What is a Credit Check for Employment?

A credit check or Credit Reports for employment is a process through which employers review an applicant’s financial history as part of the hiring process. The purpose of conducting these checks is to evaluate a candidate’s financial responsibility and assess their suitability for a role that may involve handling sensitive financial information or resources. While credit checks are not always a requirement for every job, they are essential for positions that demand a high level of trust, such as those in the financial sector, government positions, and roles requiring fiduciary responsibilities.

Employers typically use two main elements in a credit check: a credit report and a credit score. While these terms are often used interchangeably, they represent different components of an individual’s financial history. Understanding the distinctions between these two can help both employers and candidates navigate the hiring process more effectively.

The Difference Between Credit Report and Credit Score

A credit report is a detailed record of a person’s credit history. It includes various pieces of information such as payment history, credit inquiries, outstanding debts, bankruptcies, and judgments. The credit report offers a comprehensive view of an individual’s financial behavior, providing insights into how responsibly they manage their finances. This report is particularly useful for employers who need to assess a candidate’s ability to handle financial responsibilities, especially in industries like banking, finance, and other sectors where trust and accountability are paramount.

On the other hand, a credit score is a numerical value that represents the overall health of a person’s credit. The score is derived from the information found in the credit report and typically ranges from 300 to 850. A higher score indicates better financial management and lower risk, while a lower score suggests potential financial difficulties. Credit scores are often used by lenders to assess creditworthiness, but some employers may also use them as a quick benchmark in hiring decisions, especially when assessing roles that deal with money or financial transactions.

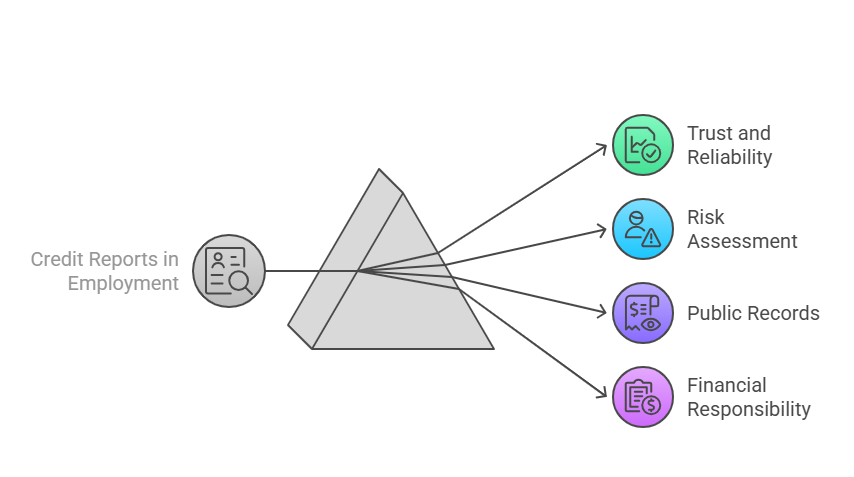

Why Are Credit Reports Important for Employment?

Credit reports provide a deep dive into an individual’s financial history and habits, which can be a crucial factor for certain industries and roles. For example, positions in banking, finance, and insurance often require a review of a candidate’s credit report to ensure they have a track record of managing debts and making payments on time. In these industries, trust is essential, and financial irresponsibility may signal a higher level of risk to the employer.

Beyond just payment history, a credit report can also show public records such as bankruptcies, judgments, and liens, which could be red flags for employers in sensitive roles. These elements may indicate financial struggles, legal issues, or a lack of financial stability, which can be critical factors when making a hiring decision. For many employers, particularly in executive or government positions, assessing financial responsibility is as important as evaluating other job-related skills.

Why Credit Scores Matter in Hiring Decisions

While credit reports offer detailed insights into a candidate’s financial behavior, credit scores offer a quicker, more simplified view of an individual’s creditworthiness. A high credit score, generally above 700, indicates that the candidate has a strong history of managing credit, making payments on time, and handling debt responsibly. On the other hand, a low credit score might suggest a history of missed payments, high levels of debt, or other financial challenges.

