Credit Check Do’s and Don’ts in the Hiring Process

In today’s competitive job market, employers use various screening methods to ensure they hire reliable and responsible candidates. One such method is conducting a credit check as part of the background screening process. While credit checks are not relevant for every industry, they play a crucial role in hiring for positions that involve financial responsibility, handling sensitive information, or high-level decision-making. However, using credit history in hiring decisions requires careful consideration to ensure compliance with legal regulations and ethical hiring practices.

What is a Credit Check in Hiring?

A credit check in the hiring process involves reviewing a candidate’s financial history to assess their level of financial responsibility. Employers typically obtain a modified version of a candidate’s credit report, which includes information such as:

- Debt obligations and payment history

- Bankruptcies and liens

- Credit utilization and accounts in collections

- Public financial records

Employers do not receive credit scores but rather a summary of the candidate’s credit activity that may indicate financial stability or risk factors. The assumption behind this check is that financial irresponsibility—such as excessive debt, missed payments, or bankruptcy—may translate to potential risks in roles involving financial management or access to sensitive company resources.

Importance of Credit Checks for Employers

Credit checks are more commonly conducted in specific industries where financial reliability is essential. Businesses that rely on integrity and trust in handling funds, assets, or client information often include credit screenings as part of their hiring process.

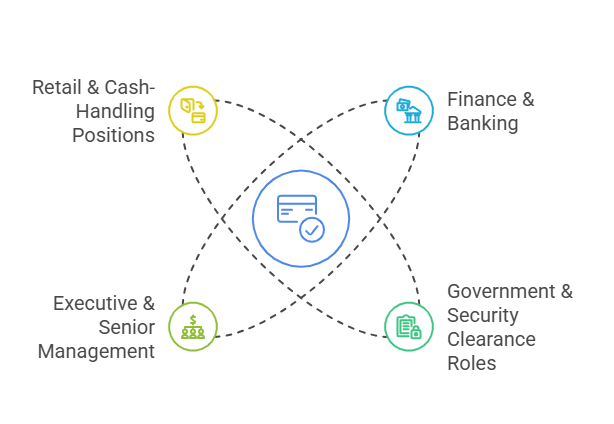

Industries Where Credit Checks Are Common:

- Finance & Banking – Employees handling financial transactions, loans, or investments must demonstrate responsible money management.

- Government & Security Clearance Roles – Positions requiring security clearance may assess financial history to identify potential fraud or bribery risks.

- Executive & Senior Management – Leadership roles often involve financial decision-making, making personal credit habits a relevant factor.

- Retail & Cash-Handling Positions – Roles involving direct access to company funds, such as store managers or accountants, may be subject to credit checks.

However, while credit history can provide insight into financial responsibility, it should never be the sole determinant in a hiring decision. Employers must evaluate credit reports fairly, legally, and with context to avoid potential discrimination or bias.

Key Do’s and Don’ts of Credit Checks in Hiring

Employers must follow best practices when integrating credit checks into their hiring process. Below is a structured table outlining the do’s and don’ts to ensure compliance and ethical decision-making.

Best Practices for Credit Checks in Hiring

RapidhireSolutions and Background Checks

Ensuring compliance with legal and ethical hiring practices requires a reliable background screening provider. RapidhireSolutions specializes in conducting comprehensive background checks, including credit screenings, to help employers make informed hiring decisions while adhering to FCRA regulations.

With fast turnaround times, accurate reports, and full compliance with hiring laws, RapidhireSolutions enables businesses to integrate credit checks seamlessly into their screening process. Their data security measures, customer support, and cost-effective solutions make them a trusted partner for employers looking to enhance their hiring process without legal risks.

Pros and Cons Comparison: RapidhireSolutions vs. Other Providers

When integrating credit checks into your hiring process, it’s essential to choose a reliable background check provider to ensure timely, accurate, and legally compliant results. The choice between different providers can have a significant impact on your hiring process efficiency and overall success. In this section, we’ll compare RapidhireSolutions to other background check service providers, focusing on key factors such as speed, accuracy, FCRA compliance, and pricing.

