Table of Contents

ToggleWhat is Mortgage Employment Verification and Why Is It Important?

What is Mortgage Employment Verification?

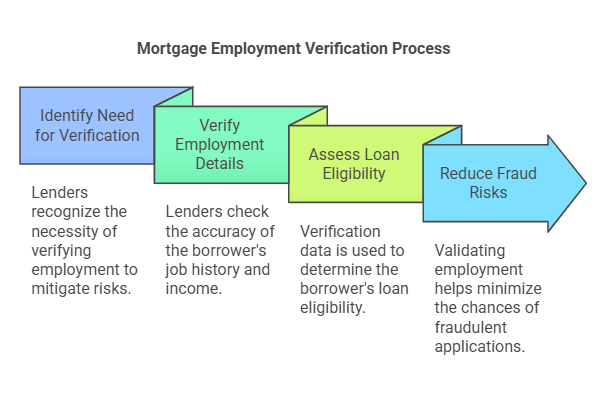

Mortgage employment verification is a crucial step in the home loan application process where lenders confirm the borrower’s employment status, income, and job history. This process helps lenders determine the borrower’s ability to repay the loan and assess the risk associated with approving the mortgage.

Why Mortgage Employment Verification Matters

Lenders require mortgage employment verification to ensure that the borrower has a stable and consistent income source to meet monthly mortgage payments. Without verifying employment, lenders would face significant risks in issuing loans to individuals who may not be financially capable of making timely payments, increasing the likelihood of defaults and foreclosures.

Mortgage employment verification helps:

- Ensure Accuracy: Verifying the borrower’s job history, income, and current employment status helps lenders verify the information provided on the mortgage application.

- Determine Loan Eligibility: Employment verification plays a key role in deciding whether the borrower qualifies for a specific loan amount based on their financial capability.

- Reduce Fraud Risks: A valid employment verification reduces the risk of fraudulent loan applications, where individuals might provide false information regarding their employment status or income.

The Role of Employment Verification in the Loan Approval Process

The loan approval process often hinges on accurate financial and employment information. Without verifying the borrower’s income, employment status, and job history, the lender cannot fully assess the borrower’s financial stability. As a result, mortgage employment verification plays a pivotal role in:

- Determining Debt-to-Income (DTI) Ratio: This ratio helps lenders assess whether the borrower can handle the mortgage payments alongside other debts.

- Establishing Loan Amount: The borrower’s income, verified through employment, can influence the amount of money they are eligible to borrow.

- Finalizing Terms and Conditions: The employment verification impacts the mortgage’s terms, such as interest rates, repayment period, and any conditions tied to the loan approval.

Why Do Lenders Require Mortgage Employment Verification?

Lenders use mortgage employment verification to assess the applicant’s financial responsibility. It helps them to:

- Verify that the borrower is employed and receives a stable income.

- Ensure the borrower’s income is sufficient to meet monthly mortgage payments.

- Confirm the accuracy of the borrower’s financial history as provided in the application.

Verification gives lenders confidence in their decision-making process, ensuring they only approve loans for applicants with a stable income.

The Mortgage Employment Verification Process-Steps, Requirements, and Challenges

The Mortgage Employment Verification Process: Step-by-Step

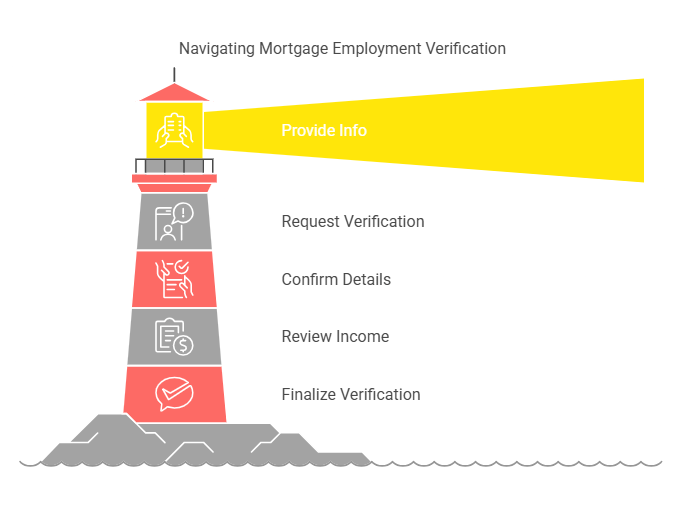

The mortgage employment verification process involves several steps to ensure that all information provided by the borrower is accurate. Lenders follow a structured approach to confirm employment, income, and job history. Below are the typical steps involved in the process:

