Pre-Adverse and Adverse Action (PA/AA): Key Steps for Employers in the Hiring Process

Background checks are essential for businesses to verify candidate credentials, ensure workplace safety, and maintain compliance with hiring laws. Employers use these screenings to assess criminal records, employment history, education, and other factors that pre adverse influence hiring decisions. However, when a background check reveals concerning information, employers must follow a legally mandated process before making a final hiring decision.

Two critical steps in this process are Pre-Adverse Action (PA) and Adverse Action (AA)—both required under the Fair Credit Reporting Act (FCRA). These steps help ensure fair hiring practices and protect candidates from discrimination or wrongful disqualification.

Failing to follow proper PA/AA procedures can result in legal consequences, including fines and lawsuits. Therefore, understanding these steps and implementing them correctly is crucial for employers to remain compliant while making informed hiring decisions.

What Is Pre-Adverse and Adverse Action?

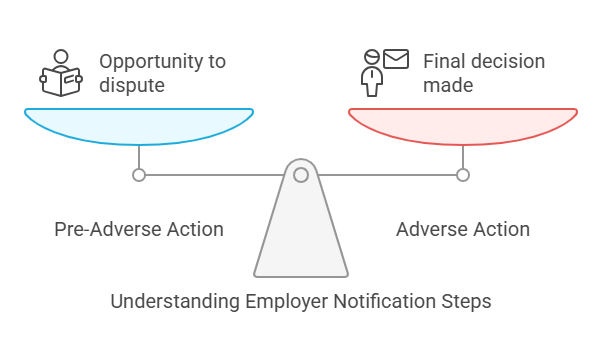

When an employer intends to deny a job opportunity based on information found in a background check, they must follow a two-step notification process:

- Pre-Adverse Action (PA): Employers provide the candidate with a notice that negative information from their background check may impact their hiring decision. This step gives the candidate a chance to review the report and dispute inaccuracies.

- Adverse Action (AA): If, after a reasonable waiting period, the employer decides to proceed with the rejection, they must send an official Adverse Action Notice to the candidate, informing them of the final decision and their rights under FCRA.

This process ensures transparency and fairness, allowing job applicants to correct any errors that might affect their employment opportunities.

Why Employers Must Follow PA/AA Compliance

✅ Legal Protection: Avoids legal risks and potential lawsuits.

✅ Fair Hiring Practices: Gives candidates the chance to dispute errors.

✅ Regulatory Compliance: Ensures adherence to FCRA and Equal Employment Opportunity Commission (EEOC) guidelines.

✅ Improved Employer Reputation: Demonstrates ethical hiring practices and fosters trust.

Types of Background Checks That Influence PA/AA Decisions

Employers conduct different types of background screenings, each impacting hiring eligibility in unique ways:

| Type of Background Check | Purpose | Potential Impact on Hiring Decision |

|---|---|---|

| Criminal Background Check | Identifies past convictions and pending cases | May lead to adverse action if relevant to the job |

| Employment Verification | Confirms past job titles, duration, and performance | Mismatched data may raise concerns |

| Education Verification | Validates degrees and certifications | Discrepancies can lead to hiring delays or disqualification |

| Credit History Check | Assesses financial responsibility (for finance-related roles) | Poor credit history may impact hiring in financial positions |

| Drug Testing | Screens for illegal substance use | A failed test may result in adverse action |

Key Aspects of Pre-Adverse and Adverse Actions

Employers must handle PA/AA steps carefully to avoid legal consequences. The table below outlines key responsibilities at each stage:

| Step | Employer Responsibility | Candidate Rights |

|---|---|---|

| Pre-Adverse Action | Send written notice with a copy of the background report and FCRA Summary of Rights | Review the report, dispute errors if needed |

| Waiting Period (5–7 Days) | Allow the candidate time to respond before making a final decision | Submit a dispute if the report contains incorrect information |

| Adverse Action | Send a formal rejection notice with details of the background check provider | Request a copy of the report and correct errors if applicable |

Understanding PA/AA procedures ensures businesses comply with federal laws while maintaining ethical hiring practices.

