Introduction to Self-Employment Income Verification

Introduction to Self-Employment Income Verification

What is Self-Employment Income Verification?

Self-employment income verification is the process of confirming the income earned by an individual who is self-employed, as opposed to someone working for an employer. For various financial processes, such as applying for loans, government assistance programs, and other financial services, self-employed individuals are often required to prove their earnings. Unlike employees who typically provide pay stubs or tax forms, self-employed individuals do not have such standardized documentation. As a result, the verification of their income can be more complex and requires different forms of proof.

This process is essential for anyone applying for services that depend on income levels, such as government benefits, mortgages, loans, or even when negotiating business deals. The self-employed need to provide reliable documentation that proves their income and demonstrates their ability to repay loans or support their application for assistance programs.

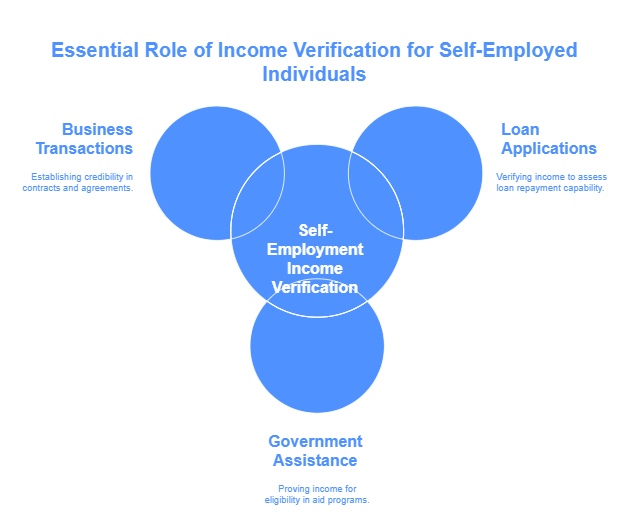

The Role of Self-Employment Income Verification

Self-employment income verification plays an important role in many financial and administrative processes. Self-employed individuals often face challenges when it comes to proving their income because they do not receive regular paychecks, and their earnings can fluctuate significantly. Financial institutions, government agencies, and businesses all need reliable methods for verifying the income of self-employed individuals to make informed decisions.

Some key purposes of self-employment income verification include:

- Loan Applications: One of the most common reasons self-employed individuals need income verification is when applying for loans or credit. Lenders often require proof of income to assess an applicant’s ability to repay a loan. Since self-employed individuals do not have pay stubs or a regular paycheck, they must rely on other forms of documentation to prove their earnings, such as tax returns, bank statements, and invoices. By verifying this income, lenders ensure that the borrower is financially capable of repaying the loan.

- Government Assistance Programs: Government programs such as food stamps, unemployment benefits, and housing assistance often require applicants to provide proof of income to determine eligibility. For self-employed individuals, income verification can be more complex because their earnings may not be as predictable as those of salaried employees. Accurate verification is crucial for these programs to ensure that they are providing aid to the right individuals.

- Business Transactions: Self-employed individuals, such as freelancers or consultants, may need to verify their income when entering into contracts or agreements with other businesses. Providing proof of income may be necessary to establish credibility, negotiate payment terms, or qualify for business loans or lines of credit.

Challenges of Self-Employment Income Verification

Verifying self-employment income presents unique challenges compared to verifying income for salaried or hourly employees. Employees typically receive regular paychecks and official documentation like W-2 forms, which makes income verification straightforward. Self-employed individuals, on the other hand, often have irregular income, and the methods they use to report earnings can vary.

Some challenges in self-employment income verification include:

- Irregular Income: Unlike salaried employees who receive a set amount each pay period, self-employed individuals often experience fluctuations in their income. For example, a freelancer might earn more in one month and less in the next, which can make it difficult to determine a consistent income. This unpredictability means that income verification for the self-employed often requires examining a longer period to assess average earnings.