- Applicant Provides Employment Information:

- During the initial mortgage application, the borrower is required to provide details about their current employer, income, job title, employment start date, and salary.

- The borrower may also provide supporting documents, such as pay stubs or tax returns.

- Request Employment Verification:

- The lender contacts the borrower’s employer or a third-party verification service to confirm the provided employment details.

- The lender may send a written employment verification form or contact the employer directly by phone or email.

- Employer Confirms Employment Details:

- The employer responds by confirming the borrower’s current employment status, job title, employment dates, and income.

- In some cases, employers may also provide additional information about job performance or job stability, though this is not always required.

- Reviewing Income Information:

- The lender may request additional documentation to verify the borrower’s income. This could include recent pay stubs, tax returns, bank statements, or other forms of proof.

- The income details help the lender assess the borrower’s ability to make monthly payments.

- Finalize the Verification:

- Once the verification is complete and all the necessary information is confirmed, the lender uses this data to assess the borrower’s eligibility for the loan.

- If any discrepancies are found, the lender may follow up with the borrower or employer to resolve them before proceeding with the approval.

What Documents Are Needed for Mortgage Employment Verification?

The exact documentation required may vary depending on the lender’s policies, but typical documents that may be requested include:

- Employment Verification Form: A standard form that the lender sends to the borrower’s employer to confirm employment details.

- Pay Stubs: Recent pay stubs that show the borrower’s income and employment status.

- Tax Returns: Tax returns from the past 1-2 years may be requested to confirm income, especially if the borrower is self-employed or has additional sources of income.

- W-2 Forms: These documents provide details of the borrower’s annual wages and tax information, helping to confirm income consistency.

- Bank Statements: Recent bank statements may be requested to confirm the borrower’s financial stability and account balances.

Challenges in Mortgage Employment Verification

While mortgage employment verification is a critical step, several challenges can arise during the process:

- Employer Non-Response or Delays: Employers may take longer to respond to verification requests, delaying the mortgage approval process.

- Inaccurate Information: If the borrower provides inaccurate employment information, such as incorrect job titles or salary figures, this can create complications in the verification process.

- Self-Employed Borrowers: For self-employed individuals, verifying income can be more complex as it often requires additional documentation like tax returns or business financials.

- Privacy Concerns: Some employers may be reluctant to share employee information due to privacy concerns, which can slow down the verification process.

To address some of these challenges, services like Rapid Hire Solutions can assist both lenders and borrowers in streamlining the employment verification process. Rapid Hire Solutions provides professional verification services to ensure quick and accurate employment checks, helping to reduce delays and ensure that the process runs smoothly.

How Mortgage Employment Verification Can Be Completed Quickly

To expedite the mortgage employment verification process, the following steps can be taken:

- Pre-emptive Documentation Submission: Borrowers can proactively provide all necessary documents, such as pay stubs, tax returns, and employment contact details, to ensure a smooth verification process.

- Use of Third-Party Verification Services: Third-party services like Rapid Hire Solutions can quickly verify employment information, reducing the waiting time involved in contacting individual employers.

- Clear Communication: Lenders and borrowers should maintain open communication, addressing any discrepancies or concerns as soon as they arise, which can speed up the resolution process.