Why Choosing the Right Background Screening Provider Matters

When handling Pre-Adverse Action (PA) and Adverse Action (AA), employers must ensure compliance with Fair Credit Reporting Act (FCRA) regulations. A reliable background check provider plays a critical role in accuracy, efficiency, and legal compliance when dealing with hiring decisions based on screening results.

Some providers lack transparency, have slow turnaround times, or provide inaccurate reports, leading to compliance risks and potential lawsuits. In contrast, RapidHireSolutions offers fast, accurate, and legally compliant background checks, ensuring a seamless PA/AA process for employers.

RapidHireSolutions vs. Other Background Check Providers

The following table compares RapidHireSolutions with other screening providers, focusing on key aspects that impact PA/AA compliance.

| Feature | RapidHireSolutions ✅ | Other Providers ❌ |

|---|---|---|

| Speed of Background Checks | 12–24 hours | 7–15 days |

| Accuracy & Verified Results | High (double-verified) | Inconsistent, risk of errors |

| Compliance with FCRA & EEOC | Fully compliant | Some providers lack full compliance |

| Automated Pre-Adverse/Adverse Action Notices | Yes, built-in compliance tools | Manual process, prone to errors |

| Custom Screening Packages | Available | Limited options |

| Customer Support | 24/7 expert assistance | Delayed response times |

✅ Key Advantages of RapidHireSolutions

- Fast & Accurate Results: Background checks processed within 12–24 hours, reducing hiring delays.

- Pre-Built Compliance Tools: Automates PA/AA notifications, ensuring employers follow FCRA regulations effortlessly.

- Error-Free Reports: Double-verified screening data reduces disputes and enhances hiring accuracy.

- Customizable Background Checks: Employers can tailor screenings based on job roles, improving relevance.

- 24/7 Customer Support: Live compliance experts assist employers through PA/AA processes.

❌ Risks of Using Inconsistent Background Check Providers

- Slow Processing Times: Delays of 7–15 days can cause hiring bottlenecks.

- Inaccurate Reports: High risk of false negatives or unverified data.

- FCRA Compliance Risks: Failure to follow proper PA/AA procedures may lead to lawsuits.

- Manual PA/AA Handling: No automated notices, increasing the chance of employer mistakes.

- Poor Customer Support: No dedicated compliance team, making it difficult for employers to navigate legal risks.

Background Check Turnaround Time: RapidHireSolutions vs. Competitors

Timeliness in PA/AA handling is critical. If background checks take too long, hiring delays may cause businesses to lose top candidates. Below is a comparison of turnaround times for various screenings:

| Type of Background Check | RapidHireSolutions ✅ (Timeframe) | Competitors ❌ (Timeframe) |

|---|---|---|

| Criminal Record Check | 24 hours | 5–7 days |

| Employment Verification | 24 hours | 7–10 days |

| Education Verification | 24 hours | 10–15 days |

| Credit History Check | 24 hours | 7–10 days |

| Drug Testing | 24 hours | 7–10 days |

Employers using RapidHireSolutions can complete hiring decisions in a fraction of the time compared to competitors, minimizing disruptions.

Why RapidHireSolutions Ensures the Best PA/AA Compliance

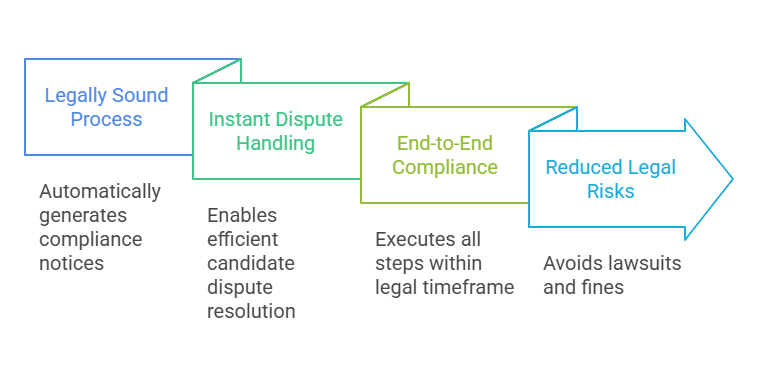

📌 Legally Sound Process: Automatically generates Pre-Adverse & Adverse Action Notices to ensure employers meet FCRA requirements.