- Lack of Standardized Documents: Employees can provide standard documentation such as pay stubs or W-2 forms, which give a clear picture of their earnings. In contrast, self-employed individuals may not have these official forms. Instead, they must rely on other documents like tax returns, invoices, bank statements, or client contracts. While these documents can serve as proof of income, they are not as straightforward as the forms used by employees, and they may require additional interpretation or clarification.

- Multiple Income Sources: Many self-employed individuals earn income from various sources. A freelance writer, for example, may receive payments from multiple clients, or a small business owner might have income from both products and services. This diversity in income sources means that verification may need to account for multiple income streams, making it more complicated than simply verifying a single paycheck.

- Document Organization and Record-Keeping: For self-employed individuals, the organization of financial documents is crucial. Maintaining accurate records of income and expenses is not only important for tax purposes but also essential for verifying income. Without proper organization, the process of verifying self-employment income can be time-consuming and prone to mistakes, potentially leading to delays in securing loans, benefits, or business deals.

Methods for Verifying Self-Employment Income

Self-employed individuals must use various methods and documents to verify their income. The most common methods involve providing tax documents, financial statements, and proof of business activities. These methods serve as proof of the self-employed individual’s earnings and allow financial institutions or government agencies to assess their financial stability.

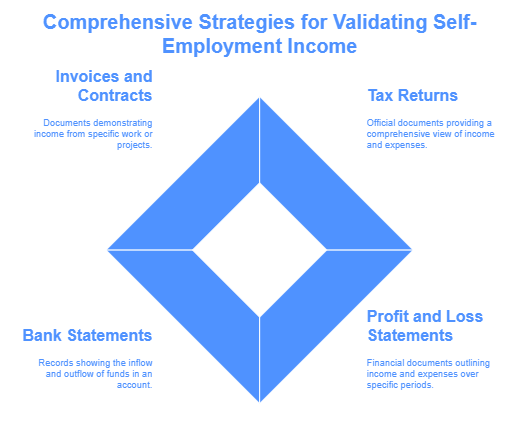

- Tax Returns:

- Description: Self-employed individuals must file tax returns with the Internal Revenue Service (IRS) each year. These returns include details about total income, business expenses, and net profit. Tax returns serve as one of the most reliable forms of verification because they provide an official, detailed record of income over a set period.

- Why It’s Used: Tax returns offer a comprehensive view of a self-employed individual’s financial situation. They include the necessary information to verify income, deductions, and net earnings, which are essential for loan or benefit applications.

- Challenges: While tax returns provide a solid foundation for income verification, they may not reflect the most current income levels. For instance, tax returns filed the previous year may not fully reflect any significant changes in income or business conditions. Furthermore, deductions and business expenses can lower the reported income, which may not always align with actual earnings.

- Profit and Loss Statements (P&L):

- Description: A Profit and Loss Statement is a financial document that outlines a self-employed individual’s income and expenses over a specific period, typically monthly, quarterly, or annually. This statement helps to determine whether the business is profitable and provides insight into revenue and expenditures.

- Why It’s Used: A P&L statement is used to show income and expenditures for a more recent period, making it a more up-to-date alternative to tax returns. It provides an accurate representation of an individual’s financial performance and can be used alongside other documents for a comprehensive income verification process.

- Challenges: The P&L statement requires accurate and detailed record-keeping. Self-employed individuals who do not maintain good records may struggle to provide an accurate P&L. Additionally, not all institutions may accept a P&L statement as official proof of income.

- Bank Statements:

- Description: Bank statements reflect the inflow and outflow of money in a self-employed individual’s account. These statements can provide insight into regular income deposits, such as payments from clients or customers.

- Why It’s Used: Bank statements provide a direct record of income deposits, showing actual cash flow. They can help verify the amount of money coming into an individual’s account, which can be useful for lenders and government agencies.

