What is Student Loan Employment Verification?

What is Student Loan Employment Verification?

Student loan employment verification is a crucial step in determining eligibility for certain repayment plans, forgiveness programs, and other benefits associated with federal student loans. It is a process through which borrowers confirm their employment status, work history, and job details to their loan servicers or the U.S. Department of Education. Employment verification is especially important for those seeking to qualify for Income-Driven Repayment (IDR) plans or Public Service Loan Forgiveness (PSLF). These programs depend on the borrower’s job type, income level, and employment duration, so verifying employment ensures that borrowers receive the benefits they are entitled to.

Unlike traditional student loan repayment methods, which are primarily based on fixed amounts, repayment terms for IDR plans and loan forgiveness programs are heavily influenced by a borrower’s employment status. Without proof of employment, a borrower may not be able to access lower monthly payments or be eligible for student loan forgiveness. Therefore, the employment verification process is integral to the overall management and repayment of federal student loans.

Why is Employment Verification Necessary?

Student loan servicers use employment verification to assess a borrower’s eligibility for various repayment programs and benefits, which is important for both the borrower and the loan servicer. Employment verification plays a particularly important role in two key areas:

- Income-Driven Repayment Plans (IDR): IDR plans offer monthly payments based on a borrower’s income and family size. In these cases, the borrower must provide accurate income verification to adjust payments accordingly. Employment verification is a vital step in confirming that a borrower qualifies for one of these plans, which is designed to make loan payments more affordable, especially for individuals with variable income or low-paying jobs.

- Public Service Loan Forgiveness (PSLF): The PSLF program is a federal initiative that allows borrowers working in qualifying public service jobs to have their loans forgiven after making 120 qualifying monthly payments under an IDR plan. To ensure that borrowers are employed in a qualifying public service field, employment verification is required to demonstrate that the borrower works for a government agency or a nonprofit organization. The employment certification process is key to tracking progress toward loan forgiveness and determining whether a borrower’s work qualifies under PSLF guidelines.

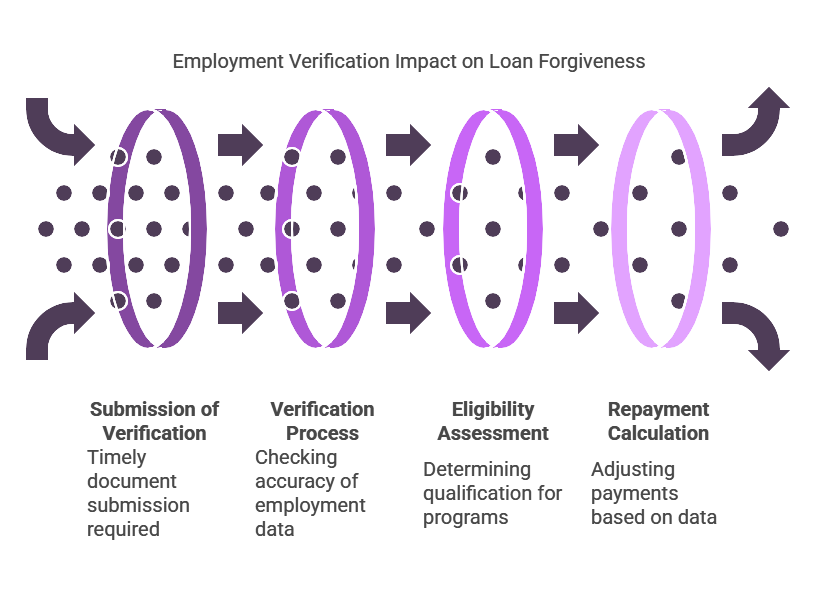

The Employment Verification Process

For federal student loan programs like PSLF and IDR plans, borrowers must undergo a formal process of verifying their employment on a regular basis. The process typically involves submitting employment verification forms and related documentation to the loan servicer or the Department of Education. For PSLF applicants, this verification is necessary annually or whenever the borrower changes employers. Borrowers must complete the Employment Certification Form (ECF), which is submitted to the U.S. Department of Education, along with supporting documentation, such as:

- Employer’s name and address

- Job title and description

- The number of hours worked per week

- Dates of employment

In addition to the ECF, borrowers may also be required to submit pay stubs, tax returns, or other forms of proof to substantiate their employment status. Loan servicers then review these documents to determine whether the borrower qualifies for the forgiveness program or the income-driven repayment plan based on their employment status.