📌 Instant Dispute Handling: Enables candidates to review and dispute background check errors efficiently.

📌 End-to-End Compliance: Ensures all PA/AA steps are executed within the legally required timeframe.

📌 Reduced Legal Risks: Avoids FCRA lawsuits and regulatory fines by ensuring a compliant hiring process.

By choosing RapidHireSolutions, employers eliminate hiring delays, reduce compliance risks, and enhance hiring accuracy.

Understanding the Legal Requirements for PA/AA

Pre-Adverse and Adverse Action (PA/AA) processes are heavily regulated under the Fair Credit Reporting Act (FCRA) and enforced by the Equal Employment Opportunity Commission (EEOC). Employers who fail to follow the correct procedures risk legal penalties, lawsuits, and reputational damage.

FCRA Compliance: Key Employer Responsibilities

Employers using consumer reports (background checks) for hiring must:

✅ Provide Pre-Adverse Action Notice – Inform candidates before making a negative hiring decision.

✅ Include a Copy of the Report – Share the background check results with the candidate.

✅ Notify Candidates of Their Rights – Provide a summary of FCRA rights, allowing them to dispute inaccuracies.

✅ Allow a Waiting Period – Give the candidate 5–7 business days to respond before making a final decision.

✅ Issue an Adverse Action Notice – If still rejecting the candidate, provide a formal rejection notice with the reason.

Failure to follow these steps can result in legal action from the candidate, including class-action lawsuits against the employer.

EEOC Guidelines & Discriminatory Hiring Risks

The EEOC enforces anti-discrimination laws, ensuring background checks are applied fairly across all candidates. Employers must:

📌 Avoid Blanket Bans – Rejecting candidates solely based on criminal records may violate discrimination laws.

📌 Consider Job Relevance – Criminal history must be assessed based on job-relatedness and business necessity.

📌 Perform Individualized Assessments – Evaluate context, rehabilitation efforts, and time since the offense.

Non-compliance with EEOC guidelines can result in lawsuits, fines, and reputational harm.

How RapidHireSolutions Helps Employers Stay Compliant

To prevent compliance risks, RapidHireSolutions offers automated PA/AA workflows, ensuring employers meet legal obligations effortlessly. Key features include:

✅ Auto-Generated PA/AA Notices – Ensures all required documentation is provided.

✅ Built-In Compliance Safeguards – Reduces the risk of legal violations.

✅ Candidate Dispute Management – Allows applicants to correct inaccuracies before final hiring decisions.

✅ Audit-Ready Reports – Employers can track and store PA/AA records for legal protection.

Frequently Asked Questions (FAQs)

Why is Pre-Adverse & Adverse Action Important?

Pre-Adverse and Adverse Action processes ensure fair hiring practices and prevent legal issues. They give candidates a chance to correct errors in their background check before facing rejection.

How Long Should Employers Wait After Sending a Pre-Adverse Action Notice?

The FCRA recommends waiting at least 5 business days before issuing an Adverse Action Notice. Some states may require a longer waiting period.

Can a Candidate Dispute Their Background Check Results?

Yes. Candidates have the right to review, dispute, and correct errors in their background check report before a final hiring decision is made.

What Happens If an Employer Skips the PA/AA Process?

Skipping PA/AA steps violates the FCRA, exposing the employer to lawsuits, fines, and reputational damage.

How Can Employers Ensure Compliance with PA/AA?

Using a trusted background check provider like RapidHireSolutions ensures compliance by automating PA/AA notifications and tracking hiring decisions accurately.

Conclusion

Employers must handle Pre-Adverse and Adverse Action with care to avoid legal risks and ensure fair hiring decisions. FCRA and EEOC compliance protect both candidates and employers, reducing the risk of discrimination claims and lawsuits.

By choosing RapidHireSolutions, businesses gain:

✔ Legally Compliant Background Checks – FCRA-approved PA/AA handling.

✔ Fast & Accurate Results – Reduces hiring delays.

✔ Automated Compliance Tools – Prevents legal errors in hiring decisions.

✔ Better Candidate Experience – Ensures transparency and fairness.

Employers who prioritize compliance and accuracy will build a stronger, legally secure hiring process, improving workforce quality and company reputation.