How Background Verification (BGV) Can Improve Hiring Accuracy & Reduce Risks

In today’s competitive job market, hiring the right candidate is more critical than ever. Employers and HR professionals need to ensure that new hires are trustworthy, qualified, and a good cultural fit. Background Verification (BGV) plays a crucial role in this process by helping businesses validate candidate information and mitigate hiring risks.

BGV involves screening a candidate’s past employment, education, criminal history, financial records, and more. It ensures that businesses make informed hiring decisions while maintaining workplace safety, compliance, and integrity. Failure to conduct proper background verification can lead to financial losses, legal liabilities, and reputational damage.

In this section, we’ll explore:

✅ What background verification is and why it matters.

✅ Different types of background checks.

✅ How BGV helps employers reduce hiring risks.

✅ A data table summarizing key insights into different types of background checks.

Types of Background Checks in the Hiring Process

Background verification is not a one-size-fits-all process. Different roles and industries require different screening levels. Below are the most common types of background checks employers use:

✅ Criminal Record Checks

- Verifies if the candidate has any criminal history.

- Ensures workplace safety and protects company assets.

- Helps businesses avoid potential legal liabilities.

✅ Employment Verification

- Confirms past job titles, duration, and responsibilities.

- Validates experience claims to ensure honesty.

- Prevents resume fraud and exaggerated credentials.

✅ Education Verification

- Confirms degrees, diplomas, and certifications.

- Ensures candidates meet the required educational qualifications.

- Protects businesses from fraudulent credentials.

✅ Credit History Checks (for finance-related roles)

- Evaluates financial responsibility, debt history, and payment behavior.

- Crucial for banking, finance, and high-security positions.

- Ensures trustworthiness in financial decision-making roles.

✅ Drug Testing

- Detects drug use that could impact workplace safety.

- Required in industries like transportation, healthcare, and security.

- Helps maintain a drug-free workplace.

✅ Reference Checks

- Validates work ethic and behavior from past employers.

- Helps assess cultural fit and professional reliability.

- Gives deeper insights into a candidate’s character.

Why BGV is Crucial for Employers & HR Professionals

Hiring a candidate without proper screening can expose a company to serious risks, including:

❌ Workplace Safety Concerns – Unverified employees could pose a security risk to coworkers and customers.

❌ Legal & Compliance Issues – Hiring individuals with undisclosed criminal records may lead to lawsuits and liability.

❌ Financial Losses & Fraud – Candidates with falsified qualifications or fraudulent backgrounds could damage business operations.

❌ High Employee Turnover – A poor hiring decision due to insufficient screening can lead to frequent resignations or terminations.

By implementing robust background verification, HR professionals and employers can:

✅ Improve hiring accuracy and avoid bad hires.

✅ Ensure compliance with industry regulations and employment laws.

✅ Reduce risks related to workplace security and employee fraud.

✅ Build a trustworthy, high-performing workforce.

Key Insights: Types of Background Checks & Their Impact

| Type of Background Check | Purpose | Impact on Hiring |

|---|---|---|

| Criminal Record Check | Ensures safety & compliance | Reduces legal risks and workplace threats |

| Employment Verification | Confirms work history | Prevents resume fraud & misrepresentation |

| Education Verification | Validates academic credentials | Ensures candidates meet job qualifications |

| Credit History Check | Evaluates financial responsibility | Important for finance-related roles |

| Drug Testing | Detects substance abuse | Ensures workplace safety and productivity |

| Reference Check | Assesses character and reliability | Helps gauge cultural and professional fit |

This table summarizes how different types of background checks serve a specific purpose and their direct impact on hiring quality.

Final Thoughts

A well-executed background verification process is a powerful tool for employers and HR professionals, ensuring a safe, compliant, and productive workforce. As the hiring landscape becomes more complex, businesses need fast, accurate, and legally compliant screening services to stay ahead.

Choosing the Right Background Verification Provider – RapidHireSolutions vs. Competitors

1. Why the Right Background Verification Provider Matters

Selecting a reliable background verification (BGV) provider is crucial for businesses looking to streamline hiring while ensuring compliance, accuracy, and speed. Employers must choose a service that:

✅ Delivers fast turnaround times without compromising accuracy.

