Table of Contents

ToggleWhat is a Tenant Screening Report and Why Should You Check It for Yourself?

A tenant screening report is a crucial document used by landlords and property managers to assess the suitability of potential tenants. This report typically includes several types of information that can help landlords make informed decisions about whether to approve or reject a rental application. For individuals seeking rental properties, it is essential to understand the importance of these reports and how they may impact the approval process. Checking your own tenant screening report before applying for rental properties is an important step in ensuring that there are no surprises when landlords perform their assessments.

What is a Tenant Screening Report?

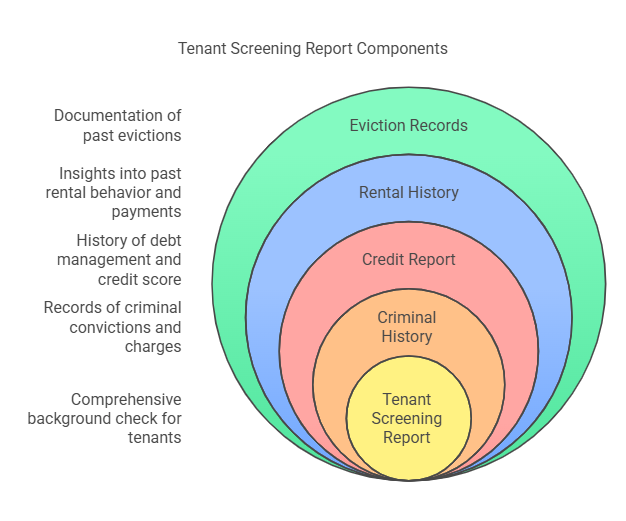

A tenant screening report is a comprehensive background check on an applicant’s rental history and financial standing. It is commonly used by landlords to evaluate prospective tenants based on various factors, including:

- Criminal History: This section typically outlines any criminal convictions, including felonies, misdemeanors, and any ongoing criminal investigations or charges.

- Credit Report: A tenant’s credit report will show the history of their debt management, including credit score, outstanding debts, bankruptcies, and payment history.

- Rental History: This section reviews a tenant’s previous rental experiences, providing insights into whether they paid rent on time, how they treated the property, and if they were ever evicted.

- Eviction Records: If a person has been evicted from a previous rental property, this will be documented in the tenant screening report. Landlords may take this as a sign of financial instability or behavioral issues.

- Employment History: Although not always included in a standard tenant screening report, some providers may also verify employment history to ensure that an applicant has a stable income.

- Civil Judgments and Liens: This portion covers any civil judgments against the individual, such as unpaid court orders, and any liens filed for unpaid debts.

Why Should You Check Your Own Tenant Screening Report?

As a potential tenant, checking your own tenant screening report is essential for several reasons:

- Proactively Addressing Issues: If there are any negative marks, such as eviction records, unpaid debts, or inaccuracies, you have the chance to address these issues before a landlord sees them.

- Avoiding Rental Rejection: Many landlords heavily rely on tenant screening reports to decide whether to approve an applicant. A negative report could result in a rejection, even if you’re otherwise a suitable tenant. Checking your report helps you be prepared.

- Correcting Errors: Errors in your tenant screening report can impact your chances of securing a rental. If there are inaccuracies, such as a mistaken eviction record or outdated financial information, you can dispute them before submitting your application.

- Enhancing Your Application: Knowing what your report looks like can help you provide additional context or references during the application process. For example, if your credit score is low due to past issues, you might be able to offer an explanation or demonstrate how you’ve improved financially.

How Tenant Screening Reports Affect the Rental Application Process

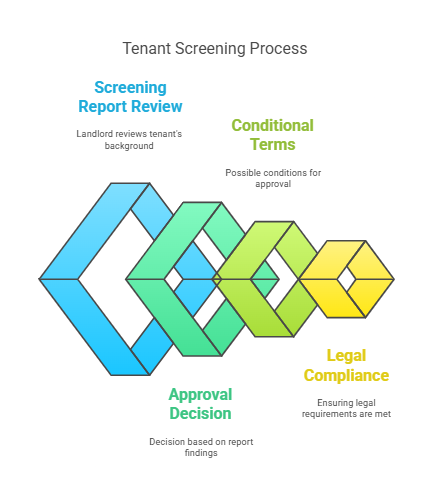

Tenant screening reports are integral to the rental process. Here’s how they influence the decision-making of landlords and property managers:

- Impact on Approval: A landlord typically uses the tenant screening report to gauge the risk of renting to an applicant. Positive reports (good credit, rental history, etc.) will likely lead to approval, while reports with issues (unpaid debts, criminal history, evictions) may lead to rejection.

- Renting Terms: If your report contains red flags, a landlord may still approve your application but with conditions, such as a higher security deposit or a co-signer.

- Legal Compliance: Landlords are required by law to obtain your consent before running a background check. Additionally, they must inform you if your application is rejected based on the results of the tenant screening report.

Overall, tenant screening reports help landlords mitigate risks associated with renting properties. For tenants, ensuring your report is accurate and up-to-date is vital to increase your chances of a successful rental application.

