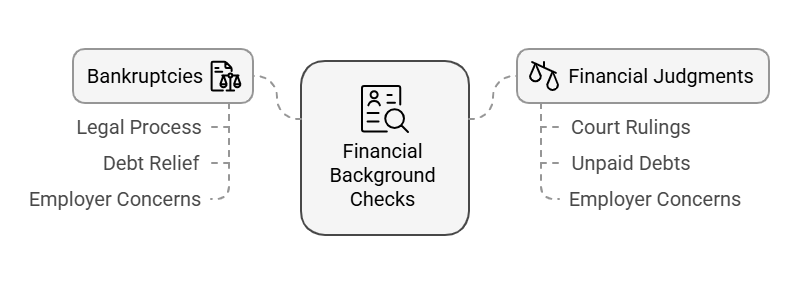

Bankruptcies and Financial Judgments: A Critical Aspect of Employer Risk Assessment Background checks

Background checks are an essential tool for employers to ensure the candidates they hire are trustworthy, responsible, and capable of performing their job duties. While most employers are familiar with criminal background checks and employment history verifications, bankruptcies and financial judgments are equally critical in certain hiring contexts. These checks help assess a candidate’s financial responsibility, particularly in roles that involve financial management, sensitive data, or fiduciary duties.

Why Financial Background Checks Matter

When a company is hiring, understanding the financial history of potential employees can be just as important as reviewing their criminal record or professional references. Financial difficulties, such as bankruptcies and financial judgments, often indicate poor money management or decision-making habits that may affect a person’s ability to carry out duties effectively, particularly in positions requiring trust, responsibility, and access to finances.

Bankruptcy filings can suggest an inability to manage personal finances, and financial judgments may reveal unresolved financial disputes that could negatively impact the candidate’s financial stability. Evaluating these records helps employers avoid potential risks that could affect the integrity and operational efficiency of their organization.

Different Types of Financial Background Checks

The two primary components of financial background checks are:

- Bankruptcies

A bankruptcy is a legal process where a person is unable to repay their debts and seeks court protection to discharge or reorganize their debts. This may raise red flags for employers, especially in roles where financial responsibility is paramount. While bankruptcy alone doesn’t indicate a candidate’s inability to perform job duties, it provides insight into a person’s financial decision-making and risk management skills. - Financial Judgments

A financial judgment occurs when a court rules that an individual owes money due to unpaid debts or disputes. This can include outstanding loans, credit card debts, or other financial obligations. Financial judgments are a significant concern for employers as they may indicate financial instability, and if unresolved, could lead to garnishments or other financial complications affecting the employee’s productivity and focus.

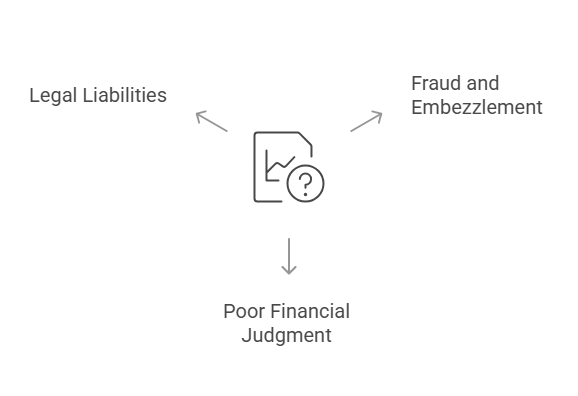

Potential Risks of Not Reviewing Financial Records

Failing to conduct comprehensive financial background checks leaves businesses vulnerable to several risks:

- Fraud and Embezzlement

Individuals with financial struggles may be more prone to engaging in fraudulent activities or embezzlement, especially in roles involving financial oversight or access to company funds. - Poor Financial Judgment

A history of bankruptcies or unresolved judgments may point to poor decision-making or an inability to manage financial resources effectively, which could be detrimental to the company. - Legal Liabilities

Hiring candidates with unresolved financial issues can expose companies to legal risks, especially in regulated industries or roles where financial trust is critical.

Thus, financial background checks are essential to mitigate these risks and ensure that employees are financially responsible and stable, especially in sensitive roles.