Employers are also involved in the employment verification process. While employees are responsible for submitting the necessary forms and documents, employers are tasked with confirming the details about the employee’s job role, hours worked, and whether the job qualifies under specific student loan programs like PSLF. This verification can be provided through direct communication between the employer and the loan servicer, or it may require the employer to complete specific forms, such as the ECF, confirming the employment details.

Importance of Accurate Employment Verification

The accuracy of employment verification is essential to the successful management of student loan repayment and eligibility for forgiveness. Any discrepancies in the verification process can delay or prevent borrowers from qualifying for repayment programs or forgiveness opportunities. Incorrect employment information or missing documentation can result in denied applications for IDR plans, PSLF, or other forms of loan assistance. For instance, if an employer fails to submit accurate hours worked or details about the borrower’s job role, the borrower may lose out on loan forgiveness or have their monthly payments recalculated at a higher rate than necessary.

The process of employment verification is crucial for maintaining a borrower’s progress under PSLF. Since loan forgiveness depends on consistent, qualifying employment, submitting accurate and timely employment verification helps borrowers track their eligibility. If borrowers do not submit employment verification documents regularly, they risk losing credit for payments that could have counted toward their loan forgiveness. Failure to submit the ECF on time can reset a borrower’s forgiveness timeline, significantly delaying the process of loan cancellation.

How Employment Verification Affects Borrowers’ Loan Repayment Plans

Student loan employment verification can have significant implications for a borrower’s repayment plan, particularly for those seeking income-driven repayment plans or loan forgiveness. Here’s how employment verification can affect loan repayment:

- Income-Driven Repayment Plans (IDR): Borrowers enrolled in IDR plans must provide income documentation to establish their monthly payment amount. Employment verification may be used to determine the borrower’s income level, which is a key factor in calculating payments. For instance, if a borrower is self-employed or has non-traditional sources of income, they may be asked to provide additional documentation, such as tax returns, bank statements, or freelance contracts, to verify their income. These forms of verification can help reduce monthly payments for borrowers who may have an inconsistent or low income.

- Public Service Loan Forgiveness (PSLF): For those pursuing PSLF, employment verification ensures that borrowers are employed with a qualifying employer. Only payments made under a qualifying employer count toward the 120 required payments for loan forgiveness. By regularly submitting employment certification forms and verifying employment status, borrowers can ensure that their monthly payments are properly credited toward loan forgiveness. Without timely and accurate employment verification, borrowers risk missing out on potential loan forgiveness.

- Deferment or Forbearance: In some cases, borrowers may be eligible for deferment or forbearance if they experience financial hardship or unemployment. Employment verification is required for some types of deferment, such as for those who are unemployed or experiencing economic hardship. By verifying their employment status, borrowers may be able to pause or reduce their loan payments for a temporary period without risking default or late fees.

- Loan Consolidation: Employment verification can also play a role in loan consolidation, which allows borrowers to combine multiple student loans into a single loan with a potentially lower interest rate. To qualify for certain repayment options, including income-driven plans and PSLF, borrowers may need to provide proof of employment during the consolidation process. This ensures that the borrower is enrolled in the correct repayment plan and eligible for potential loan forgiveness or repayment relief.

