States That Ban Credit Checks for Employment: An Overview

In recent years, a growing number of states in the U.S. have taken steps to ban or restrict the use of credit checks for employment purposes. These measures have sparked widespread debates about fairness, discrimination, and the relevance of credit history in hiring decisions. Credit checks in employment have long been used as a tool for employers to assess a candidate’s reliability, responsibility, and overall financial responsibility, especially for positions that involve financial decision-making, management roles, or access to sensitive financial information. However, the practice has raised concerns over its impact on certain demographics, particularly individuals who may have experienced financial hardships but are otherwise qualified for the job.

What Are Credit Checks in Employment?

A credit check is a process where an employer requests a report from a credit bureau to evaluate a potential employee’s credit history. This report typically includes information such as the candidate’s credit score, outstanding debts, payment history, bankruptcies, and any collections or liens. Employers often request credit checks for positions that require managing company finances or handling sensitive financial information, such as accounting, financial planning, and executive roles. In certain sectors, credit history has been considered a valuable indicator of a person’s trustworthiness and financial stability.

Why Do Some States Ban Credit Checks for Employment?

Despite their common use, credit checks for employment have come under scrutiny for several reasons. Many critics argue that credit checks can disproportionately impact certain groups of people, particularly those with lower incomes or individuals who have faced financial hardships. These hardships may include medical expenses, unexpected job loss, or personal crises that lead to poor credit history. In these cases, credit history may not necessarily reflect an individual’s ability to perform the tasks required by the job.

Moreover, studies have shown that credit history is not a reliable predictor of job performance. For example, individuals with poor credit may still be highly skilled and qualified for a position, and their credit history may not have any bearing on their ability to succeed in their role. As a result, certain states have implemented bans on credit checks to ensure that job candidates are not unfairly discriminated against due to their financial history.

The main reason for banning credit checks in employment is to promote fairness and prevent discrimination. These laws are intended to ensure that employers evaluate candidates based on their skills, experience, and qualifications rather than on their credit history. It is also a measure to protect individuals who may face challenges in rebuilding their credit scores after experiencing a difficult financial situation.

Types of Positions Where Credit Checks Are Typically Required

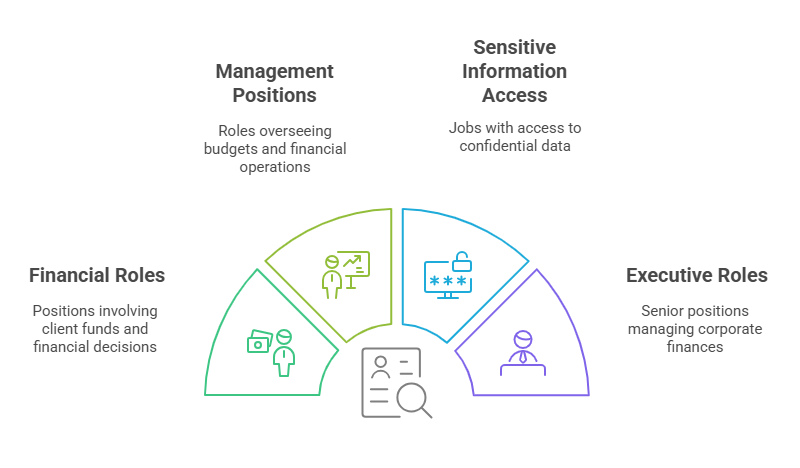

Credit checks are generally requested for positions that involve handling large sums of money, sensitive financial data, or decision-making authority over financial matters. Some of the positions where credit checks are often required include:

- Financial Roles: Jobs in banking, accounting, financial advising, and investment management often involve handling client funds or making significant financial decisions. Employers in these industries may require credit checks to assess a candidate’s financial trustworthiness and to minimize the risk of fraud or financial mismanagement.

- Management Positions: Managers, particularly those responsible for overseeing budgets, payroll, or financial operations, may undergo credit checks to ensure they are financially responsible and capable of managing company resources effectively.

- Positions with Access to Sensitive Information: Employees who have access to sensitive financial data or personal information of clients, customers, or the company may be subjected to credit checks as a security measure to protect against potential misuse or theft of data.

- Executive Roles: CEOs, CFOs, and other senior executives often face credit checks as part of the hiring process, given their significant responsibility in managing corporate finances and the company’s financial reputation.