- Challenges: While bank statements are useful for showing income deposits, they do not categorize income in a detailed manner. Without a clear breakdown of business income and personal expenses, bank statements may be difficult to interpret.

- Invoices and Contracts:

- Description: Invoices sent to clients or customers can be used to demonstrate the income that a self-employed individual is earning for specific work or projects. Signed contracts also provide evidence of the terms and conditions agreed upon between a self-employed individual and their clients.

- Why It’s Used: Invoices and contracts are specific to individual work completed or agreements made, which can serve as proof that income has been earned and is owed.

- Challenges: Some self-employed individuals may not keep formal invoices for every transaction, particularly if their work is informal or the income is earned on a small scale. As a result, this method may not be as comprehensive or consistent as other forms of verification.

Why Self-Employment Income Verification Is Essential

The verification of self-employment income is vital to ensure that individuals qualify for the services or benefits they are seeking. Whether it’s securing a loan, applying for government assistance, or entering into a business agreement, accurate income verification helps avoid fraud and ensures that financial assessments are fair.

Process, Methods, and Best Practices for Self-Employment Income Verification

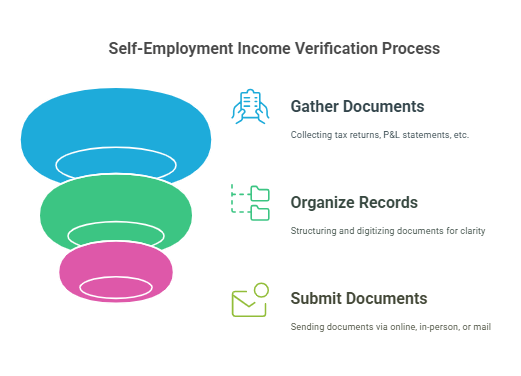

Step-by-Step Process of Self-Employment Income Verification

When self-employed individuals are required to verify their income for various purposes—whether applying for loans, government assistance programs, or business deals—there is a systematic process to follow. The process often involves gathering specific documents, filling out forms, and submitting them for review. Below is a breakdown of the typical steps involved in self-employment income verification.

Step 1: Gather the Necessary Documentation

Before initiating the verification process, it is crucial to gather all required documents that prove your income. The exact documents required may vary depending on the specific purpose for which income verification is needed. However, the most common documentation includes:

- Tax Returns: Federal and state tax returns (Form 1040, Schedule C) are the cornerstone of self-employment income verification. These forms provide a complete record of your earnings, expenses, and net income for the year. Lenders or agencies often ask for the last two years’ tax returns for a comprehensive look at your financial history.

- Profit and Loss (P&L) Statements: A P&L statement summarizes your business income and expenses over a certain period. This document helps give an up-to-date picture of your earnings and can be particularly helpful when your tax return data is outdated or doesn’t fully reflect recent income changes.

- Bank Statements: Bank statements are used to verify the flow of income into your account. Lenders may request several months’ worth of bank statements to assess the consistency of your cash flow.

- Invoices and Client Contracts: For businesses or freelance workers, invoices and client contracts are crucial in verifying the amount of income earned from specific services or products. These documents prove that you’ve been paid or will be paid for the work completed or services rendered.

- Business Licenses or Registration: In some cases, self-employed individuals may need to show that they have a valid business license or registration, especially if they are operating in regulated industries or need to prove their business legitimacy.

Step 2: Organize Your Financial Records

Once you have gathered all the necessary documents, the next step is to organize them in a way that makes the income verification process smooth. This is where self-employed individuals can sometimes face challenges—proper organization is key to a fast and accurate verification.

Best practices for organizing financial records:

- Maintain Clear Categories: Group all of your income-related documents together in one place. For example, separate invoices, tax forms, bank statements, and receipts for easy access.

- Digitize Your Records: If you haven’t done so already, consider digitizing your financial records. Many agencies, lenders, and government bodies accept digital copies of documents. Scanning or taking high-quality photos of your documents can speed up the submission process.