The Role of Employers in Student Loan Employment Verification

Employers have a significant responsibility in the student loan employment verification process. Not only must they verify job status for borrowers, but they also must ensure that the information they provide is accurate and timely. Employers can play an active role in helping their employees maintain eligibility for student loan benefits by providing the necessary documentation when required. For instance, employers may need to complete the Employment Certification Form (ECF) to confirm the employee’s status in a public service role or provide other documents showing the employee’s employment details.

However, employers often face challenges in ensuring accurate and timely employment verification. Many employers are not familiar with the specific documentation required by loan servicers and may lack the administrative resources to track and provide this information efficiently. This can lead to delays or errors in the verification process. Additionally, employers must stay updated on the requirements for loan forgiveness programs, as the rules and criteria may change over time.

As a result, many businesses turn to third-party services like Rapid Hire Solutions to assist with employment verification. These services help employers streamline the process, ensuring that employment verification is completed quickly and accurately. Third-party services can simplify the process of providing employment verification, reducing the burden on HR departments and ensuring compliance with federal regulations.

Statistics and Studies on Employment Verification

Data from the U.S. Department of Education and other sources demonstrate the importance of employment verification in student loan repayment. According to a 2020 report, more than 400,000 borrowers had their Public Service Loan Forgiveness applications denied due to missing or incomplete employment verification. This statistic underscores the necessity of timely and accurate employment verification to avoid disruptions in repayment or forgiveness.

Additionally, a study by the Federal Reserve revealed that a significant portion of student loan borrowers struggle with income-based repayment plans because of difficulties in proving their income. The study indicated that nearly 20% of borrowers applying for income-driven repayment plans failed to provide sufficient documentation, resulting in higher monthly payments than necessary.

Overall, the verification process is essential for borrowers seeking to access the benefits of federal student loan programs, particularly for those with income-based repayment plans or seeking loan forgiveness. Without proper employment verification, borrowers risk losing eligibility for these crucial repayment options, which could prolong their loan repayment period and increase overall loan costs.

Responsibilities of Employers in Student Loan Employment Verification

Employers play a central role in the student loan employment verification process. Their involvement is crucial in ensuring that employees are eligible for federal student loan repayment benefits, such as Income-Driven Repayment (IDR) plans and Public Service Loan Forgiveness (PSLF). Employers must verify the employment details of their workers to ensure that those who are eligible for loan forgiveness or adjusted payments receive the appropriate benefits.

Key Responsibilities of Employers:

- Providing Accurate Employment Information: Employers are responsible for providing accurate details regarding the employee’s job status, such as their title, job description, number of hours worked per week, and the start and end dates of employment. These details are critical for loan servicers or the U.S. Department of Education to determine if the employee qualifies for any of the loan repayment options or forgiveness programs.

- Completing Employment Certification Forms (ECF): One of the most common ways that employers contribute to the verification process is by completing the Employment Certification Form (ECF). This form is a key requirement for Public Service Loan Forgiveness (PSLF), where employees working for qualifying public service employers submit their details to demonstrate that they are making progress toward the 120 qualifying payments needed for loan forgiveness. Employers must complete the ECF to confirm that the employee works for a qualifying organization and is meeting the necessary hours.

- Ensuring Timeliness and Accuracy: Since timely and accurate employment verification is essential for both IDR plans and PSLF, employers must provide verification documents promptly. Failure to submit the necessary paperwork can delay the verification process and may result in the borrower losing credit for qualifying payments.

- Cooperating with Loan Servicers: Employers are often required to cooperate directly with loan servicers and government agencies to verify employment status. This may involve confirming an employee’s role, confirming their hours worked, and providing specific job details requested by the servicer. Employers must ensure they maintain accurate employee records to facilitate this verification process.

- Handling Verification for Employees with Non-Traditional Employment Types: Employers who manage freelancers, contract workers, or other non-traditional employees may face additional challenges when verifying employment. For example, gig economy workers, consultants, or part-time employees may not have a standard employment contract or set hours. In these cases, employers must be diligent in accurately verifying employment by providing necessary alternative documents, such as freelance contracts, pay stubs, or other financial documents.