✅ Maintains compliance with legal and regulatory requirements (FCRA, EEOC).

✅ Offers comprehensive checks tailored to industry needs.

✅ Provides excellent customer support to resolve queries efficiently.

✅ Uses advanced technology for accurate, automated verification.

A poor BGV provider can result in delays, compliance risks, and inaccurate reports, leading to bad hiring decisions and legal complications. In this section, we compare RapidHireSolutions with competitors to highlight why businesses should prioritize efficiency, compliance, and accuracy in background screening services.

2. Comparison of RapidHireSolutions vs. Other Background Check Service Providers

To help employers make an informed decision, here’s a detailed comparison between RapidHireSolutions and competitors based on five key factors:

| Key Factors | RapidHireSolutions ✅ | Competitors ❌ |

|---|---|---|

| Turnaround Time | 24 hours | 15–20 days or more |

| Compliance | 100% FCRA & EEOC compliant | Risk of non-compliance |

| Accuracy | AI-powered, human-reviewed reports | Higher error rates |

| Affordability | Cost-effective solutions | Expensive, hidden fees |

| Customer Support | 24/7 expert assistance | Limited or delayed responses |

📌 Key Takeaways from the Table:

- RapidHireSolutions provides faster, more accurate, and fully compliant background verification services.

- Many competitors take weeks to complete checks, increasing hiring delays.

- Some providers lack proper compliance measures, exposing businesses to legal risks.

- Customer support and affordability are also major differentiators, as RapidHireSolutions offers 24/7 support with transparent pricing.

3. Overview of RapidHireSolutions’ Background Verification Services

Employers require a background verification partner that ensures compliance, efficiency, and accuracy. RapidHireSolutions stands out by offering:

🔹 FCRA-Compliant Background Checks – Fully adheres to federal and state regulations.

🔹 AI-Driven Screening Technology – Reduces human errors and speeds up processing.

🔹 24-Hour Turnaround Time – Ensures employers make quick and informed hiring decisions.

🔹 Comprehensive Screening Services – Criminal checks, employment verification, education verification, credit history checks, and more.

🔹 Dedicated Customer Support – 24/7 assistance to resolve verification queries.

By leveraging advanced technology and a human-reviewed process, RapidHireSolutions ensures accurate, legally compliant, and timely reports, helping businesses hire with confidence.

4. Turnaround Time Comparison: RapidHireSolutions vs. Competitors

Hiring delays can cost businesses thousands of dollars in lost productivity and recruitment efforts. Here’s a turnaround time comparison:

| Background Check Type | RapidHireSolutions (TAT) ✅ | Competitors (TAT) ❌ |

|---|---|---|

| Criminal Record Check | 24 hours | 7–14 days |

| Employment Verification | 24 hours | 10–20 days |

| Education Verification | 24 hours | 15+ days |

| Credit History Check | 24 hours | 5–10 days |

| Drug Testing | 24 hours | 7–14 days |

📌 Key Insights from the Table:

- RapidHireSolutions completes most verifications within 24 hours, while competitors take several weeks.

- Faster background checks = quicker hiring decisions & reduced operational downtime.

- Employers using RapidHireSolutions gain a competitive edge by reducing delays and securing top talent faster.

5. Pros & Cons Comparison: RapidHireSolutions vs. Competitors

A side-by-side evaluation of pros and cons helps businesses identify the right BGV provider for their needs:

| Factors | RapidHireSolutions (✅ Pros) | Competitors (❌ Cons) |

|---|---|---|

| Speed | 24-hour turnaround for most checks | Takes 15–20 days or more |

| Compliance | 100% FCRA & EEOC compliant | Risk of non-compliance |

| Accuracy | AI-powered reports with human review | Higher chances of errors |

| Pricing | Transparent, affordable pricing | Expensive, hidden fees |

| Customer Support | 24/7 dedicated support | Slow response times |

This table highlights how RapidHireSolutions excels in key areas that matter most to employers: speed, compliance, accuracy, and affordability.