How Banning Credit Checks Impacts Businesses and Employees

The decision to ban credit checks for employment has significant implications for both employers and employees. For businesses, these bans require adjustments to their hiring practices and policies. Employers will no longer be able to use credit history as a factor in hiring decisions, especially for positions where financial stability was considered important. This could lead to challenges in assessing the financial responsibility of candidates for certain roles, such as those in finance or management.

However, the ban may also benefit businesses in the long term by encouraging employers to focus more on the actual qualifications, skills, and experience of candidates rather than relying on potentially discriminatory financial data. It can also reduce the risk of legal challenges related to the use of credit checks in hiring, as businesses may be more likely to avoid violating anti-discrimination laws.

For employees, particularly those who have faced financial challenges in the past, these bans can open up more job opportunities. Many qualified candidates who may have been disqualified due to poor credit history may now have a fairer chance at securing employment. This is particularly important for individuals who are working to rebuild their credit and are seeking stable employment to improve their financial situation.

Additionally, for job seekers, knowing that credit checks may not be a factor in the hiring process can reduce anxiety and provide more confidence in applying for a broader range of jobs.

Why Is It Important to Understand the Impact of Credit Check Bans?

Understanding the implications of credit check bans is important for both employers and job seekers. For employers, it is essential to stay informed about the laws in their state to ensure that their hiring practices are compliant. Employers must adjust their screening processes to focus on relevant qualifications, such as work experience, skills, and education, rather than credit history. This can also help employers avoid legal risks associated with non-compliance.

For job seekers, awareness of the states that ban credit checks can help them identify opportunities where they may be judged based on their abilities and experience rather than their financial history. It also allows them to better navigate the job market and apply for positions that align with their qualifications without worrying about their credit score being a determining factor.

As states continue to evaluate and amend laws regarding credit checks for employment, it is important to stay updated on these changes and adjust hiring practices accordingly.

States That Ban Credit Checks for Employment: What Employers Need to Know

The practice of conducting credit checks for employment purposes has long been debated across various industries, especially as more states move to restrict or entirely ban the use of credit checks for hiring decisions. Understanding how these laws work and which states have enacted such measures is crucial for both employers and employees. In this section, we will provide a comprehensive list of states that have passed laws to limit or prohibit the use of credit checks for employment and how these laws affect employers’ hiring practices.

States That Have Banned or Restricted Credit Checks for Employment

As of now, several states have passed laws that either ban or restrict the use of credit checks in employment decisions. While the specifics of each state’s law may differ, they share a common goal: to prevent discrimination and ensure that job candidates are evaluated based on their qualifications, skills, and experience rather than their financial history. Let’s explore the states that have taken action to restrict credit checks in the hiring process.

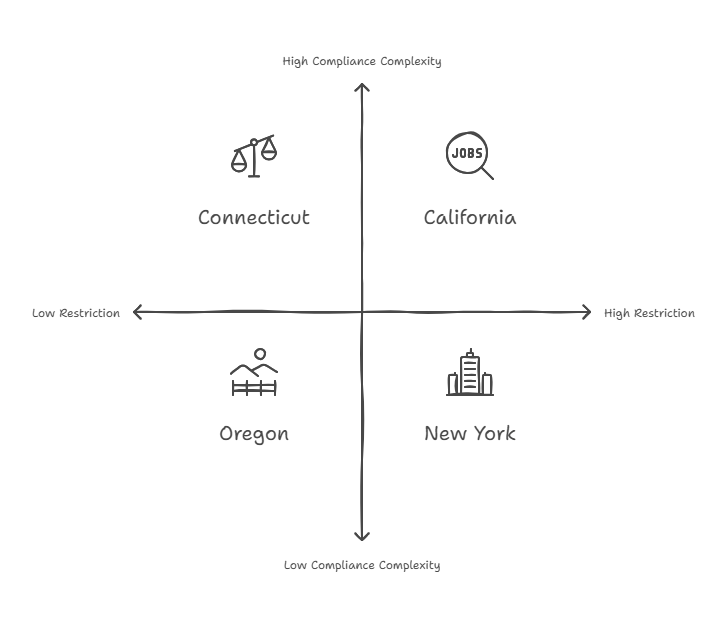

- California California has been one of the leading states in prohibiting the use of credit checks for most types of employment. Under the California Labor Code, employers cannot use an individual’s credit report or credit history to make employment decisions unless the position falls under specific exemptions. These exemptions include positions involving financial duties, access to sensitive financial information, or those regulated by state or federal law (e.g., certain financial institutions).

