Understanding Regulatory Compliance Risks in Hiring

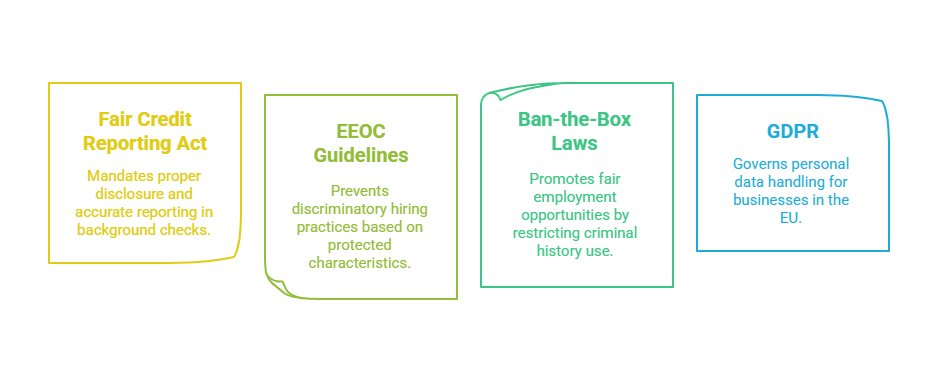

Regulatory compliance in hiring refers to the adherence to local, state, and federal employment laws designed to ensure fairness, transparency, and legal accountability in the hiring process. Employers must comply with regulations such as the Fair Credit Reporting Act (FCRA), Equal Employment Opportunity Commission (EEOC) guidelines, and Ban-the-Box laws to avoid legal consequences. Failure to meet compliance standards can result in fines, lawsuits, and reputational damage. Companies that neglect compliance risk discrimination claims, negligent hiring lawsuits, and violations of candidate privacy rights.

Key Regulatory Risks in Hiring

Companies face several regulatory compliance risks when hiring new employees. Some of the most significant risks include:

- Discrimination Claims: Employers must follow EEOC guidelines to ensure hiring practices do not discriminate based on race, gender, age, or disability.

- Negligent Hiring Lawsuits: Hiring employees with undisclosed criminal histories or falsified qualifications can expose businesses to liability.

- Privacy Violations: Mishandling background check data can lead to breaches of data privacy laws, including the General Data Protection Regulation (GDPR).

- Ban-the-Box Compliance: Many states and local governments prohibit employers from inquiring about criminal history early in the hiring process.

- Fair Credit Reporting Act (FCRA) Violations: Employers conducting background checks must obtain candidate consent and provide proper disclosure before making hiring decisions.

The Role of Background Checks in Compliance

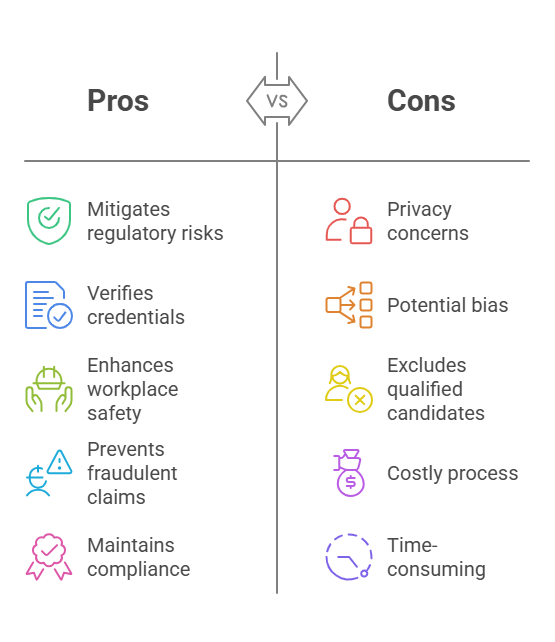

Background checks play a vital role in mitigating regulatory risks. They help employers verify a candidate’s credentials, identify criminal records, and ensure compliance with employment laws. Different types of background checks contribute to a safer and legally compliant hiring process:

- Criminal History Checks: Identify prior convictions that could pose a risk to workplace safety.

- Employment Verification: Confirms work history to prevent fraudulent employment claims.

- Education Verification: Ensures candidates possess the degrees and certifications required for the role.

- Drug Testing: Helps employers maintain a drug-free workplace while complying with industry regulations.

- Credit Checks: Used for positions involving financial responsibility to assess a candidate’s financial history.

By implementing comprehensive background checks, employers reduce hiring risks, enhance workplace safety, and maintain compliance with employment laws.

Regulatory Compliance Risks and Mitigation Strategies

The table below summarizes key regulatory compliance risks and how background checks help mitigate them:

| Compliance Risk | Description | How Background Checks Help |

|---|---|---|

| Discrimination | Hiring bias based on race, gender, age, etc. | Ensures fair and unbiased hiring practices |

| Negligent Hiring | Hiring unqualified or risky employees | Verifies criminal, employment, and education records |

| Privacy Violations | Mishandling of personal data | Ensures secure and legally compliant data handling |

| Ban-the-Box Violations | Asking about criminal history too early | Delays criminal background checks until appropriate stage |

| FCRA Non-Compliance | Failure to obtain consent and provide disclosure | Ensures employer follows legal pre-employment screening steps |

A well-structured hiring compliance strategy that includes background checks helps businesses avoid these risks while promoting transparency and fairness in the hiring process.