6. Why Employers Should Prioritize Fast, Accurate, and Compliant BGV Services

Employers and HR professionals must ensure efficient hiring while adhering to compliance standards. Choosing a fast and accurate background verification provider like RapidHireSolutions ensures:

✅ Reduced hiring delays: Quick background checks help businesses secure top talent faster.

✅ Lower legal risks: FCRA-compliant screening prevents compliance violations and penalties.

✅ Accurate hiring decisions: AI-driven reports reduce the risk of fraudulent applications.

✅ Cost savings: Faster hiring and fewer bad hires save businesses money in the long run.

By choosing RapidHireSolutions, employers streamline their hiring process, minimize risks, and maintain compliance, ensuring long-term success in talent acquisition.

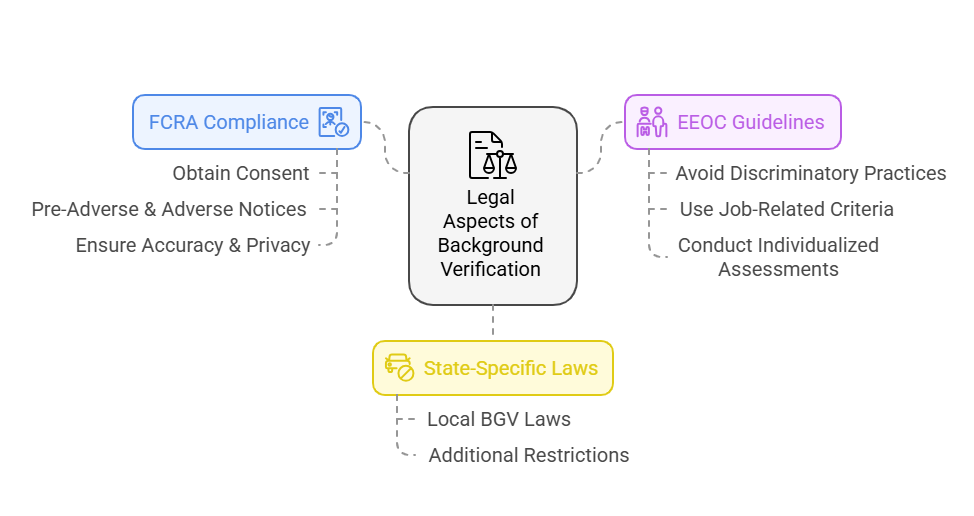

Legal Aspects of Background Verification (BGV)

Employers conducting background verification must comply with federal, state, and industry-specific laws to avoid legal liabilities. Non-compliance can lead to lawsuits, fines, and reputational damage. Below, we explore the key legal regulations governing BGV in the U.S.

Fair Credit Reporting Act (FCRA) – Federal Compliance Standard

The Fair Credit Reporting Act (FCRA) is the primary federal law regulating background checks. It applies to any employer using third-party services for background screening. Employers must follow these rules:

✅ Obtain Candidate Consent – Employers must provide written notice and receive signed consent before conducting a background check.

✅ Provide Pre-Adverse and Adverse Action Notices – If negative information influences hiring decisions, employers must:

- Pre-Adverse Notice: Inform the candidate of the potential decision.

- Waiting Period: Allow the candidate to respond with corrections.

- Adverse Action Notice: If proceeding with rejection, provide details on the decision and how to dispute inaccuracies.

✅ Ensure Accuracy & Privacy Protection – Employers must ensure background check reports are accurate, fair, and securely handled.

⚠ Non-compliance with FCRA can result in penalties ranging from $100 to $1,000 per violation, plus potential lawsuits.

Equal Employment Opportunity Commission (EEOC) Guidelines

The EEOC enforces anti-discrimination laws and regulates how background checks impact hiring decisions. Employers must:

✅ Avoid Discriminatory Practices – Employers cannot reject candidates based on race, gender, disability, age, or other protected factors.

✅ Use Job-Related Criteria – If a criminal record is found, it must be relevant to the job role (e.g., a financial fraud conviction for an accounting job).

