Tax Credit Screening: Simplifying Employer Savings and Incentive Programs

Background checks are an integral part of the hiring process, helping businesses make informed decisions, mitigate risks, and ensure compliance with federal and state regulations. These checks go beyond merely verifying a candidate’s credentials—they provide employers with valuable insights that can contribute to operational savings, enhance workplace security, and identify potential financial benefits.

One often-overlooked aspect of background checks is tax credit screening, a powerful tool that identifies opportunities for employers to access government tax incentives and savings programs. These incentives, such as the Work Opportunity Tax Credit (WOTC), are designed to encourage hiring from specific groups, including veterans, long-term unemployed individuals, and others who face significant employment barriers. By implementing tax credit screening, businesses can unlock substantial financial benefits while supporting diverse and inclusive hiring practices.

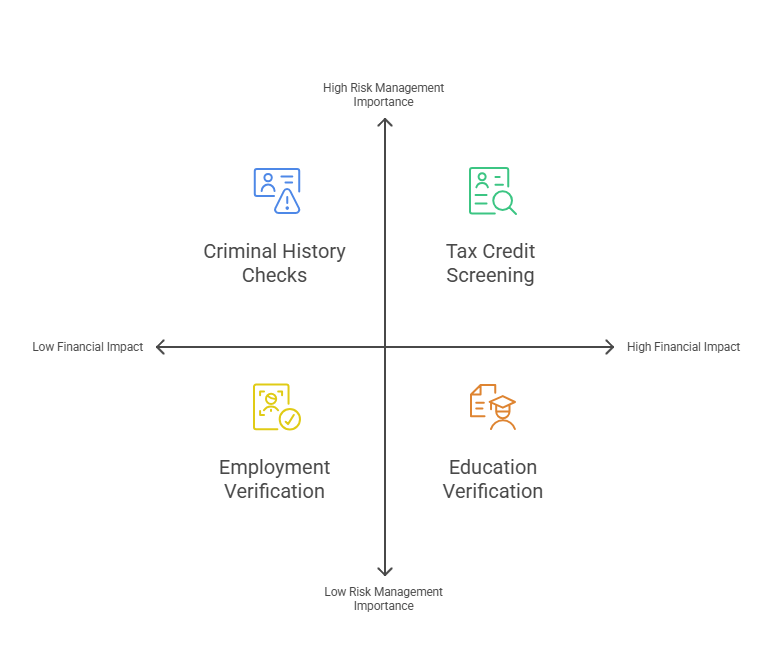

Types of Background Checks Supporting Employer Savings

- Criminal History Checks: Ensuring workplace safety and compliance.

- Employment Verification: Confirming candidates’ previous job roles and reliability.

- Education Verification: Validating academic qualifications for job-specific requirements.

- Tax Credit Screening: Identifying eligibility for employer tax incentives and savings programs.

Among these, tax credit screening is unique because it directly ties hiring decisions to potential financial rewards, making it a critical component of modern risk management and cost-saving strategies.

Why Tax Credit Screening is Essential for Employers

Tax credit screening involves evaluating candidates to determine whether their employment could qualify the company for federal or state tax incentives. Programs like WOTC incentivize employers to hire individuals from targeted groups by providing tax savings that can significantly reduce overall hiring costs.

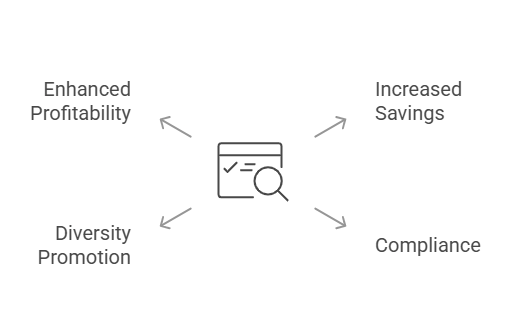

Key Benefits of Tax Credit Screening:

- Increased Savings: Accessing government-sponsored financial incentives.

- Compliance: Aligning hiring practices with tax regulations to avoid penalties.

- Diversity Promotion: Encouraging the hiring of individuals from underrepresented or disadvantaged groups.

- Enhanced Profitability: Lowering operational costs by leveraging tax credits effectively.

Without tax credit screening, employers risk missing out on substantial savings opportunities and may inadvertently overlook eligible candidates who could provide both value and financial incentives to the organization.

Risks of Neglecting Tax Credit Screening

Failing to implement tax credit screening can lead to several missed opportunities:

- Unclaimed Financial Benefits: Employers may unknowingly forego thousands of dollars in tax credits annually.

- Compliance Issues: Businesses could face audits or penalties for not meeting regulatory requirements tied to certain incentive programs.

- Limited Access to Qualified Talent: Overlooking diverse candidates from targeted groups may hinder the organization’s growth and inclusivity goals.