How to Obtain a Tenant Screening Report on Yourself: A Step-by-Step Guide

Obtaining your own tenant screening report is a proactive approach to ensuring that your rental application process goes smoothly. By reviewing your report, you can identify potential issues early on, dispute inaccuracies, and provide explanations where necessary. In this section, we will guide you through the process of obtaining a tenant screening report on yourself, including the different services available, the required documentation, and tips for effectively accessing your report.

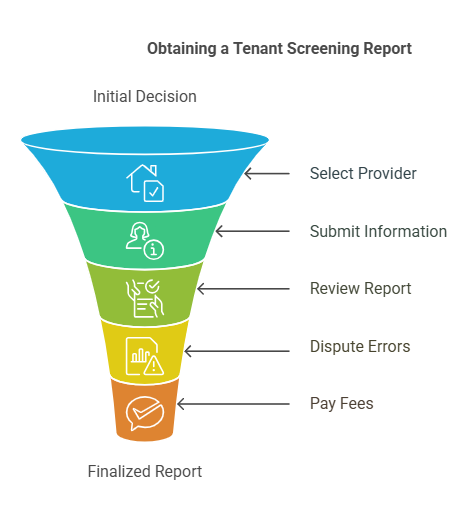

Step-by-Step Guide to Obtaining Your Tenant Screening Report

There are several ways you can obtain your tenant screening report. Below are the steps to follow depending on the service you choose:

1. Choose a Tenant Screening Report Provider

Several companies specialize in providing tenant screening reports for individuals. These providers gather data from multiple sources, including credit bureaus, public records, and past landlords. Some of the most well-known tenant screening services include:

- TransUnion: Known for providing detailed credit reports, TransUnion also offers tenant screening services.

- Experian: This major credit bureau offers tenant screening services, which include background checks, eviction records, and criminal history.

- CoreLogic SafeRent: A leading provider of tenant screening services, CoreLogic offers comprehensive reports that include credit, criminal background, and rental history.

- RentSpree: RentSpree offers tenant screening tools, providing a combination of credit reports, eviction history, and criminal background checks.

- MyRental: MyRental offers a full suite of tenant screening services, including background checks, credit reports, and eviction history.

Each provider may have its own specific requirements and features, so it’s essential to compare their offerings and decide which one best suits your needs.

2. Provide the Required Information

To obtain your tenant screening report, you will need to provide certain personal details. This information is essential for verifying your identity and pulling accurate data from public records and other databases. The following information may be required:

- Full Name: Ensure that you provide your legal name as it appears on official documents.

- Date of Birth: This is used to verify your identity and to ensure that the correct data is retrieved.

- Social Security Number (SSN): Your SSN helps in verifying your identity and retrieving your credit history and other records.

- Address History: Some services may ask for your address history for the past several years to gather data about your rental history.

3. Review Your Report

Once your request is processed, you will typically receive your tenant screening report via email or through a secure online portal. The report may include the following details:

- Credit Score and Credit History: Information about your creditworthiness, payment history, and any current outstanding debts.

- Rental History: Records of your past rental agreements, including any evictions or disputes.

- Criminal Background: A check of any criminal convictions or charges on record.

- Eviction Records: Information about any past evictions, including the reason for eviction and dates.

- Public Records: Information such as judgments, liens, or bankruptcies that might be available in the public domain.

Review each section carefully to ensure the information is accurate. Pay particular attention to discrepancies in your rental history, criminal background, or credit history, as these could affect your rental application.

4. Dispute Inaccurate Information

If you find any errors in your tenant screening report, you have the right to dispute them. Contact the provider or the relevant authority to request corrections. Common errors include:

- Mistaken Evictions: If a previous eviction record is incorrect or pertains to someone else with a similar name, it is important to dispute this.

- Outdated Credit Information: If old debts or resolved credit issues are still showing up, request that the information be updated.

- Incorrect Criminal Records: If there are criminal records on file that do not belong to you, or if charges were dismissed, make sure to have them removed or corrected.

Each tenant screening service will have a process in place for disputing errors, and they are generally required to investigate and resolve disputes within a certain time frame.

5. Pay the Required Fees

While some tenant screening reports are free, many providers charge a fee for the service. These fees vary based on the provider and the type of information included in the report. The costs can range from a nominal fee to a higher cost for more comprehensive reports, which may include credit checks, criminal background, eviction records, and more.

It’s important to be aware of the costs before requesting your report to ensure that it fits within your budget.

Comparison of Tenant Screening Report Providers

Below is a table summarizing the key features of some well-known tenant screening report providers:

| Provider | Cost | Services Offered | Required Information | Turnaround Time |

|---|---|---|---|---|

| TransUnion | $20 – $40 | Credit report, rental history, criminal check | SSN, DOB, address history | 1-3 business days |

| Experian | $15 – $40 | Credit report, criminal check, eviction records | SSN, DOB, address history | 1-2 business days |

| CoreLogic SafeRent | $25 – $50 | Credit check, criminal background, eviction history | SSN, address history | 1-3 business days |

| RentSpree | Free for tenants | Credit check, rental history, eviction records | SSN, DOB, address history | Instant to 1 business day |

| MyRental | $30 – $50 | Credit report, criminal check, rental history, eviction records | SSN, DOB, address history | 1-3 business days |

Key Considerations When Choosing a Tenant Screening Report Provider

- Cost: Some services are free, while others require a fee. Determine what fits your budget and needs.