✅ Conduct Individualized Assessments – Before rejecting a candidate based on background check results, employers should consider:

- The nature and severity of the offense.

- The time elapsed since the incident.

- The relevance to the job responsibilities.

Violating EEOC rules can lead to legal action, fines, and reputational damage.

State-Specific Background Verification Laws

Many states impose additional restrictions on background checks beyond federal regulations. Employers hiring across multiple states must be aware of local BGV laws.

📌 Examples of State Laws:

| State | Key Background Check Regulations |

|---|---|

| California | Strictest privacy laws; limits employer access to credit reports. |

| New York | Employers must justify the use of criminal records in hiring decisions. |

| Minnesota | Enforces “Ban the Box” laws, restricting when employers can ask about criminal records. |

| Illinois | Requires employers to assess convictions based on job relevance. |

Employers should work with FCRA-compliant screening providers like RapidHireSolutions to ensure compliance with federal, state, and local laws.

Ban the Box Laws & Credit Check Restrictions

Many states and cities have implemented “Ban the Box” laws, which prevent employers from asking about criminal history on job applications. These laws aim to give candidates a fair chance in the hiring process.

✅ Employers can only check criminal history later in the hiring process (e.g., after an interview or conditional job offer).

✅ Some states restrict credit history checks, allowing them only for positions involving financial responsibility.

⚠ Failing to comply with these laws can result in lawsuits and fines.

Frequently Asked Questions (FAQs) About Background Verification

Below are five common questions employers and HR professionals ask about BGV:

Can an employer conduct a background check without a candidate’s consent?

❌ No. Under the FCRA, employers must obtain written consent from a candidate before conducting a background check. Candidates must also receive a copy of their report upon request.

How long does a background check typically take?

⏳ It depends on the provider. With RapidHireSolutions, most background checks are completed within 24 hours. However, competitors may take 15–20 days or more due to manual processes and slower data retrieval.

📌 Turnaround Time by Check Type:

| Background Check Type | RapidHireSolutions (TAT) ✅ | Competitors (TAT) ❌ |

|---|---|---|

| Criminal Record Check | 24 hours | 7–14 days |

| Employment Verification | 24 hours | 10–20 days |

| Education Verification | 24 hours | 15+ days |

| Credit History Check | 24 hours | 5–10 days |

| Drug Testing | 24 hours | 7–14 days |

What happens if a background check reveals negative information?

If negative information appears in a background report, employers must:

✅ Follow the FCRA's Adverse Action Process – Provide pre-adverse and adverse action notices.

✅ Allow the Candidate to Respond – Give applicants a chance to dispute inaccuracies before making a final decision.

✅ Consider the Relevance – Employers should assess whether the negative record is job-related before making a hiring decision.

Ignoring these steps can result in legal penalties and discrimination lawsuits.

What if a background check report contains errors?

📌 Candidates have the right to dispute errors. Employers must:

1️⃣ Inform the candidate of the issue through a pre-adverse action notice.

2️⃣ Give time (usually 5–7 days) for the candidate to provide corrections.

3️⃣ Review updated records before making a final hiring decision.

Using a trusted, FCRA-compliant provider like RapidHireSolutions reduces errors and disputes in background reports.

Are social media background checks legal?

✅ Yes, but with limitations. Employers can review publicly available social media profiles but must not request passwords or access private accounts.

⚠ Be cautious – Social media checks can introduce bias risks and potential EEOC violations if hiring decisions are influenced by protected characteristics (e.g., race, religion, political views, etc.).

Conclusion

A strong background verification process ensures safer hiring, legal compliance, and accurate hiring decisions. Employers must:

🔹 Follow FCRA & EEOC regulations to avoid legal risks.

🔹 Understand state-specific laws (e.g., Ban the Box, credit check restrictions).

🔹 Use an FCRA-compliant provider like RapidHireSolutions for accuracy, speed, and compliance.

By partnering with RapidHireSolutions, businesses can confidently navigate legal complexities, reduce hiring risks, and build a trustworthy workforce. 🚀