Pros and Cons Table Comparison

| Feature | RapidhireSolutions | Competitors |

|---|---|---|

| Speed of Results | ✅ 24-hour turnaround | ❌ 15-20 days |

| Accuracy | ✅ High accuracy | ❌ Inconsistent data |

| FCRA Compliance | ✅ Fully compliant | ❌ May have gaps |

| Pricing Transparency | ✅ No hidden fees | ❌ Hidden fees |

| Customer Support | ✅ Excellent support | ❌ Limited support |

RapidhireSolutions: The Best Choice for Credit Checks

RapidhireSolutions stands out as a top choice for employers seeking reliable and efficient credit check services. When it comes to hiring decisions, timely access to accurate information is crucial. RapidhireSolutions provides a 24-hour turnaround for credit checks, allowing businesses to quickly move forward in the hiring process. This is in stark contrast to many competitors, whose processing times can take anywhere from 15 to 20 days, causing delays that can impact recruitment timelines.

One of the most notable advantages of RapidhireSolutions is its commitment to FCRA compliance. The Fair Credit Reporting Act (FCRA) sets the standards for how employers can use credit information in hiring decisions. RapidhireSolutions ensures that its credit checks adhere to the strict guidelines set forth by the FCRA, reducing the risk of lawsuits or penalties for non-compliance. Additionally, RapidhireSolutions prides itself on accurate data—ensuring employers have access to trustworthy and up-to-date information when making hiring decisions.

Another significant advantage of using RapidhireSolutions is its transparent pricing structure. Many competitors in the market may offer lower upfront costs but tack on hidden fees, making the final cost unclear. In contrast, RapidhireSolutions is upfront about its pricing, with no hidden fees, allowing businesses to budget accurately for their hiring needs.

Data Table – Service Comparison

| Service Feature | RapidhireSolutions | Competitors |

|---|---|---|

| Processing Time | ✅ 24 hours | ❌ 15-20 days |

| FCRA Compliance | ✅ Fully Compliant | ❌ May Not Be Fully Compliant |

| Cost | ✅ No Hidden Fees | ❌ Hidden Fees |

| Customer Service | ✅ 24/7 Support | ❌ Limited or No Support |

| Accuracy of Reports | ✅ High Accuracy | ❌ Risk of Inaccurate Data |

Deep Dive into Pros and Cons

Pros of RapidhireSolutions:

- Fast Results: With a 24-hour turnaround, RapidhireSolutions allows you to make quicker, more informed hiring decisions.

- High Accuracy: Employers receive accurate, up-to-date credit information, ensuring that your hiring decisions are based on trustworthy data.

- FCRA Compliance: RapidhireSolutions ensures full compliance with the Fair Credit Reporting Act, protecting your business from legal risks.

- Transparent Pricing: Unlike some competitors, there are no hidden fees, making it easy to budget for credit checks without surprises.

- Excellent Customer Support: The dedicated customer service team is available 24/7 to answer questions and provide assistance.

Cons of Competitors:

- Slow Results: Competitors may take up to 20 days to deliver credit reports, significantly delaying hiring decisions.

- Inconsistent Data: Data accuracy can sometimes be compromised, which could lead to poor hiring decisions.

- Lack of Compliance: Some providers may not follow FCRA guidelines closely, putting your business at risk of non-compliance.

- Hidden Fees: Some competitors have hidden charges that inflate the final cost of credit checks.

- Limited Support: Customer service may be unavailable or difficult to reach, causing delays in resolving issues.

Final Thoughts on Choosing the Right Provider

Choosing the right background check provider is crucial to ensuring your hiring process is efficient, legally compliant, and accurate. RapidhireSolutions offers several distinct advantages that make it the ideal choice for employers who need fast, reliable, and legally compliant credit checks. From their 24-hour processing time to their FCRA compliance, RapidhireSolutions makes it easier for employers to make informed decisions quickly and confidently.

In contrast, competitors often fall short in areas like processing time, data accuracy, and customer support, which can delay hiring and lead to costly mistakes. By choosing RapidhireSolutions, businesses ensure that they are making hiring decisions based on the most accurate, up-to-date, and legally compliant information available.