Best Practices and Common Mistakes in Mortgage Employment Verification

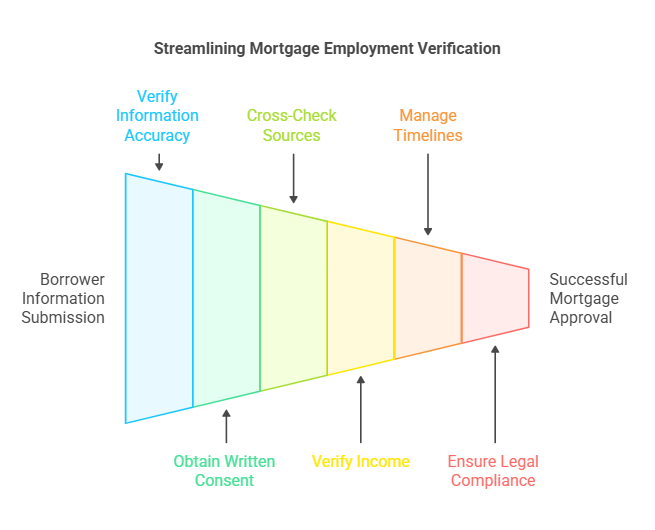

Mortgage employment verification is one of the most crucial steps in the mortgage application process. Both lenders and borrowers must understand the importance of accurate verification, the best practices to ensure efficiency, and the common mistakes to avoid. In this section, we’ll focus on practical steps to ensure a smooth and streamlined verification process.

Best Practices for Mortgage Employment Verification

To ensure that the mortgage employment verification process goes smoothly and is completed without unnecessary delays, both lenders and borrowers need to follow these best practices.

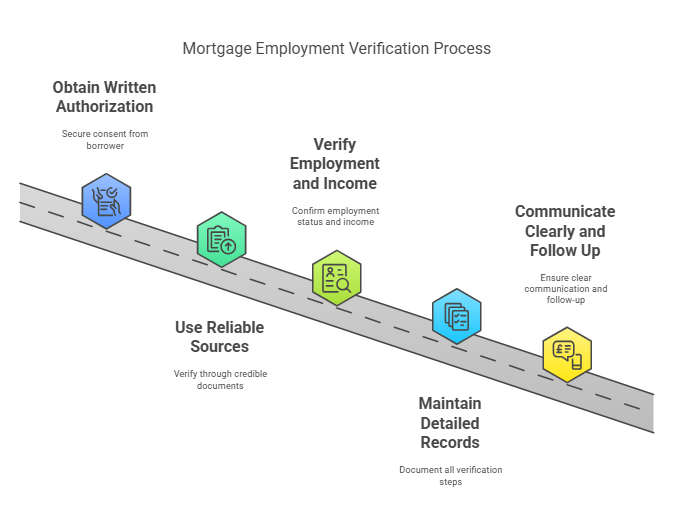

1. Obtain Written Authorization from the Borrower

Before starting the employment verification process, ensure that you have written consent from the borrower. This is legally required and ensures that the borrower is fully aware that their employment details will be verified. A clear consent form protects both the lender and the borrower from any legal issues.

2. Use Reliable and Credible Sources

Verification must come from trusted, credible sources. Relying on official documents, such as pay stubs, W-2 forms, and tax returns, is essential to confirm the borrower’s employment and income status. For further efficiency, lenders can use services like Rapid Hire Solutions, which specializes in providing accurate, up-to-date employment verification to ensure that the process is conducted with integrity.

3. Verify Employment Status and Income Thoroughly

Lenders should ensure that both the borrower’s employment status and their income are thoroughly verified. This step ensures that the borrower is in stable, full-time employment and earns enough to repay the mortgage. Pay stubs, tax returns, and employment verification letters should be cross-referenced and verified for accuracy.

4. Maintain Detailed Records

Lenders should document all the verification steps in detail. This record-keeping helps streamline future processes, provides transparency, and ensures that all communications and steps are fully traceable. By maintaining detailed records, lenders can resolve potential issues more easily.

5. Communicate Clearly and Follow Up Promptly

Communication is key to a smooth process. Lenders should always communicate clearly with borrowers, letting them know what documents are needed and setting expectations for timelines. Regular follow-ups will ensure that all missing or incomplete information is quickly rectified, reducing the risk of delays.