Financial Background Checks: Key Insights

The table below illustrates the differences in financial responsibility between candidates who have experienced bankruptcy or financial judgments versus those without any such history. It highlights potential risks and benefits employers should consider when reviewing financial history during the hiring process.

| Factor | With Bankruptcy | With Financial Judgment | No Financial Issues |

|---|---|---|---|

| Financial Stability | Risk of financial instability, potential stress | Indicates unresolved financial disputes | Higher likelihood of financial responsibility |

| Risk of Fraud | Higher risk, especially in financial roles | Moderate risk depending on the nature of the judgment | Lower risk for roles with financial oversight |

| Trustworthiness | Could raise concerns about decision-making | May signal lack of financial discipline | Viewed as stable and responsible |

| Impact on Job Performance | May affect focus and productivity due to financial stress | Could impact concentration or morale | Likely to perform well in financial tasks |

| Potential for Garnishments | Possible garnishment of wages or assets | Potential garnishment or payment plans | No risk of wage garnishment or financial strain |

How RapidHireSolutions Supports Employers

At RapidHireSolutions, we understand the importance of conducting thorough financial background checks as part of the hiring process. Our financial records review services include bankruptcy and financial judgment checks, ensuring that employers have access to the most accurate and up-to-date information about their candidates. By using our services, businesses can make well-informed hiring decisions that minimize risks and enhance their operational efficiency.

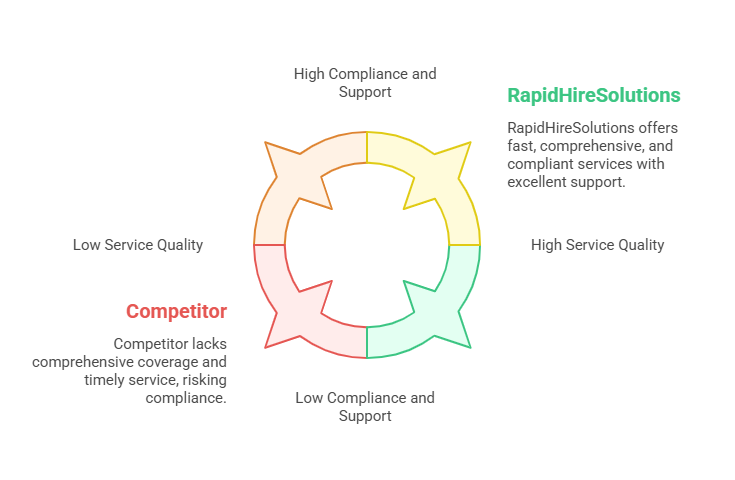

Comparing RapidHireSolutions with Other Background Check Providers for Bankruptcies and Financial Judgments

When it comes to assessing candidates for financial stability and responsibility, choosing the right background check provider is essential. There are various services available, but not all provide the same level of detail, compliance, and speed. In this section, we will compare RapidHireSolutions with another competitor in the field, focusing on their bankruptcy and financial judgment checks. This comparison will help employers understand why RapidHireSolutions may be the superior choice when it comes to mitigating risks related to financial instability.

Key Features to Compare

When evaluating background check providers, several factors should be taken into account. These include the accuracy and reliability of financial record analysis, turnaround time, compliance with federal regulations, customer service, and the comprehensiveness of reports. Let’s explore how RapidHireSolutions compares with a leading competitor.

Data Table: RapidHireSolutions vs. Competitor

The table below compares the key features of RapidHireSolutions and a competitor offering bankruptcy and financial judgment checks. Each attribute is essential for employers looking to make well-informed hiring decisions.

| Feature | RapidHireSolutions ✅ | Competitor ❌ |

|---|---|---|

| Turnaround Time | ✅ 24-hour turnaround | ❌ 10-14 days turnaround |

| Comprehensive Financial Coverage | ✅ Full coverage of bankruptcies and judgments | ❌ Limited coverage |

| Compliance | ✅ Fully compliant with FCRA and local/state laws | ❌ Partial compliance |

| Customer Support | ✅ 24/7 support, fast response | ❌ Limited support, slower response |

| Pricing Model | ✅ Competitive pricing, no hidden fees | ❌ Higher fees, unclear pricing model |

| Accuracy | ✅ 99%+ accuracy rate | ❌ 85% accuracy rate |

Why RapidHireSolutions Stands Out

- Fast Turnaround Time

RapidHireSolutions offers a 24-hour turnaround time, ensuring employers have the necessary financial judgment and bankruptcy information quickly to make hiring decisions. In contrast, the competitor has a significantly longer processing time of 10-14 days, which can delay the hiring process. - Comprehensive Coverage

RapidHireSolutions provides comprehensive checks, ensuring that employers have access to complete financial history, including bankruptcies, judgments, and related records. On the other hand, the competitor offers partial coverage, potentially leaving gaps in the financial background information. - Compliance with Legal Standards

RapidHireSolutions prioritizes compliance with the Fair Credit Reporting Act (FCRA) and state laws, ensuring that all background checks are legally sound. The competitor, however, may not fully comply with all necessary regulations, posing potential risks for employers. - Customer Support

RapidHireSolutions excels in customer service with a dedicated team available 24/7 to answer any questions or resolve issues promptly. The competitor, however, offers limited customer support, which could cause delays or frustrations during the hiring process. - Pricing

RapidHireSolutions provides transparent and competitive pricing, with no hidden fees, making it a cost-effective choice for employers. The competitor, however, has unclear pricing and higher fees, making it a less economical option for employers seeking a reliable and budget-friendly service.