- Colorado Colorado has enacted a law that prohibits employers from using credit history in employment decisions for most job applicants. The only exceptions to this rule are roles where the use of a credit report is required by law, or positions involving financial responsibility such as those related to banking or accounting.

- Connecticut Connecticut’s law restricts employers from requesting or using credit reports for hiring decisions unless the position involves access to confidential or proprietary financial information, or the position is in law enforcement or a financial institution. The law is aimed at preventing discrimination based on an applicant’s financial difficulties.

- Maryland Maryland also prohibits employers from using credit reports as part of the hiring process for most positions. There are limited exceptions for certain job categories such as those in financial services, law enforcement, or positions that require national security clearances. Employers must also disclose to applicants if they plan to run a credit check and obtain written consent before doing so.

- Nevada In Nevada, the law bans employers from using credit reports as a factor in hiring decisions unless the position involves financial responsibilities or requires access to confidential financial information. The state law provides protections for applicants who may face discrimination due to their credit history.

- Oregon Oregon’s law prohibits most employers from conducting credit checks during the hiring process unless the job involves specific financial duties, such as those related to banking, financial services, or other roles where financial responsibility is crucial. Employers are required to explain why a credit report is necessary for the role.

- Washington Washington state also limits the use of credit checks for employment, allowing them only in certain circumstances, such as positions requiring access to financial records or roles with substantial financial responsibility. Employers must have a valid business reason for requesting a credit check and must notify applicants beforehand.

- Hawaii Hawaii’s law restricts the use of credit checks for employment purposes unless they are required by law or are necessary for positions that involve significant financial duties, such as accounting or positions in financial institutions.

- Illinois Illinois has similar restrictions on the use of credit checks for hiring decisions. Employers can only request a credit report for certain roles, particularly those in the financial sector or those where the position involves substantial financial responsibilities.

- New York New York has passed legislation restricting employers from using credit reports in hiring decisions. This law, which was passed in 2015, applies to most positions, with specific exceptions for financial services, law enforcement, and jobs involving significant financial responsibilities. New York employers are required to obtain written consent before conducting a credit check.

- Vermont Vermont has also adopted laws that limit the use of credit reports in hiring decisions. Credit checks can only be used for positions in which the employer is legally required to check an applicant’s credit or for positions that involve handling money, financial management, or access to confidential financial data.

Table: States and Their Credit Check Restrictions for Employment

| State | Credit Check Ban or Restriction | Exemptions | Affected Employers |

|---|---|---|---|

| California | Ban on most credit checks for employment. | Exemptions for financial, law enforcement, and sensitive financial roles. | Private and public sector employers in most industries. |

| Colorado | Prohibits credit checks for most jobs. | Exemptions for financial services and legally required roles. | Most employers, especially in non-financial sectors. |

| Connecticut | Restricts credit checks for most positions. | Exemptions for financial services, law enforcement, and confidential roles. | Employers in financial institutions or law enforcement. |

| Maryland | Credit checks prohibited for most job applicants. | Exemptions for positions in financial services and law enforcement. | Employers in finance, law enforcement, and national security. |

| Nevada | Bans credit checks for most jobs. | Exemptions for financial responsibility roles. | Employers in financial institutions, law enforcement, etc. |

| Oregon | Credit checks prohibited for most positions. | Exemptions for positions involving financial duties. | Employers outside financial sectors. |

| Washington | Restricts credit checks unless justified by business needs. | Exemptions for roles involving financial responsibility. | Financial and other sensitive roles. |

| Hawaii | Bans credit checks unless legally required or necessary for financial roles. | Exemptions for roles in finance and law enforcement. | Employers requiring financial oversight. |

| Illinois | Restricts credit checks for employment decisions. | Exemptions for financial services roles and similar positions. | Employers in finance, law enforcement, and other sensitive fields. |

| New York | Restricts credit checks for most positions. | Exemptions for financial services and law enforcement roles. | Employers in banking, financial services, law enforcement. |

| Vermont | Credit checks prohibited for most jobs. | Exemptions for positions in finance and those with access to financial data. | Employers in financial and sensitive sectors. |

How These Bans Impact Employers

The laws that restrict or ban credit checks for employment in certain states present significant challenges for employers, especially those in industries where financial roles are critical. Employers will need to adjust their screening practices to align with these laws, ensuring that they no longer rely on credit reports as a screening tool for most candidates. Here’s how these bans impact employers:

- Adjusting Hiring Practices: Employers must now focus more on traditional hiring methods, such as evaluating an applicant’s skills, experience, and qualifications. They may need to revise job descriptions and update their recruitment processes to comply with state laws.