Challenges Employers Face in Employment Verification

Employers can face various challenges in the student loan employment verification process, particularly when it comes to the specific details required for IDR plans and PSLF. Some of the common challenges employers encounter include:

- Unclear Guidelines or Confusion: Many employers may not be aware of the requirements of student loan employment verification, especially with newer programs like PSLF. The criteria for qualifying employment can be complex, and employers may need more guidance to know what constitutes qualifying work for these programs. Without clarity on the types of employers that qualify or the required documentation, mistakes or delays can occur.

- Administrative Burden: The employment verification process can become an administrative burden for employers, especially for small businesses or companies without dedicated HR departments. Handling multiple requests for verification, tracking employees’ eligibility, and staying up to date with the regulations can overwhelm smaller organizations, leading to delays or errors in the process.

- Verifying Non-Traditional Work: For employers who manage contract workers, freelancers, or part-time employees, verifying employment for student loan purposes can be especially tricky. These workers often don’t have the same documentation as full-time employees, such as pay stubs or regular contracts. Employers must find alternative ways to verify employment, such as providing bank statements, tax returns, or self-employment records.

- Uncertainty in Ongoing Employment: Employees who change jobs frequently or work in temporary positions may make the verification process more complicated. Borrowers who have a history of changing employers may need to submit multiple employment verification forms to ensure that all their previous employers are properly recorded for PSLF or IDR purposes. This can be confusing for employers, especially when verification needs to go back several years.

Responsibilities of Employees in Student Loan Employment Verification

While employers have specific obligations in the employment verification process, employees are also responsible for ensuring that their student loan repayment applications are completed correctly and on time. Employees must take proactive steps to submit the necessary documentation and forms for verification and loan forgiveness.

Key Responsibilities of Employees:

- Providing Accurate Information: Employees must provide accurate and complete information on employment certification forms and other related documents. This includes submitting the correct details about their job role, employer, and hours worked. Inaccurate or incomplete information may delay the verification process and could result in an employee losing credit for qualifying payments.

- Submitting Employment Certification Forms (ECF): Employees must submit the ECF to their loan servicer or the U.S. Department of Education, depending on the type of repayment plan or forgiveness program they are applying for. The form is used to confirm that they are employed by a qualifying employer. Employees are responsible for ensuring they submit the form annually or whenever they change employers, as required by the loan servicer.

- Tracking Employment History: Employees are also responsible for tracking their employment history accurately. Borrowers seeking PSLF must submit their employment history to track their progress toward forgiveness. Employees must keep detailed records of their employment, including the dates of employment, number of hours worked, and their job title.

- Providing Additional Documentation: In certain cases, employees may be asked to provide additional documents to verify their employment, such as pay stubs, tax returns, or contract agreements. Borrowers with non-traditional employment, such as gig workers or freelancers, may need to submit alternative documentation, such as invoices, bank statements, or tax filings. Employees should be diligent about gathering and submitting the correct documentation to ensure timely verification.

- Working with Employers to Ensure Accurate Verification: Employees are responsible for communicating with their employers to ensure that employment verification forms are completed correctly. If there are discrepancies or issues with the employer’s verification process, employees may need to clarify or provide additional information to ensure that the employer submits accurate details.

Methods of Employment Verification: Manual vs. Digital

The process of employment verification can be carried out in both manual and digital formats. The method chosen will depend on the employer’s resources, the employee’s type of job, and the servicer’s requirements.

Manual Verification:

In a manual verification process, employees and employers would need to fill out paper forms, such as the Employment Certification Form (ECF), and submit them via mail or fax. Employers are responsible for reviewing the documents and confirming that the employee meets the requirements for PSLF or IDR eligibility.

While manual verification is still common, it can be time-consuming and prone to errors, as it involves more paperwork, physical mailing, and multiple steps for both the employee and employer.