- Create an Income Summary: To make things easier for the person reviewing your income, consider preparing a simple summary of your income over a set period (e.g., a month, a quarter, or a year). This summary can be created using your P&L statement and bank statements. Make sure it clearly breaks down your income sources.

Step 3: Submit Your Documents

After gathering and organizing your documents, the next step is to submit them to the relevant authority, financial institution, or government agency. The method of submission varies, and the most common options are:

- Online Submission: Many agencies and lenders now allow individuals to submit their self-employment income verification documents online. This can be done through a website or a dedicated portal, where you upload your files directly. Digital submission can be fast, convenient, and help avoid the risk of lost documents.

- In-Person Submission: Some entities may require you to submit the documents in person, particularly if you are applying for government assistance or business loans at a local office. In-person submission can also allow you to directly ask questions if something is unclear.

- Mail Submission: Although less common today, some organizations may still require physical copies of documents to be mailed. Make sure you use certified mail or another secure method to track the package and confirm that it has been received.

Tip: Regardless of how you submit your documentation, make sure to keep copies of all documents for your records. This is essential in case there are issues or delays in processing your verification.

Common Methods for Verifying Self-Employment Income

When it comes to verifying self-employment income, the verification methods can vary based on the institution requesting the information. Below are the most common methods used to verify self-employed income:

1. Tax Returns (Federal and State)

What It Is: Tax returns are among the most official and widely accepted forms of verifying self-employment income. When self-employed, your annual income is reported through tax forms such as the 1040 and Schedule C, which details your business income and expenses.

Why It’s Used: Tax returns provide a full picture of your financial history, including income, deductions, and overall profitability. These documents also serve as proof that you’ve filed your taxes and are in compliance with government regulations.

Pros:

- Official, government-issued documentation

- Provides a comprehensive record of income and expenses

- Accepted by most lenders and agencies

Cons:

- May be outdated for verifying recent income

- Can reflect deductions that reduce taxable income, which may not accurately reflect your actual earnings

2. Profit and Loss (P&L) Statements

What It Is: A P&L statement is a detailed document that outlines your business’s income and expenses for a specific period, typically monthly, quarterly, or annually. It is used to assess your business’s profitability and cash flow.

Why It’s Used: P&L statements are helpful because they provide a snapshot of how much money your business is generating after expenses. This document is often used when tax returns are not recent or do not fully reflect the current financial situation of the business.

Pros:

- Provides up-to-date information about business income

- Helps assess business health and profitability

- Can be used in addition to tax returns for verification

Cons:

- Requires accurate record-keeping of income and expenses

- Must be prepared in a standardized format to be understood easily by lenders or agencies

3. Bank Statements

What It Is: Bank statements show all financial transactions in your business or personal bank account(s) over a specific period. These statements can help verify deposits that reflect self-employment income, such as client payments.

Why It’s Used: Bank statements are often requested as a supplementary verification method to confirm that the money is being deposited into an account. They are especially useful for showing consistent income over time.

Pros:

- Shows actual deposits and cash flow

- Easy to obtain and submit

- Can confirm steady income from clients or customers

Cons:

- Does not offer a breakdown of income versus personal spending

- May not provide sufficient detail for lenders or agencies to assess business expenses

4. Invoices and Contracts

What It Is: Invoices and contracts are used to prove that self-employed individuals have worked for clients and have received payments for those services. They provide direct evidence of income earned from specific projects.

Why It’s Used: This method is commonly used for freelancers and consultants who have ongoing work with clients. Invoices and contracts help establish the relationship between the self-employed individual and their clients, showing how much income is expected or has been received.

Pros:

- Provides clear documentation of work completed and payments owed

- Directly links income to specific clients or projects

Cons:

- Some self-employed individuals may not keep formal invoices for all transactions

- Invoices alone may not show the overall consistency or volume of income

Best Practices for Self-Employment Income Verification

While the methods of verifying self-employment income are well-established, there are also best practices that can ensure a smooth and efficient process. These practices will help self-employed individuals to be better prepared when their income is being verified, whether for a loan, government assistance program, or any other financial transaction.