Common Mistakes to Avoid During Mortgage Employment Verification

Even though mortgage employment verification is crucial, there are common mistakes that often complicate or delay the process. Below are some of the most frequent errors and how to avoid them.

1. Providing Inaccurate or Incomplete Information

Providing incomplete or inaccurate employment details is one of the most common mistakes that can delay the mortgage approval process. Borrowers should double-check their information before submitting it to the lender. Lenders should also verify all details through official channels to avoid errors.

2. Not Securing Proper Written Consent

If written consent is not obtained before initiating the verification process, the lender risks violating privacy regulations, which can delay the approval process or lead to legal complications. Always ensure that the borrower has signed the necessary consent forms before proceeding.

3. Relying Solely on Self-Reported Information

While the borrower’s self-reported information is essential, it should not be the sole source used for verification. Lenders should cross-check details with official documents such as pay stubs, tax returns, or directly contact the employer for verification. Failing to verify the information with reliable sources can lead to complications down the line.

4. Failing to Verify Income Properly

Incorrect or incomplete verification of income is a major mistake that can undermine the mortgage process. Lenders should verify the borrower’s income through official documentation such as pay stubs or bank statements. Verifying income from multiple sources ensures its accuracy and helps lenders make a confident lending decision.

5. Delays in the Verification Process

Delays often happen when employers take too long to respond or when borrowers provide incomplete documentation. To avoid delays, lenders should ensure that borrowers submit all necessary documentation upfront and follow up regularly to ensure timely responses from employers.

6. Ignoring Legal and Privacy Concerns

Mortgage employment verification involves collecting sensitive personal data. Lenders must comply with privacy laws and regulations to ensure that the information is kept confidential. Non-compliance could lead to legal issues or data breaches. Lenders should also follow guidelines regarding how and when personal data is used.

Frequently Asked Questions (FAQs) about Mortgage Employment Verification

What documents are required for mortgage employment verification?

Typically, lenders will ask for pay stubs, tax returns (such as W-2 or 1099 forms), employment verification letters, and sometimes additional financial documents such as bank statements. These documents are necessary to verify the borrower’s income and employment status.

How long does the mortgage employment verification process take?

The verification process can take anywhere from a few days to a week, depending on the responsiveness of the employer and the completeness of the borrower’s documentation. Using a service like Rapid Hire Solutions can speed up the process by ensuring accurate and quick responses.

How can I speed up the mortgage employment verification process?

Borrowers can speed up the process by submitting complete and accurate documentation upfront. Lenders can expedite verification by using third-party services like Rapid Hire Solutions, which specializes in fast and accurate employment verification. Timely communication and regular follow-ups also help prevent delays.

Why is mortgage employment verification important?

Mortgage employment verification is important because it helps lenders assess the borrower’s ability to repay the mortgage. By confirming the borrower’s employment status and income, lenders can determine whether the borrower has the financial capacity to meet monthly mortgage payments.

Conclusion

Mortgage employment verification is a fundamental step in the mortgage application process, ensuring that borrowers have the financial stability to manage their loan repayments. By adhering to best practices, avoiding common mistakes, and maintaining accurate records, lenders can streamline the process and reduce the likelihood of delays. Mortgage employment verification is not just about confirming a borrower’s employment; it’s a critical step in safeguarding both the lender’s and borrower’s interests.

For both lenders and borrowers, accuracy is essential. Using official documentation, relying on trusted sources, and seeking professional services like Rapid Hire Solutions can simplify the process. Borrowers must also ensure they submit complete and accurate information, while lenders must maintain open communication and clear expectations.

In the end, by focusing on accuracy, efficiency, and compliance with privacy laws, the mortgage employment verification process becomes a smoother, faster, and more transparent experience for everyone involved. This not only facilitates timely loan approval but also fosters a positive relationship between lenders and borrowers, ensuring that the mortgage process is as straightforward and stress-free as possible.

By following the steps outlined in this article, lenders can improve their overall efficiency, reduce errors, and ensure a higher rate of successful loan approvals.