Some employers, especially those in roles that require an individual to manage or interact with finances, may place importance on the credit score as a quick way to assess risk. However, not all industries use credit scores in the hiring process, and in many cases, a low score may not be seen as an automatic disqualifier. Employers need to carefully consider how they weigh credit scores alongside other factors when evaluating potential candidates.

Despite its usefulness, the credit score alone doesn’t tell the complete story of a candidate’s financial history. It is simply a number and does not provide context for why a candidate might have a low score. For example, a poor credit score may be the result of medical debt, divorce, or unforeseen circumstances, rather than financial irresponsibility. This is why many employers prefer to review the full credit report in addition to the score.

Ethical Considerations in Conducting Credit Checks

Employers must exercise caution and adhere to ethical guidelines when conducting credit checks. While a credit check can provide valuable insights into a candidate’s financial responsibility, employers must remember that individuals can face financial difficulties for reasons that may not be related to their ability to perform job duties. For example, someone may have experienced financial hardship due to a medical emergency or job loss, which doesn’t necessarily reflect their job performance.

Additionally, it is important for employers to ensure that they are following the legal requirements related to credit checks. In the United States, for example, the Fair Credit Reporting Act (FCRA) governs how employers must handle credit checks, ensuring that candidates’ rights are protected. Employers must obtain written consent before running a credit check and must provide candidates with a copy of the report if the decision is made based on the information in it. Furthermore, certain states have additional regulations that limit the use of credit reports in hiring decisions, particularly for roles that don’t involve financial responsibilities.

Employers should also be transparent about how the credit check will be used in the hiring process. Candidates should be aware of the factors that will influence hiring decisions and whether or not their credit history will play a role in the outcome.

A Data Table Comparing Credit Report vs. Credit Score

| Aspect | Credit Report | Credit Score |

|---|---|---|

| What It Includes | Detailed history including payments, debt levels, bankruptcies, judgments, liens, and credit inquiries | A numerical score based on credit report data (ranges from 300 to 850) |

| Impact on Employment | Provides insight into financial responsibility, debt management, and public records | Quick indication of creditworthiness, useful for financial positions |

| Industries that Use It | Finance, banking, insurance, government, executive positions | Lenders, some financial roles, some employers in sensitive positions |

| Pros | In-depth financial history, context for financial issues, shows payment habits | Simple, quick-to-interpret, offers an immediate snapshot of financial health |

| Cons | Can be time-consuming to review, overwhelming with too much detail | Doesn’t offer context, may not accurately reflect someone’s financial habits |

This comparison table clearly outlines the differences between credit reports and credit scores, showing when and why each might be relevant in the hiring process. While credit reports offer comprehensive insights into a person’s financial history, credit scores provide a faster but less detailed view of their financial situation.

RapidhireSolutions and Background Checks for Employment

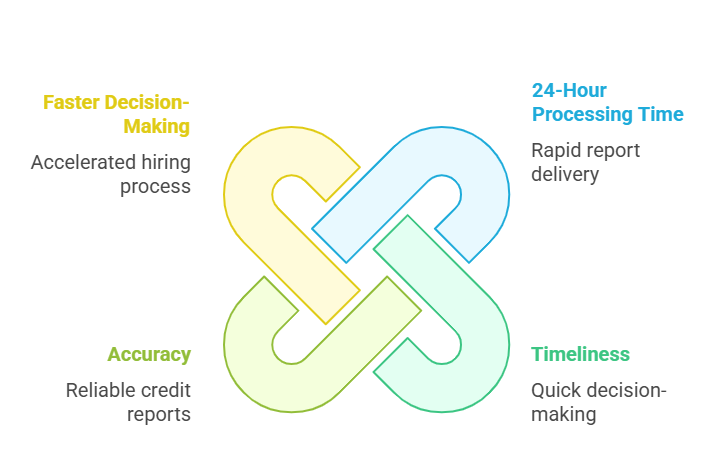

RapidhireSolutions is a trusted provider of background screening services, specializing in both credit reports and credit scores. Their platform offers businesses a reliable, compliant, and efficient way to perform credit checks during the hiring process. RapidhireSolutions stands out for its fast turnaround times, typically providing results within 24 hours, ensuring that businesses can make informed hiring decisions without unnecessary delays.