1. Keep Accurate and Detailed Records

One of the most important practices for self-employed individuals is maintaining accurate and organized records. This includes keeping track of all invoices, payments, receipts, and business expenses. Accurate documentation makes the verification process faster and more transparent, as it allows you to provide clear evidence of your income and expenses.

2. Use Accounting Software

Using accounting software such as QuickBooks or FreshBooks can help you maintain up-to-date financial records. These tools can automatically generate reports like P&L statements and tax summaries, making it easier to provide accurate data when verifying your income.

3. Be Prepared to Provide Multiple Forms of Documentation

While tax returns are often the primary document for verifying self-employment income, it’s often helpful to provide supplementary documentation. This could include bank statements, invoices, contracts, and P&L statements. Being prepared to submit multiple forms of proof will provide a more complete and accurate picture of your income.

The Role of Self-Employment Income Verification in Financial Processes

As you can see, self-employment income verification is an important and sometimes complex process, requiring individuals to provide a variety of documents and records. Being proactive about maintaining clear and accurate financial records can make the income verification process smoother and faster. By understanding the methods and best practices for verifying income, self-employed individuals can better navigate loan applications, government assistance programs, and business transactions.

Services by Rapid Hire Solutions

Rapid Hire Solutions provides comprehensive services to help individuals and businesses with the self-employment income verification process. Their team assists with compiling financial documentation, ensuring that all necessary paperwork is submitted, and ensuring compliance with verification requirements.

For self-employed individuals, Rapid Hire Solutions can assist by:

- Helping organize and compile tax returns, profit and loss statements, and bank records.

- Reviewing documents for accuracy to ensure a smooth verification process.

- Providing guidance on how to properly complete and submit verification forms.

- Offering solutions for businesses that need assistance verifying income for employees or contractors.

Whether you’re an entrepreneur applying for a loan or a gig worker seeking benefits, Rapid Hire Solutions ensures the process is seamless and efficient.

Legal Aspects of Self-Employment Income Verification

Self-employment income verification is not only a necessary step in financial transactions but is also governed by specific laws and regulations that ensure the integrity and fairness of the verification process. It is crucial for both self-employed individuals and the institutions requesting income verification to adhere to these legal requirements to avoid issues like fraud, misrepresentation, or breaches of privacy. Here’s an overview of the legal framework surrounding self-employment income verification:

1. Reporting Requirements and Tax Laws

One of the main legal aspects of self-employment income verification is the requirement to report all income and expenses accurately. In the United States, self-employed individuals must report their income and deductions on tax forms, including:

- Form 1040: This form is used to file individual income taxes, and it is where self-employed individuals report their total income from all sources.

- Schedule C: Attached to the 1040 form, Schedule C is used to report income or loss from a business that you operated or a profession you practiced as a sole proprietor.

Self-employed individuals must adhere to the Internal Revenue Service (IRS) guidelines for reporting income and expenses accurately. Failure to report income or deductions can lead to legal consequences, including audits, penalties, or legal action. Lenders, government agencies, and other institutions that verify self-employment income typically request these tax forms to ensure that the self-employed individual is in compliance with the law.

Key Takeaway: It is critical for self-employed individuals to maintain accurate financial records and file taxes properly to comply with the law and avoid complications during income verification.

2. Fair Credit Reporting Act (FCRA) and Privacy Laws

When self-employment income verification involves credit checks or is part of the process for receiving loans or assistance, the Fair Credit Reporting Act (FCRA) and other privacy laws come into play. The FCRA regulates how financial institutions, lenders, and credit agencies can use credit reports and personal information.

- FCRA Compliance: Under the FCRA, entities requesting income verification must ensure that the information they collect and use is accurate, and they must get the individual’s consent before pulling their credit report or using their financial data.