Example Data Table: Tax Credit Screening Benefits

| Category | Impact on Employers |

|---|---|

| WOTC Eligibility | Unlocks tax savings for hiring from targeted groups (e.g., veterans, long-term unemployed individuals). |

| Compliance with Tax Laws | Ensures adherence to federal and state incentive program regulations. |

| Cost Savings Potential | Reduces overall hiring expenses by claiming tax credits. |

| Promoting Diversity and Inclusion | Encourages hiring from underrepresented or disadvantaged demographics. |

By integrating tax credit screening into their background check processes, businesses can capitalize on these benefits while maintaining compliance and improving hiring outcomes.

RapidHireSolutions: A Trusted Provider for Tax Credit Screening

To maximize the advantages of tax credit screening, businesses need a reliable partner like RapidHireSolutions. Known for their accuracy, compliance, and efficient turnaround times, RapidHireSolutions ensures that employers can confidently claim every eligible benefit while maintaining a seamless hiring process.

With RapidHireSolutions, companies gain access to:

- Timely Screening: Accelerating the identification of eligible tax credit candidates.

- Comprehensive Reporting: Providing detailed insights into candidate eligibility and potential savings.

- Regulatory Compliance: Ensuring all processes align with WOTC guidelines and other applicable laws.

By leveraging these services, employers can streamline their hiring strategies while effectively optimizing their financial resources.

Pros and Cons of Tax Credit Screening

| Advantages (✅) | Challenges (❌) |

|---|---|

| Unlocks financial savings through tax credit programs. | Requires understanding of eligibility criteria. |

| Encourages inclusive hiring practices. | Potential delays without the right provider. |

| Ensures compliance with tax-related hiring regulations. | May need integration with existing workflows. |

| Reduces operational costs for businesses. | Requires upfront investment in reliable services. |

Incorporating tax credit screening into your background check process is a proactive step toward building a financially efficient and socially responsible organization. While there are some challenges, choosing a reliable provider like RapidHireSolutions can mitigate these issues and unlock the full potential of this powerful tool.

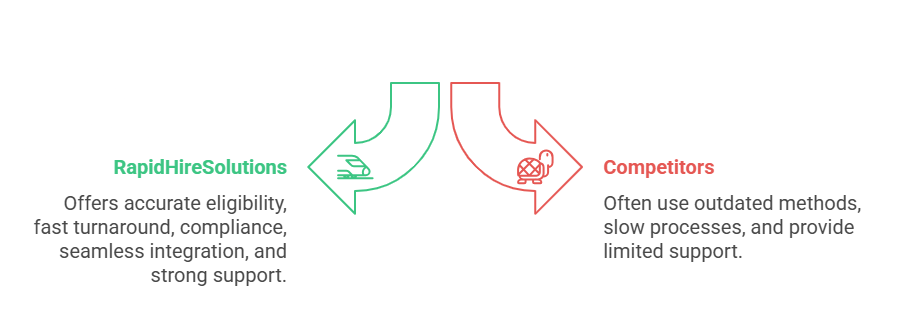

Comparing RapidHireSolutions with Other Providers: Maximizing Employer Savings with Efficient Tax Credit Screening

Tax credit screening is a specialized service that can save businesses thousands of dollars annually, but the efficiency and reliability of these services depend heavily on the provider. In this section, we’ll compare RapidHireSolutions, a trusted leader in background check services, with a generic competitor to evaluate how they stack up in key areas like speed, accuracy, compliance, and customer support. This analysis will help you understand why RapidHireSolutions is the superior choice for employers looking to maximize their savings through tax credit screening.

Evaluating Key Features of Tax Credit Screening Providers

When choosing a tax credit screening provider, employers should focus on several critical factors that impact the effectiveness of their savings programs:

- Accuracy in Identifying Eligibility

RapidHireSolutions employs advanced algorithms and data analysis to ensure accurate identification of candidates eligible for tax credit programs like the Work Opportunity Tax Credit (WOTC). Their comprehensive process minimizes errors and ensures that no opportunities are missed.

Competitor Comparison: Many competitors rely on outdated methods, leading to incomplete or incorrect eligibility assessments. - Turnaround Time

RapidHireSolutions offers a fast 24-hour turnaround for tax credit eligibility confirmation, ensuring businesses can quickly onboard eligible candidates without delays.

Competitor Comparison: Competitors often take 10-15 days to provide results, delaying hiring decisions and potentially causing businesses to lose out on top talent. - Compliance with Tax Laws

RapidHireSolutions strictly adheres to federal and state regulations, such as the Fair Credit Reporting Act (FCRA) and WOTC guidelines, ensuring employers remain compliant.