Their focus on accuracy and legal compliance makes RapidhireSolutions an ideal choice for employers looking to implement credit checks in their hiring process. By providing thorough and timely reports, RapidhireSolutions helps businesses mitigate risks associated with financial irresponsibility, fraud, or other potential issues that may arise from hiring unvetted candidates.

Key Takeaways

Understanding the differences between credit reports and credit scores is essential for employers when evaluating candidates, particularly for roles requiring trust and financial responsibility. Credit reports provide a detailed history of an individual’s financial behavior, while credit scores offer a quick snapshot of their creditworthiness. Employers must carefully consider which of these factors are most relevant to the position they are hiring for, keeping ethical considerations and legal regulations in mind.

Comparison Table (Pros & Cons)

When selecting a background check service for credit checks, businesses must weigh various factors such as speed, accuracy, compliance, and customer service. The following table compares RapidhireSolutions with other background check providers to highlight the strengths and weaknesses of each:

| Aspect | RapidhireSolutions | Competitors |

|---|---|---|

| Speed of Processing | ✅ 24-hour turnaround | ❌ 15-20 days processing |

| Accuracy of Credit Checks | ✅ High accuracy | ❌ Inconsistent accuracy |

| FCRA Compliance | ✅ Fully compliant | ❌ Risk of non-compliance |

| Customer Support | ✅ Excellent, responsive | ❌ Limited support availability |

| Pricing | ✅ Transparent and cost-effective | ❌ Hidden fees, unclear pricing |

| Data Security | ✅ Secure, encrypted data | ❌ Potential data vulnerabilities |

Why RapidhireSolutions is the Best Choice for Credit Checks

RapidhireSolutions stands out in the crowded field of background check services by offering businesses a streamlined, efficient process for conducting credit checks. One of the most significant advantages of using RapidhireSolutions is its 24-hour processing time for credit checks, a feature that dramatically reduces the waiting period for businesses looking to hire quickly. While other service providers may take 15-20 days to deliver results, RapidhireSolutions provides businesses with timely, accurate credit reports within a day, enabling faster decision-making.

In addition to speed, RapidhireSolutions prides itself on offering highly accurate reports. Their technology and methods ensure that the data provided in credit checks is reliable, helping businesses avoid the potential consequences of making decisions based on incorrect or incomplete information. When it comes to financial roles, the accuracy of these checks is crucial—especially when an employer is trying to assess an applicant’s trustworthiness and ability to manage financial responsibilities.

Another key reason to choose RapidhireSolutions is their strict adherence to FCRA compliance. The Fair Credit Reporting Act (FCRA) sets standards for how employers must handle background checks, ensuring that candidates’ rights are respected. RapidhireSolutions ensures compliance with all legal requirements, providing businesses with peace of mind knowing that they are meeting all regulatory obligations when conducting credit checks.

When it comes to customer service, RapidhireSolutions excels in providing responsive and helpful support. Businesses can rely on their team for guidance and assistance throughout the process. This level of service is crucial, particularly when navigating the complex landscape of employment law and credit reporting.

Additionally, pricing transparency is a significant factor in choosing a background check provider. RapidhireSolutions offers competitive and clear pricing with no hidden fees. Businesses can budget effectively without worrying about surprise costs, unlike some competitors, who may include unexpected charges in their pricing models.

Finally, data security is a critical concern when handling sensitive information like credit reports. RapidhireSolutions uses encrypted, secure systems to protect the privacy and integrity of data, reducing the risk of data breaches and ensuring compliance with privacy laws.