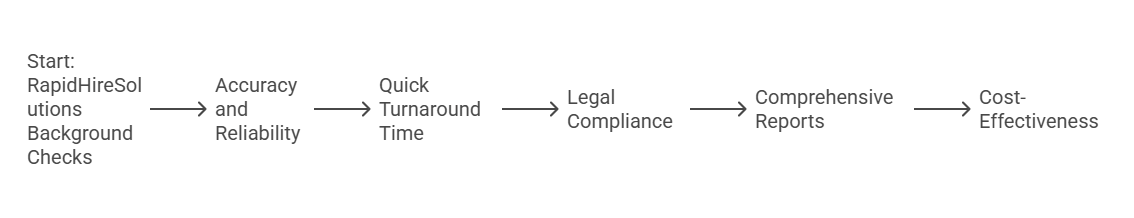

Detailed Analysis of RapidHireSolutions’ Strengths

1. Accuracy and Reliability

One of the most critical factors when it comes to background checks, particularly financial ones, is accuracy. Employers need to ensure that the information they receive is reliable and up-to-date to make informed hiring decisions. RapidHireSolutions boasts a 99%+ accuracy rate, ensuring that the financial records, including bankruptcies and judgments, are accurate and comprehensive. With a higher level of accuracy, employers can trust the information they receive and mitigate risks associated with financial instability.

2. Quick Turnaround Time

Another significant benefit of using RapidHireSolutions is the 24-hour turnaround time for bankruptcy and financial judgment checks. This speed allows employers to quickly proceed with hiring decisions, minimizing the waiting period and maintaining operational efficiency. In contrast, the competitor’s turnaround time of 10-14 days can delay the hiring process, which is especially problematic when urgent hires are needed.

3. Legal Compliance and Peace of Mind

RapidHireSolutions is committed to staying compliant with all relevant laws, including the Fair Credit Reporting Act (FCRA) and any state-specific regulations. By using RapidHireSolutions, employers can rest assured that their background checks are legally compliant, reducing the risk of lawsuits or compliance-related issues. This compliance is a key selling point for employers who want to avoid the legal ramifications of improper background checks.

4. Comprehensive Reports

In addition to providing accurate and reliable information, RapidHireSolutions offers comprehensive financial background reports. This ensures that employers are receiving all the relevant details about a candidate’s bankruptcy or financial judgments, including case numbers, dates, and the current status of any financial disputes. The competitor’s limited coverage might leave out essential details, which could be problematic for employers seeking complete insight into a candidate’s financial history.

5. Cost-Effectiveness and Transparent Pricing

RapidHireSolutions offers competitive pricing with no hidden fees, ensuring that employers get the best value for their investment. The competitor’s unclear pricing structure and higher costs could result in unexpected charges, making it a less favorable option for companies looking for cost-effective background check solutions.

Pros and Cons of RapidHireSolutions and the Competitor

Pros of RapidHireSolutions:

- ✅ Fast turnaround time (24-hour processing)

- ✅ Comprehensive financial coverage

- ✅ High level of legal compliance

- ✅ 24/7 customer support

- ✅ Competitive and transparent pricing

Cons of the Competitor:

- ❌ Longer turnaround time (10-14 days)

- ❌ Limited financial coverage

- ❌ Partial compliance with legal standards

- ❌ Slower customer support

- ❌ Higher pricing with unclear fees

Why RapidHireSolutions is the Best Choice

RapidHireSolutions stands out as the superior choice for employers seeking comprehensive and reliable bankruptcy and financial judgment checks. With a fast turnaround time, high accuracy rate, full legal compliance, and excellent customer service, RapidHireSolutions provides businesses with the tools they need to make informed hiring decisions and mitigate risks associated with financial instability. By choosing RapidHireSolutions, employers gain peace of mind, knowing that they are receiving comprehensive, accurate, and timely financial background checks.