- Exemptions and Special Considerations: While credit checks may be prohibited in most instances, many states provide exemptions for certain roles, such as those in financial services, law enforcement, or positions involving access to sensitive financial information. Employers in these sectors will still be able to use credit checks, but they must be aware of the specific criteria that apply to their industry.

- Compliance Risks: Employers must stay up-to-date with the ever-evolving landscape of credit check laws in each state. Non-compliance can lead to legal consequences, including fines or lawsuits, which is why it is essential to work with experienced background check providers to ensure compliance with local laws.

- Impact on Small Businesses: Small businesses may be particularly affected by credit check bans, as they often lack the resources to screen applicants thoroughly through other means. The inability to rely on credit reports for hiring decisions can make it more challenging for small businesses to evaluate candidates, particularly for positions that involve financial responsibilities.

How RapidHireSolutions Can Help Employers

For employers who operate in multiple states or are unsure of the legal nuances regarding credit checks in their state, it is essential to partner with a reliable background check service provider like RapidHireSolutions. Rapid Hire Solutions offers comprehensive background screening services, ensuring compliance with state and federal regulations, including those related to credit checks. With RapidHireSolutions, employers can streamline their hiring processes, avoid costly legal mistakes, and ensure that they are making informed hiring decisions based on accurate, up-to-date information.

Legal Aspects of Credit Check Bans, FAQs, and Key Takeaways

The practice of using credit checks in employment decisions has become increasingly controversial, especially as more states have enacted laws to restrict or ban the practice. Understanding the legal implications of these bans is crucial for both employers and employees. In this section, we will dive into the legal aspects surrounding credit check bans, including compliance with the Fair Credit Reporting Act (FCRA), the relationship between state laws and federal regulations, and the consequences of non-compliance. Additionally, we will address some frequently asked questions (FAQs) and provide key takeaways for employers and employees alike.

Legal Aspects of Credit Check Bans

Fair Credit Reporting Act (FCRA)

The Fair Credit Reporting Act (FCRA) is a federal law that regulates how consumer credit information is collected and used. Although the FCRA does not outright ban credit checks for employment purposes, it does impose certain requirements on employers who choose to use them. For example, employers must obtain written consent from the candidate before pulling a credit report. If the employer plans to take an adverse action (e.g., not hiring the candidate) based on the results of the credit check, they must provide the candidate with a copy of the report and a notice of the decision.

However, in states with credit check bans or restrictions, employers must comply with both the FCRA and the state-specific laws. This creates a dual layer of regulation that employers must navigate to avoid legal complications. In these cases, employers must ensure that they are not violating state laws that prohibit the use of credit checks in certain employment decisions.

State-Specific Laws

As we’ve seen in Part 2, several states have implemented laws that restrict or ban credit checks for employment. While some states, such as California, Colorado, and New York, have comprehensive laws that prohibit the use of credit checks in most hiring decisions, others have more limited restrictions. These laws can vary significantly, and employers must stay informed about the specific requirements in each state where they operate.

For instance, some states only allow credit checks for positions that involve financial duties, while others, like Connecticut and Oregon, restrict the use of credit checks unless required by law or necessary for the role. These varying state laws create a complex landscape that employers must navigate to ensure compliance. Additionally, some states, like Maryland, require employers to notify candidates when a credit check will be performed and obtain written consent.

Employers must also be aware of exemptions to these laws. For example, many states allow credit checks for certain job categories, including those in finance, law enforcement, or positions involving access to sensitive financial data. Understanding the nuances of these exemptions is crucial to ensuring compliance.

Adverse Action Process

Even in states where credit checks are allowed, employers must follow the adverse action process if they plan to use the results of a credit check to make a negative hiring decision. Under the FCRA, employers must follow a two-step process:

- Pre-Adverse Action Notification: If an employer is considering taking adverse action (such as not hiring a candidate) based on a credit report, they must notify the candidate in advance. This notification must include a copy of the credit report and a notice of the employer’s intent to take action.

