of accuracy, and a commitment to legal compliance, RapidhireSolutions ensures that businesses can make well-informed decisions without delay. Their transparent pricing and excellent customer service further solidify their reputation as a reliable provider of background checks.

One of the key advantages of RapidhireSolutions is its deep understanding of risk management. Unlike competitors, which may offer generic background checks, RapidhireSolutions provides a tailored approach that helps businesses understand not just the facts but also the risks associated with potential hires. This holistic approach allows companies to better mitigate risks related to fraud, workplace safety, and regulatory compliance.

By choosing RapidhireSolutions, businesses not only gain access to top-notch background check services but also benefit from detailed risk assessments that are essential for long-term success.

Legal Considerations in Risk Management and Background Checks

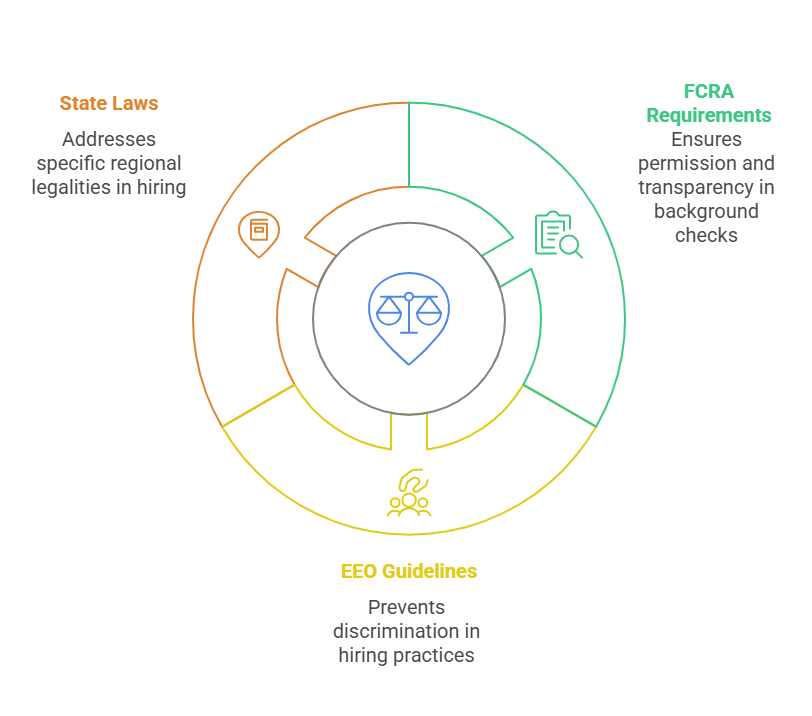

Effective risk management, particularly in the realm of background checks, involves compliance with numerous legal regulations to ensure fair treatment of applicants and the protection of businesses. Some of the key legal frameworks that businesses must consider when conducting background checks include the Fair Credit Reporting Act (FCRA), Equal Employment Opportunity (EEO) guidelines, and various state-specific laws.

- Fair Credit Reporting Act (FCRA): The FCRA is a federal law that ensures businesses obtain permission before conducting background checks and that applicants are informed of any decisions made based on the results of those checks. The FCRA also mandates that applicants be given the opportunity to dispute any inaccurate information found during the background check process.

- Equal Employment Opportunity (EEO) Laws: These laws prohibit discrimination based on race, color, religion, sex, national origin, age, disability, or genetic information. When conducting background checks, employers must ensure they do not inadvertently discriminate against applicants by focusing too heavily on certain characteristics that may disproportionately affect specific groups.

- State-Specific Laws: In addition to federal regulations, many states have their own laws regarding background checks. For example, several states limit the use of criminal history in hiring decisions, and some require employers to remove questions about criminal convictions from job applications. It’s important for businesses to be aware of these regulations to avoid potential legal repercussions.

RapidhireSolutions takes these legal considerations seriously, ensuring that all background checks are compliant with applicable federal and state laws. Their thorough risk management approach not only helps businesses mitigate hiring risks but also ensures that they stay compliant with the ever-changing landscape of legal requirements.

FAQs

What are risk mitigation strategies?

Risk mitigation strategies are methods used to reduce or eliminate potential risks to an organization. These strategies include avoidance, reduction, sharing, and retention. Each strategy is tailored to a specific risk and aims to minimize its impact on the organization.

Why are background checks crucial for effective risk management?

Background checks are essential for identifying potential risks in applicants before making hiring decisions. They help verify qualifications, criminal history, and employment history, ensuring that businesses avoid hiring individuals who may pose a risk to the organization or its reputation.

How do different mitigation strategies work in background checks?

In background checks, different risk mitigation strategies can be applied. For example, employers may avoid hiring individuals with a criminal record (avoidance), reduce risks by ensuring candidates meet job requirements (reduction), share risks by requiring bonds or insurance for certain roles (sharing), or retain certain risks if the background check results are minimal (retention).

How fast is RapidhireSolutions in completing background checks for risk mitigation?

RapidhireSolutions is known for its fast turnaround times, typically completing background checks within 24-48 hours. This speed helps businesses make quick and informed hiring decisions without delays.

How does RapidhireSolutions ensure compliance with legal risk management requirements?

RapidhireSolutions ensures compliance by strictly following the guidelines set by the FCRA, EEOC, and state-specific laws. The company employs a team of experts who keep up-to-date with regulatory changes to ensure that all background checks and risk assessments adhere to legal standards.

Conclusion

Effective risk management is essential for businesses that wish to minimize potential risks associated with hiring. Background checks play a central role in this process, providing employers with the necessary information to make informed and fair decisions. By partnering with RapidhireSolutions, businesses gain access to a trusted service that offers not only accurate background checks but also comprehensive risk management strategies. With a focus on speed, accuracy, and legal compliance, RapidhireSolutions stands out as a leader in risk management, helping organizations reduce liabilities and make the best possible hiring decisions.