Digital Verification:

In contrast, digital verification allows employees and employers to submit forms electronically. Many loan servicers and third-party companies now offer online portals for employment certification, allowing borrowers to submit forms, upload supporting documentation, and receive real-time feedback. Digital verification significantly speeds up the process, reduces the likelihood of errors, and ensures that documents are received securely and promptly.

The rise of digital solutions for employment verification has streamlined the process, making it more efficient for both employees and employers. Many employers have adopted digital systems to track employee work hours and submit forms directly to student loan servicers.

The Role of Third-Party Services in Employment Verification

Employers and employees alike often rely on third-party services like Rapid Hire Solutions to streamline the employment verification process. These services help businesses manage the employment verification process efficiently, ensuring that all necessary documentation is completed accurately and on time. Rapid Hire Solutions provides comprehensive background check services, including verifying employment for student loan purposes. By partnering with a service like Rapid Hire Solutions, employers can reduce administrative burden, ensure compliance with state and federal regulations, and help employees maintain eligibility for loan repayment benefits and forgiveness programs.

Key Steps in the Student Loan Employment Verification Process

The student loan employment verification process can be broken down into several key steps, which help ensure that borrowers meet the eligibility criteria for various repayment options. Below is an outline of these steps:

| Step | Description |

|---|---|

| 1. Employee Completes ECF | The borrower fills out the Employment Certification Form (ECF) to provide their employment details. |

| 2. Employer Reviews and Completes ECF | The employer reviews the form and provides the necessary details about the employee’s employment status. |

| 3. Submission to Loan Servicer | The employee submits the completed ECF to their loan servicer or the U.S. Department of Education. |

| 4. Loan Servicer Reviews Documents | The loan servicer or federal agency reviews the submitted form and supporting documentation for accuracy. |

| 5. Verification Confirmation | Borrowers are notified about the verification status and whether they qualify for the requested loan benefits. |

Legal Aspects of Student Loan Employment Verification

Student loan employment verification plays a crucial role in determining eligibility for repayment plans and forgiveness programs. It’s essential for both employers and employees to understand the legal framework surrounding the verification process to ensure compliance with relevant laws. The process is subject to various regulations that govern how employment verification is conducted, who is responsible for submitting forms, and how the data can be used by loan servicers.

Relevant Laws and Regulations

- Higher Education Act (HEA) of 1965: The HEA is a foundational piece of legislation that governs federal student aid programs, including federal student loans. The HEA provides the structure for Income-Driven Repayment (IDR) plans and Public Service Loan Forgiveness (PSLF), both of which require employment verification. The law allows borrowers to qualify for loan forgiveness after making qualifying payments while employed by a qualifying public service employer.

- Fair Credit Reporting Act (FCRA): The FCRA primarily governs the use of consumer information, including background checks, and ensures that individuals’ information is handled securely and accurately. When employers verify employment for student loan purposes, they must adhere to FCRA guidelines. For instance, if third-party services are used to verify employment, these services must be certified under the FCRA to ensure that all data is accurate and used appropriately.

- Equal Employment Opportunity Laws: Employment verification for student loans should be performed in compliance with federal and state Equal Employment Opportunity (EEO) laws, including Title VII of the Civil Rights Act of 1964, the Americans with Disabilities Act (ADA), and the Age Discrimination in Employment Act (ADEA). Employers must ensure that the verification process does not discriminate against any employee based on race, color, national origin, sex, disability, or age. It’s essential that employment verification is a neutral and non-discriminatory process.

- Public Service Loan Forgiveness (PSLF) Regulations: Public Service Loan Forgiveness is one of the primary student loan forgiveness programs that require employment verification. The PSLF program is designed to forgive federal student loans for individuals employed in qualifying public service jobs. The U.S. Department of Education sets strict guidelines for what constitutes qualifying employment and requires the submission of Employment Certification Forms (ECF) to verify eligibility.It’s important for both employers and employees to be aware of these guidelines. Employees working in public service sectors such as government, non-profit organizations, or certain types of public health roles need to verify their employment regularly to track their progress toward loan forgiveness.