Legal Considerations, FAQs, and Conclusion

When assessing bankruptcies and financial judgments during the hiring process, employers must navigate several legal considerations to ensure they are compliant with state and federal regulations. While these checks are crucial for mitigating financial risk, improper handling of financial records can expose employers to legal challenges. In this section, we will cover the legal implications, answer frequently asked questions (FAQs), and provide a conclusion on the importance of evaluating bankruptcies and financial judgments in the hiring process.

Legal Considerations in Assessing Bankruptcies and Financial Judgments

Understanding the legal framework surrounding financial background checks is critical for employers. In the U.S., various laws regulate how employers can use financial information obtained through background checks. Two key regulations that employers must be aware of are the Fair Credit Reporting Act (FCRA) and state-specific laws.

1. Fair Credit Reporting Act (FCRA)

The FCRA governs the use of consumer reports by employers, including bankruptcy and financial judgment checks. Under the FCRA, employers must:

- Obtain written consent from the candidate before conducting a background check.

- Provide candidates with a copy of the report if an adverse decision is made based on the financial information.

- Ensure accuracy by using reliable sources to gather financial data.

- Notify candidates if the background check results in a decision to withdraw a job offer.

2. State-Specific Laws

In addition to federal laws like the FCRA, each state may have additional regulations governing the use of financial information in hiring decisions. For example, some states prohibit employers from considering bankruptcy filings older than a certain number of years (e.g., seven years). Additionally, some states may have stricter rules on how and when bankruptcies and financial judgments can be used to make hiring decisions. Employers should always consult with legal experts to ensure they are in compliance with local regulations.

3. Discrimination Concerns

Employers should be cautious about how they use bankruptcy and financial judgment information. Discriminatory hiring practices based on financial status, especially if a candidate’s bankruptcy filing is due to reasons such as medical debt or job loss, could lead to lawsuits or reputational damage. It’s crucial that employers apply financial information fairly and consistently to avoid claims of discrimination.

Frequently Asked Questions (FAQs)

Why is it important to review bankruptcies and financial judgments when hiring?

Reviewing bankruptcies and financial judgments provides employers with valuable insight into a candidate’s financial responsibility. For roles that involve managing finances, handling sensitive data, or making fiduciary decisions, understanding a candidate's past financial behavior is crucial to mitigate risks. A history of financial instability could indicate potential issues with decision-making, trustworthiness, or performance.

Are there legal restrictions on accessing financial history during background checks?

Yes, there are legal restrictions on how and when financial history can be accessed. The FCRA mandates that employers obtain written consent from candidates before conducting a background check. Additionally, state laws may limit how far back in time an employer can consider bankruptcies or judgments, as well as the conditions under which this information can be used in the hiring process.

How can financial judgment checks protect a company from fraud?

Financial judgment checks can help employers identify patterns of financial instability that may indicate potential risks, such as the inability to manage personal finances responsibly. In cases where a candidate has a history of fraudulent activity or financial mismanagement, these checks allow employers to make more informed decisions, reducing the likelihood of fraud or other financial issues occurring within the company.

What industries benefit the most from these checks?

Industries that rely heavily on trust, financial responsibility, or sensitive data handling can benefit significantly from bankruptcy and financial judgment checks. This includes sectors like banking, finance, healthcare, government, and any business with positions involving fiduciary duties, access to company funds, or sensitive financial data

Can bankruptcy affect a candidate’s chances of getting hired?

While having a bankruptcy on record does not automatically disqualify a candidate, it can influence hiring decisions, especially for positions involving financial oversight. Employers need to consider the context of the bankruptcy (e.g., personal financial hardship vs. fraudulent activity) and how it may affect the candidate’s ability to perform the job. It is essential to evaluate the candidate holistically, considering all aspects of their qualifications.

Conclusion

Incorporating bankruptcy and financial judgment checks into the hiring process is a crucial step for employers seeking to minimize financial risk. By conducting thorough background checks, businesses can gain valuable insights into a candidate’s financial responsibility, which is particularly important for roles with fiduciary responsibilities, financial oversight, or access to sensitive data.

Legal compliance is a top priority, and employers must ensure that their background check practices adhere to federal and state regulations, such as the Fair Credit Reporting Act (FCRA). By choosing a trusted provider like RapidHireSolutions, employers can ensure accurate, timely, and legally compliant background checks. These checks not only help businesses make informed hiring decisions but also contribute to maintaining a financially responsible and trustworthy workforce.

Ultimately, the decision to assess bankruptcies and financial judgments is a critical one, and employers should prioritize using reliable background check services to protect their organizations from potential financial and legal risks.