- Post-Adverse Action Notification: If the employer decides to proceed with the adverse action, they must send the candidate a post-adverse action notice. This notice must explain the reasons for the decision and inform the candidate of their right to dispute the information in the report.

It’s important to note that the adverse action process is required by federal law, regardless of whether a state has restrictions on the use of credit reports. However, in states that ban or restrict credit checks, employers may not be able to initiate this process at all, as they are prohibited from using the credit report as part of their decision-making.

Legal Consequences of Non-Compliance

Failure to comply with state-specific credit check laws and the FCRA can lead to serious legal consequences for employers. If an employer conducts a credit check in violation of state laws, they may be subject to fines or legal action. Additionally, if an employer fails to follow the adverse action process correctly, they could face lawsuits or penalties from candidates who believe their rights were violated.

For example, in states like California and Colorado, candidates who believe that their credit report was used unlawfully in a hiring decision can file complaints with the state’s labor department or file a lawsuit against the employer. Similarly, failure to provide the proper notifications as required by the FCRA can lead to consumer protection lawsuits and other legal actions.

To mitigate the risk of non-compliance, employers should work with experienced background screening companies that are well-versed in both state and federal regulations. This ensures that credit checks and other background checks are conducted legally and in accordance with the latest laws.

FAQs: Frequently Asked Questions about Credit Check Bans

Can employers still use credit checks for certain positions in states with a ban?

Yes, in many states that have banned or restricted credit checks for employment, there are exemptions for specific job categories. For example, employers can still conduct credit checks for positions that involve handling sensitive financial data or positions in law enforcement, banking, or financial institutions.

How do state bans on credit checks affect the hiring process for financial roles?

State bans on credit checks typically have exemptions for positions that require financial responsibility. This means that employers in the financial industry may still be able to use credit checks as part of their hiring process for positions such as accountants, loan officers, or financial analysts.

What steps can an employer take if they need to conduct a credit check in a state that bans it?

If an employer needs to conduct a credit check for a position in a state with a ban or restriction, they should first ensure that the position qualifies for one of the exemptions (e.g., financial positions). If the position is not exempt, the employer should explore other means of evaluating candidates, such as assessing their qualifications, experience, and skills.

What should job seekers know about their credit history being used in the hiring process?

Job seekers should be aware that employers in certain states may not be able to use their credit history as a factor in the hiring process. It is important for job seekers to understand their rights and know whether their credit report will be used during the hiring process. If they are concerned about their credit report, they should review it beforehand to ensure that there are no errors.

How do states that ban credit checks enforce compliance?

States that ban credit checks for employment enforce compliance through various means, including penalties, fines, and investigations by state labor departments or consumer protection agencies. Employers found in violation of these laws can be subject to civil lawsuits, government investigations, and reputational damage.

Key Takeaways

- State-Specific Regulations: Employers must be aware of the state-specific laws that govern the use of credit checks for employment purposes. While some states have comprehensive bans, others offer exemptions for specific roles.

- Adverse Action Process: Employers who use credit checks must comply with the FCRA’s adverse action process, including providing candidates with notification of their decision and the opportunity to dispute the information.

- Legal Risks: Failure to comply with state and federal regulations regarding credit checks can result in legal consequences, including lawsuits, fines, and damage to an employer’s reputation.

- Using a Professional Screening Service: Employers should work with experienced background screening companies like Rapid Hire Solutions to ensure compliance with both state and federal laws, especially in states that ban or restrict credit checks.

- Impact on Job Seekers: Job seekers in states with credit check bans may benefit from increased job opportunities, particularly for those with poor credit histories, as employers can no longer rely on credit reports as a screening tool for most roles.

Conclusion

The growing trend of states banning credit checks for employment highlights the evolving conversation around fairness and discrimination in the hiring process. For employers, staying compliant with these laws is essential to avoid legal risks and ensure that hiring practices remain fair and transparent. By using reliable background screening services, such as those provided by RapidHireSolutions, employers can streamline their hiring processes, make informed decisions, and adhere to state-specific regulations. Ultimately, credit check bans are a step toward creating a more equitable and inclusive job market for all candidates, regardless of their financial history.