- State-Specific Regulations: In addition to federal laws, each state may have its own regulations regarding employment verification for student loans. For example, states may have additional protections regarding employee privacy or specific requirements for public service employees to qualify for loan forgiveness programs. Employers need to be familiar with both state and federal rules to ensure compliance.

Consequences of Non-Compliance

Failure to properly verify employment for student loan purposes can lead to significant consequences for both employees and employers. Some of the potential outcomes include:

- For Employees: If employment verification is not submitted or completed correctly, employees may lose credit for qualifying payments or fail to meet the eligibility requirements for loan forgiveness programs like PSLF. This could result in extended loan repayment periods, higher monthly payments, and the loss of benefits that could have reduced their loan balance or forgiven it entirely.

- For Employers: Employers who do not fulfill their responsibilities in providing accurate employment verification may face reputational damage and possible legal repercussions. While the legal liability for employers may be minimal in terms of penalties, failing to provide the necessary documentation could strain relationships with employees and delay the loan repayment process.

Frequently Asked Questions (FAQs)

Can I get a loan without proof of employment for student loan purposes?

Employment verification is often required for Income-Driven Repayment (IDR) plans and Public Service Loan Forgiveness (PSLF). However, borrowers who are unemployed or under-employed may still be able to qualify for a repayment plan based on their income, provided they submit alternative documentation such as tax returns, pay stubs, or other income verification forms.

What happens if I can’t provide employment verification for my student loan application?

If you cannot provide employment verification, your loan servicer may not be able to approve your request for an IDR plan or PSLF. In such cases, you may need to provide alternative documentation, such as tax returns or income statements, to demonstrate your eligibility for a specific repayment program. It’s essential to stay in communication with your servicer and explain any challenges you may be facing.

Are there any risks involved in the employment verification process for student loans?

The risks associated with employment verification are primarily related to inaccurate information or incomplete forms. If the wrong details are submitted, it could delay the repayment process or cause you to miss qualifying payments for loan forgiveness programs. Additionally, employers must ensure that the verification process complies with legal guidelines to avoid potential legal or regulatory issues.

How far back do I need to submit employment verification for my student loans?

For Public Service Loan Forgiveness, you’ll need to submit Employment Certification Forms annually, or whenever you change employers. This ensures that your loan servicer can track your qualifying payments. If you’ve been employed in public service roles for a long time, you may need to submit verification for past years to count toward your forgiveness program.

Can Rapid Hire Solutions help with employment verification for student loans?

Yes, Rapid Hire Solutions offers comprehensive background check services, including employment verification for student loan purposes. Their services help employers streamline the verification process, ensuring that all required documentation is submitted accurately and on time, while also complying with state and federal regulations. Employees can also rely on Rapid Hire Solutions to ensure that they meet the necessary verification criteria for loan repayment benefits and forgiveness programs.

Conclusion

Student loan employment verification is a crucial process that ensures employees qualify for the various federal repayment programs and forgiveness opportunities available to them. Both employers and employees have specific roles in ensuring the accuracy and timeliness of the verification process. Employers must provide correct details and submit documentation in a timely manner, while employees must be proactive in submitting the required forms and ensuring that their eligibility is properly tracked.

Understanding the legal aspects surrounding student loan employment verification is essential for all parties involved. Employees and employers alike must be aware of the requirements for programs like PSLF and IDR plans, and they must ensure that the necessary verification forms are completed accurately and on time. With the assistance of third-party services like Rapid Hire Solutions, employers can streamline the verification process, ensuring that they remain compliant with federal and state regulations while helping employees stay on track for loan forgiveness and repayment benefits.

By maintaining a clear understanding of the requirements and addressing any potential challenges proactively, employers and employees can ensure that they maximize their student loan repayment options and achieve their financial goals.