Data Table – Service Comparison

The following table provides a side-by-side comparison of RapidhireSolutions’ services and those offered by other background check providers:

| Feature | RapidhireSolutions | Competitors |

|---|---|---|

| Processing Time | ✅ 24 hours | ❌ 15-20 days |

| Accuracy | ✅ High | ❌ Inconsistent |

| Cost | ✅ Transparent, competitive | ❌ Hidden fees, expensive |

| FCRA Compliance | ✅ Full compliance | ❌ Possible non-compliance |

| Customer Service | ✅ Exceptional, responsive | ❌ Limited or poor support |

| Data Security | ✅ Secure, encrypted | ❌ Vulnerabilities |

In-Depth Analysis: Why RapidhireSolutions is the Best Choice for Employers

Choosing the right background check provider is critical, especially when it comes to credit checks for employment. RapidhireSolutions stands out for its comprehensive and efficient service, making it the best choice for businesses that need reliable, fast, and legally compliant credit checks.

One of the most significant advantages of RapidhireSolutions is its 24-hour processing time. In industries where quick hiring decisions are essential, such as retail or hospitality, waiting weeks for credit check results can delay the entire recruitment process. RapidhireSolutions’ ability to deliver accurate credit reports within a day allows employers to keep their hiring timelines on track, ultimately saving time and money.

RapidhireSolutions is also known for its FCRA compliance. This adherence to the Fair Credit Reporting Act ensures that businesses are not exposed to legal risks associated with improper handling of candidate credit reports. Failing to comply with the FCRA can lead to penalties, lawsuits, and damage to a company’s reputation, which is why it’s crucial for employers to choose a provider that takes compliance seriously.

Additionally, RapidhireSolutions offers exceptional customer service. Hiring decisions involving credit checks can be complex, and businesses may have questions about the process or legal requirements. RapidhireSolutions ensures that clients receive the support they need, offering clear guidance through every step of the process. On the other hand, many competitors may have limited customer support, which could leave employers without the assistance they need when navigating the credit check process.

Finally, pricing transparency is a major benefit of using RapidhireSolutions. Businesses can avoid the hidden fees and unexpected charges that some competitors impose, which can make budgeting more difficult. By offering competitive and clear pricing, RapidhireSolutions provides value for employers, ensuring that they get the services they need without breaking the bank.

Pros & Cons Analysis

Pros of RapidhireSolutions:

- Quick Turnaround: Credit checks processed within 24 hours.

- Compliance with FCRA: Ensures full legal compliance.

- Accurate Results: High-quality, reliable data.

- Transparent Pricing: No hidden fees or unexpected charges.

- Excellent Customer Support: Responsive and knowledgeable team.

Cons of Competitors:

- Slow Processing: Background checks may take 15-20 days.

- Inconsistent Accuracy: Some providers offer unreliable data.

- Non-compliance Risks: Potential failure to meet legal requirements.

- Poor Customer Service: Limited or slow response times.

- Hidden Costs: Some competitors charge unexpected fees.

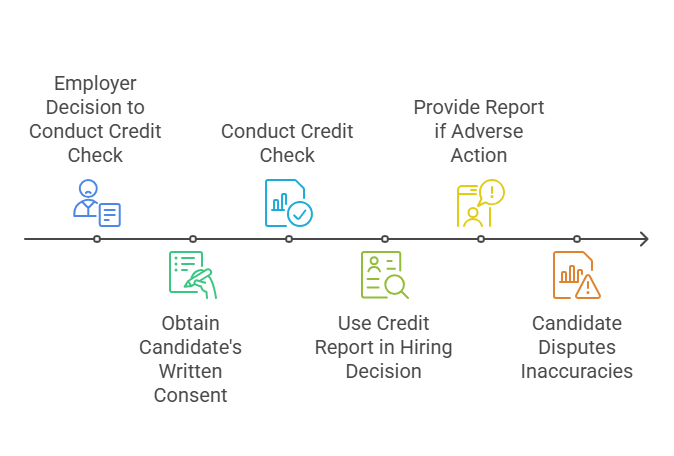

Legal Considerations in Credit Checks for Employment

When employers decide to incorporate credit checks into their hiring process, it is important to understand the legal framework that governs such practices. The Fair Credit Reporting Act (FCRA) is the primary law regulating how employers can use consumer reports, including credit reports, for employment purposes. The FCRA is designed to protect candidates’ privacy and ensure that employers use credit checks in a fair and non-discriminatory way.