- Turnaround Time: If you need the report urgently, choose a provider with a faster turnaround.

- Report Scope: Ensure the provider includes the information most relevant to you, such as criminal background, rental history, and credit reports.

- Accuracy and Reputation: Read reviews and check the reputation of the provider to ensure they provide accurate and reliable reports.

By following these steps and choosing the right provider, you can obtain a comprehensive tenant screening report on yourself and use it to improve your chances of being approved for a rental property.

Common Questions, What to Do If There Are Errors, and Conclusion on Tenant Screening Reports

Tenant screening reports are an essential part of the rental application process, and understanding how to use them effectively is crucial. This section addresses common questions about tenant screening reports, explains how to handle errors, and provides guidance on interpreting your report for rental success.

Common Questions About Tenant Screening Reports

How Long Does It Take to Process a Tenant Screening Report?

The processing time for a tenant screening report depends on the service provider and the complexity of the information being verified. Typically, it can take anywhere from a few minutes to a few days. Some reports, such as credit checks, may be processed almost instantly, while others—such as criminal background checks or eviction history—may require more time.

What Information is Included in a Tenant Screening Report?

A tenant screening report may include several types of information that landlords use to evaluate an applicant’s suitability for a rental property:

- Credit Report: Shows your credit score, current debts, payment history, and outstanding balances.

- Criminal Background Check: Reveals any criminal records or charges, which can significantly influence a landlord’s decision.

- Rental History: Lists your previous rental properties, including any late payments or evictions.

- Eviction Records: If you have been evicted, this will be included in the report, which is important for landlords to assess.

- Employment Verification: Some reports also include employment verification, ensuring that you have stable income.

What Should I Do If I Find an Error on My Tenant Screening Report?

Mistakes can happen, and tenant screening reports are not immune to inaccuracies. If you spot an error on your report, here’s what you should do:

- Identify the Error: Review your report carefully to pinpoint where the mistake has occurred. Common errors include inaccurate criminal records, mistaken identities, or outdated eviction histories.

- Contact the Service Provider: Reach out to the provider of the tenant screening service and notify them of the error. Provide any documentation you have to support your claim.

- Dispute the Information: If the error pertains to your credit report, you can file a dispute with the credit bureaus (e.g., TransUnion, Experian). If it concerns eviction records or criminal background checks, follow the dispute process outlined by the tenant screening service.

- Follow Up: Keep track of the dispute process and ensure that the incorrect information is rectified. This may take a few weeks, so make sure to follow up regularly.

How Can I Improve My Tenant Screening Report?

If your tenant screening report reveals issues like late payments, eviction records, or a low credit score, there are several ways to improve it:

- Pay Off Outstanding Debts: Address any unpaid bills or outstanding debts, especially credit card balances, to improve your credit score.

- Provide Positive Rental References: If you’ve had positive rental experiences in the past, ask previous landlords to provide references that speak to your reliability as a tenant.

- Get a Co-Signer: If your credit score or rental history is an issue, consider having a co-signer with better credit to back your application.

- Secure Employment or Income Verification: If you have an inconsistent job history, providing strong evidence of stable income can help your case.

Is It Legal for Landlords to Use My Tenant Screening Report Against Me?

Yes, landlords can legally use tenant screening reports to assess your suitability for renting. However, they must follow certain laws when doing so:

- Fair Housing Act: Landlords cannot discriminate based on race, gender, religion, or disability, among other protected characteristics.

- Tenant Screening Laws: Landlords must obtain your consent to run a tenant screening report. They are also required to provide you with a copy of the report if it results in a denial or adverse decision.

- Accuracy: Landlords must ensure that the information they use is accurate and up to date. If they use incorrect data to make a decision, it could be considered an unfair practice.

Practical Tips for Using Tenant Screening Reports

1. Check Your Report Early

Review your tenant screening report well in advance of applying for a rental property. This gives you time to address any discrepancies or issues before they impact your chances of getting approved.

2. Gather Supporting Documentation

If there are potential red flags on your report, such as eviction history or a low credit score, be prepared to explain them to potential landlords. Supporting documentation such as letters of explanation, payment plans, or proof of improved credit can help strengthen your application.

3. Know Your Rights

Familiarize yourself with tenant rights regarding tenant screening reports. If your application is denied based on the information in your report, landlords are required to notify you and provide you with the opportunity to dispute any inaccuracies.

Conclusion

Tenant screening reports play a significant role in the rental process, affecting both landlords’ decisions and tenants’ ability to secure a lease. By proactively checking your own tenant screening report, addressing potential issues, and knowing your rights, you can improve your chances of a smooth and successful rental application process. If there are errors on your report, don’t hesitate to dispute them to ensure you present an accurate and fair picture to prospective landlords. Ultimately, understanding the process and maintaining a clean record will serve you well in securing rental housing.