- Privacy Concerns: Self-employed individuals must be aware of their rights regarding privacy. The use of personal financial information for verification purposes is governed by privacy laws, including the Right to Financial Privacy Act (RFPA). This act restricts government access to personal financial records without the individual’s consent, except in specific circumstances.

When providing documents such as tax returns or bank statements for income verification, it’s important to understand that these documents may contain sensitive information. Thus, individuals should always be cautious about sharing these documents, ensuring that they are provided to trusted parties.

Key Takeaway: Both self-employed individuals and organizations requesting income verification must be aware of the FCRA and privacy regulations to protect personal data and ensure compliance with the law.

3. Anti-Fraud Laws and Misrepresentation

One of the main concerns in self-employment income verification is the potential for fraud. Misrepresentation of income or expenses can result in severe legal consequences, such as penalties, disqualification from government programs, or criminal charges. For instance, inflating income or underreporting expenses to qualify for loans or assistance is considered fraud.

Institutions requesting income verification have legal obligations to detect and prevent fraudulent activities. They may require supplementary documentation and conduct follow-up checks to verify that the information provided is accurate. In the case of government assistance programs, fraudulent claims can lead to disqualification, repayment demands, and criminal prosecution.

Key Takeaway: Self-employed individuals must always provide accurate and truthful information when verifying their income. Misrepresentation can lead to serious legal consequences.

Frequently Asked Questions (FAQs)

What documents do I need to verify my self-employment income?

-

- Common documents required to verify self-employment income include:

- Federal and state tax returns (Form 1040, Schedule C)

- Profit and Loss (P&L) statements

- Bank statements

- Invoices and client contracts

- Business licenses or registrations

- Common documents required to verify self-employment income include:

Can I use my bank statements to verify my self-employment income?

Yes, bank statements are often used to verify income, as they show the deposits made into your account. However, they may not provide a complete picture of your expenses or overall financial situation. It’s often helpful to provide additional documents like tax returns or P&L statements to supplement your bank statements.

What if my tax return doesn’t fully reflect my current income?

If your tax return doesn’t fully reflect your current income (for example, if your income has significantly increased since the last tax year), you may need to provide supplementary documents such as a current P&L statement, recent bank statements, or invoices to give a more accurate picture of your earnings.

How do I avoid delays or issues in income verification?

To avoid delays, make sure to gather all the required documents before submitting them. Keep your financial records organized and up-to-date. Double-check that all information on your forms and documents is accurate. Additionally, be prepared to provide supplementary documents if requested.

Can I verify my self-employment income without using tax returns?

While tax returns are the most common and accepted form of verification, some institutions may accept alternative forms of verification, such as a P&L statement, bank statements, or client contracts. Be sure to check with the requesting party to understand what alternatives they accept.

Conclusion: Importance of Accurate Self-Employment Income Verification

Self-employment income verification is a crucial step for individuals who are self-employed, whether they are applying for a loan, government assistance, or any other program that requires proof of income. While the process can be more complex than traditional employment verification, understanding the necessary steps and maintaining accurate financial records can make the verification process much easier.

Legal aspects surrounding self-employment income verification, such as tax reporting requirements, privacy laws, and anti-fraud regulations, emphasize the need for accuracy and compliance throughout the process. Misrepresentation of income can lead to serious legal consequences, so it is important to ensure that all documents are truthful and complete.

For self-employed individuals, the best practice is to keep clear and organized records, submit accurate documentation, and follow the necessary legal steps to verify income. By doing so, you will not only streamline the process but also avoid unnecessary complications, delays, or legal challenges.

Remember, whether you are seeking a loan, government assistance, or entering into a contract, providing clear and verified self-employment income documentation is an essential part of ensuring that you can access the resources or services you need. Following the correct procedures and understanding your rights will help you navigate the process smoothly and successfully.