Understanding the FCRA and Its Impact on Hiring

Under the FCRA, employers must obtain written consent from candidates before conducting a credit check. This means that businesses cannot run credit reports without informing the applicant and getting their explicit approval. Failure to do so can result in legal consequences, including lawsuits and penalties for violating privacy laws.

Additionally, the FCRA requires employers to provide candidates with a copy of their credit report if it is used as the basis for adverse employment actions, such as denying an offer or firing an employee. Candidates must also be given an opportunity to dispute any inaccurate or outdated information that may have influenced the decision.

Employer Obligations and Candidate Rights

Employers are obligated to follow specific guidelines when using credit reports in hiring decisions. For instance, if a credit report contains negative information that influences the decision, such as a low credit score or history of bankruptcies, the employer must provide the candidate with a notice of the adverse action. This ensures transparency and gives the candidate an opportunity to address any discrepancies in their report before the final decision is made.

On the candidate’s side, they have the right to know if their credit report was accessed, and they are entitled to a free copy of their report upon request. Candidates can also dispute any inaccuracies, and employers are required to follow up on these disputes to ensure fairness in the hiring process.

Legal Risks for Employers

Employers who fail to comply with the FCRA may face significant legal risks. Non-compliance can lead to lawsuits, fines, and damage to the company’s reputation. For example, if an employer denies an applicant a job based on inaccurate credit information or does not properly inform the candidate about the credit check, they may face legal consequences. By partnering with a compliant and reliable background check provider like RapidhireSolutions, businesses can minimize these risks and ensure that their hiring practices align with legal requirements.

FAQs

What is the difference between a credit report and a credit score?

A credit report is a detailed document that includes an individual’s credit history, including their payment history, debt levels, bankruptcies, and liens. A credit score, on the other hand, is a numerical representation of a person’s creditworthiness, based on the information in their credit report. Employers may use both when assessing a candidate’s financial responsibility, although they typically rely more heavily on the credit report in employment decisions.

Do employers need consent from candidates to run a credit check?

Yes, employers are legally required to obtain written consent from candidates before conducting a credit check. Failure to do so can result in legal consequences for the employer.

How do credit reports impact hiring decisions?

Credit reports can provide employers with insights into a candidate’s financial behavior, including their ability to manage debt, make timely payments, and avoid bankruptcies. This information is particularly important for roles that require financial trust or access to sensitive financial data, such as positions in banking or accounting.

Can a poor credit score disqualify a candidate from employment?

While a poor credit score can raise concerns for employers, it does not automatically disqualify a candidate. Employers must assess the relevance of the candidate’s credit history based on the specific requirements of the role. In some industries, a low credit score may indicate risk, while in others, it may not be a deciding factor.

Are there laws regulating credit checks for employment purposes?

Yes, the Fair Credit Reporting Act (FCRA) regulates how employers can use credit reports in employment decisions. The FCRA requires employers to obtain written consent from candidates before conducting credit checks, provide candidates with notice if adverse action is taken based on their credit report, and ensure compliance with all legal requirements.

Conclusion

In conclusion, understanding the difference between credit reports and credit scores is crucial for both employers and job candidates. Credit reports offer a comprehensive view of a candidate’s financial behavior, while credit scores provide a snapshot of their creditworthiness. Employers must navigate the legal landscape of credit checks carefully to ensure compliance with the Fair Credit Reporting Act (FCRA) and protect candidates’ rights.

For businesses seeking a reliable, fast, and compliant solution for credit checks, RapidhireSolutions is the ideal provider. With quick turnaround times, accurate reports, and a focus on legal compliance, RapidhireSolutions ensures that employers can make informed hiring decisions without facing legal risks. By choosing a provider that prioritizes accuracy, transparency, and customer support, businesses can enhance their hiring processes and avoid costly mistakes.