Legal Considerations for Credit Checks in Hiring

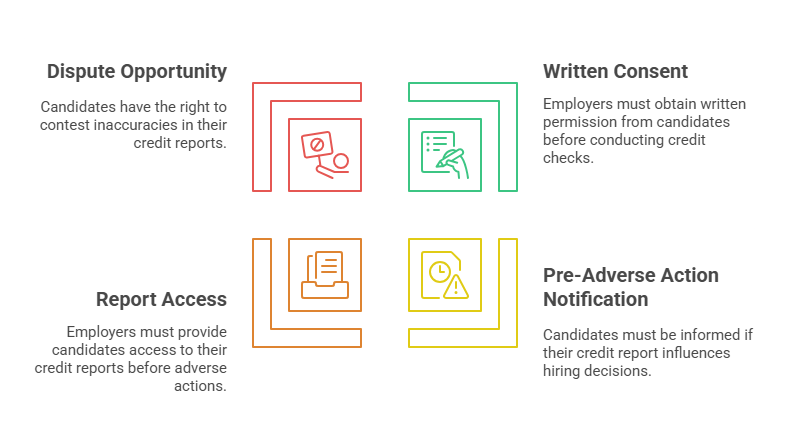

When employers decide to include credit checks as part of their hiring process, it is crucial to understand the legal framework that governs the use of such checks. In the U.S., the Fair Credit Reporting Act (FCRA) sets strict guidelines for employers who use credit reports in employment decisions. These guidelines are designed to protect job candidates from unfair treatment based on their credit history while ensuring that employers can make informed decisions for positions requiring financial responsibility.

Fair Credit Reporting Act (FCRA)

The FCRA is a key regulation that employers must comply with when conducting credit checks. Under this act, employers are required to obtain written consent from candidates before conducting a credit check. They must also inform candidates if their credit report is being used to make hiring decisions. This process is referred to as “pre-adverse action” notification, and candidates must be provided with a copy of their credit report before any negative employment action (e.g., not hiring or firing) can be taken based on it. Employers are also obligated to give candidates an opportunity to dispute any inaccuracies in the report.

Failure to follow the FCRA’s rules can result in legal consequences, including lawsuits or penalties. Employers who neglect to disclose their intent to run a credit check, fail to inform candidates of their rights, or do not provide the proper notifications risk legal liability.

State-Specific Laws

In addition to federal regulations like the FCRA, employers must also comply with state-specific laws governing credit checks. For instance, several states restrict the use of credit reports in employment decisions, particularly for positions that do not require financial responsibilities. Some states require employers to justify their use of credit reports or even ban the practice in certain industries. Employers must stay updated on the specific regulations in their state to ensure compliance.

Employers should also be aware that credit checks cannot be used as a tool for discrimination. For example, it would be illegal for an employer to use credit history in a manner that disproportionately impacts applicants based on their race, gender, or other protected characteristics under anti-discrimination laws.

Frequently Asked Questions (FAQs)

What is a pre-employment credit check?

A pre-employment credit check is when an employer reviews a candidate’s credit history as part of the hiring process. It is often used to assess the candidate's financial responsibility, especially for roles that require managing money or sensitive financial data.

Do employers need permission to run a credit check?

Yes, employers must obtain written consent from the candidate before conducting a credit check. This is a requirement under the Fair Credit Reporting Act (FCRA).

Does a poor credit score automatically disqualify a candidate?

No, a poor credit score does not automatically disqualify a candidate. Employers should assess credit history in the context of the specific job role and take into consideration any explanations the candidate may provide regarding their financial situation.

How long does a credit check take?

The length of time it takes to conduct a credit check varies depending on the service provider. Typically, it can range from a few minutes to a couple of days, but some providers, like RapidhireSolutions, offer fast results within 24 hours.

Is credit check discrimination legal?

No, using credit history in a discriminatory manner is illegal. Employers must apply credit checks consistently to all candidates for the same role and ensure that they do not disproportionately affect any protected groups.

Conclusion

Credit checks in the hiring process are a powerful tool for employers, but they must be used carefully and in compliance with legal regulations. By following the Fair Credit Reporting Act (FCRA) and relevant state laws, employers can minimize legal risks and make well-informed decisions that protect both their business and the candidates they hire.

Using a trusted background screening provider like RapidhireSolutions ensures that credit checks are conducted swiftly, accurately, and in full compliance with the law. By adhering to best practices and legal guidelines, businesses can maintain a fair and transparent hiring process while making the right decisions for roles that demand financial trustworthiness.

Remember, credit checks should never be the sole determinant in hiring decisions, and employers should always consider candidates’ qualifications and potential. Ensuring that these checks are used appropriately will help you build a strong and compliant workforce, fostering trust, safety, and productivity in your organization.