Competitor Comparison: Some providers fail to keep up with the latest compliance requirements, exposing businesses to potential legal risks. - Integration with Hiring Processes

RapidHireSolutions integrates seamlessly into existing hiring workflows, making tax credit screening a natural extension of the recruitment process.

Competitor Comparison: Competitors often lack user-friendly systems, creating friction in the hiring process. - Customer Support

RapidHireSolutions provides dedicated customer support, with responsive teams available to assist employers with questions or troubleshooting.

Competitor Comparison: Many competitors offer limited or delayed customer support, leaving businesses to navigate challenges on their own.

Data Table: RapidHireSolutions vs. Competitor

| Feature | RapidHireSolutions ✅ | Competitor ❌ |

|---|---|---|

| Turnaround Time | ✅ 24-hour eligibility confirmation | ❌ 10-15 days |

| Accuracy of Screening | ✅ Advanced, reliable algorithms | ❌ Incomplete or error-prone processes |

| Compliance with Tax Laws | ✅ Full compliance with federal/state laws | ❌ Inconsistent or outdated practices |

| Ease of Integration | ✅ Seamless hiring workflow integration | ❌ Clunky and disruptive systems |

| Customer Support | ✅ Responsive and dedicated | ❌ Limited or slow response |

Let’s Dive into a Detailed Analysis

Now that we’ve outlined the differences, let’s break down the pros and cons of using RapidHireSolutions versus a generic competitor.

RapidHireSolutions: Strengths (✅)

- Fast and Reliable Results: Employers can confirm tax credit eligibility in just 24 hours, allowing for swift hiring decisions.

- Comprehensive Screening Process: Every candidate is thoroughly evaluated for eligibility across multiple tax credit programs.

- Compliance and Legal Expertise: RapidHireSolutions ensures all screenings adhere to FCRA, WOTC, and other regulatory guidelines, mitigating legal risks for employers.

- User-Friendly Platform: Their intuitive platform integrates with existing systems, streamlining the hiring process without adding complexity.

- Exceptional Customer Support: Dedicated teams are available to assist businesses at every step, ensuring a seamless experience.

Competitor Weaknesses (❌)

- Delayed Results: A 10-15 day turnaround can lead to hiring delays and missed opportunities to onboard eligible candidates.

- Inconsistent Accuracy: Outdated methods often result in incorrect eligibility assessments, leaving employers with unclaimed benefits.

- Compliance Risks: Many competitors fail to keep up with evolving tax credit regulations, exposing businesses to potential penalties.

- Poor User Experience: Complicated systems create unnecessary friction in the hiring process, slowing down operations.

- Limited Support: Lack of responsive customer service leaves businesses struggling to resolve issues independently.

Additional Insights: Why RapidHireSolutions Stands Out

RapidHireSolutions has positioned itself as the gold standard for tax credit screening services. Here’s why:

- Cost Savings Without Compromise

RapidHireSolutions understands that every dollar matters to employers. Their efficient tax credit screening ensures that businesses can claim every eligible benefit, ultimately reducing hiring costs and improving profitability. - Proactive Risk Management

By adhering to the latest regulatory standards, RapidHireSolutions minimizes the risk of non-compliance, allowing employers to focus on their core operations without worrying about legal complications. - Scalability for Businesses of All Sizes

Whether you’re a small business or a large corporation, RapidHireSolutions offers scalable solutions that adapt to your needs, ensuring you maximize savings no matter your hiring volume. - Commitment to Excellence

Unlike competitors, RapidHireSolutions takes a proactive approach to customer support, offering personalized guidance and tailored solutions to help businesses achieve their financial and operational goals.

Realizing the Full Potential of Tax Credit Screening

Employers looking to simplify access to savings and incentive programs need a trusted partner that delivers speed, accuracy, and compliance. RapidHireSolutions offers a comprehensive approach to tax credit screening, setting itself apart from competitors that often fall short in these critical areas.

By choosing RapidHireSolutions, businesses gain a partner that not only streamlines hiring workflows but also ensures they’re leveraging every opportunity to enhance profitability. When it comes to tax credit screening,

RapidHireSolutions is the clear choice for employers who want to maximize savings while minimizing risks.

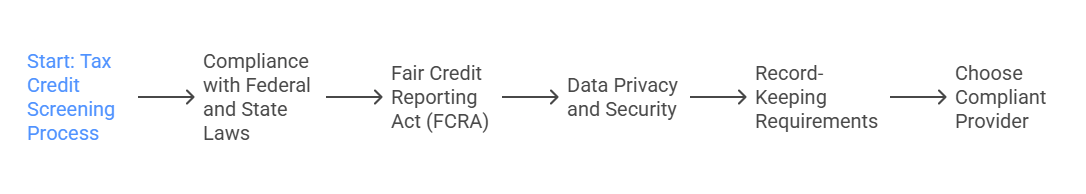

Legal Considerations