Why Employers Review Credit Reports in the Hiring Process

Background checks are an essential part of the hiring process for employers across industries. They help employers verify an applicant’s background, ensuring that candidates meet specific standards for roles and that they fit within the organization’s values and requirements. Common background checks include criminal record checks, employment history verification, educational verification, and credit reports. Each of these checks provides insight into a candidate’s suitability for the role they are applying for.

One of the most critical checks is the credit report, which offers valuable information about an applicant’s financial behavior. Credit reports can shed light on an applicant’s financial responsibility, decision-making skills, and overall trustworthiness. Understanding why employers review credit reports, particularly for certain job roles, can help businesses make informed and effective hiring decisions.

The Role of Credit Reports in the Hiring Process

Credit reports provide detailed information about an applicant’s financial history, including debts, payment histories, bankruptcies, and credit scores. These reports help employers assess how responsible a candidate may be when handling financial matters, which is especially crucial for positions involving financial management, trust, or sensitive information.

Employers use credit reports for several reasons, including:

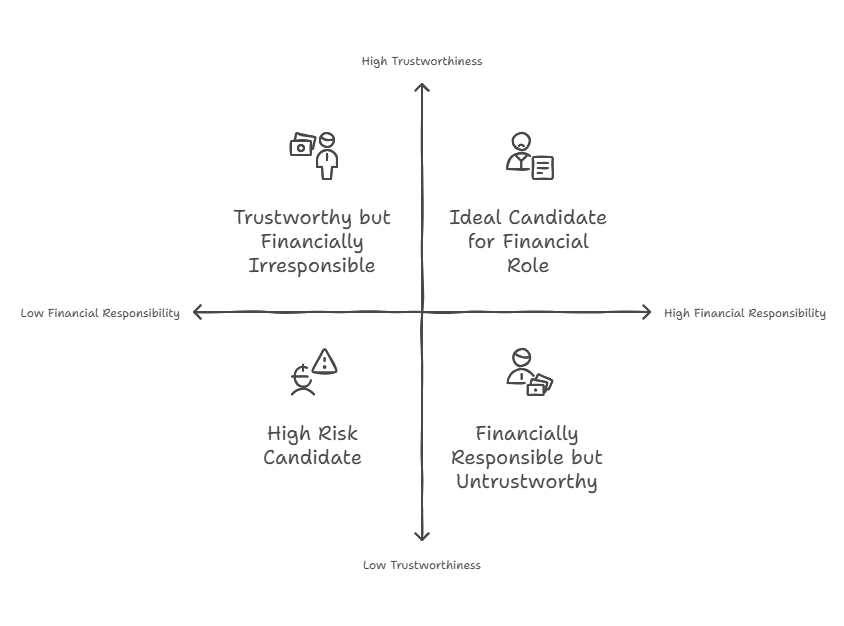

- Financial Responsibility: A clean credit report suggests that a candidate is likely to be responsible when it comes to managing money, which is important for roles involving financial duties.

- Trustworthiness: Employees who handle money, sensitive data, or have access to company resources need to be trustworthy. A candidate’s credit history can offer insight into their reliability.

- Risk Management: Employers may view credit reports as an indicator of potential risks for the organization, especially in positions that involve financial decisions, access to company funds, or customer relations.

Credit reports are also beneficial for reducing fraud risks and ensuring that employees entrusted with sensitive financial information are financially responsible and trustworthy.

The Pros and Cons of Reviewing Credit Reports in Hiring

As with any background check, reviewing credit reports during the hiring process comes with its set of advantages and disadvantages. To help better understand the value of credit checks, here is a comparison table that outlines some of the key pros and cons:

| Pros | Cons |

|---|---|

| ✔ Helps assess financial responsibility | ❌ May introduce bias or discrimination |

| ✔ Identifies trustworthiness for sensitive roles | ❌ May deter qualified candidates with poor credit |

| ✔ Reduces risk for companies in financial roles | ❌ Could delay the hiring process |

The table illustrates how credit reports can be beneficial in assessing a candidate’s financial reliability, especially for positions involving sensitive roles, such as those in finance or management. However, it also highlights potential drawbacks, such as possible bias and delays in the hiring process.

Why Employers Review Credit Reports

Credit reports offer a unique perspective on a candidate’s financial background, which can be essential for employers in certain industries. For example, in roles that involve managing money, credit reports can provide insight into how a candidate might handle financial pressures. On the other hand, candidates with poor credit histories may face challenges in roles that require handling large sums of money or sensitive financial information, as it may indicate a higher level of financial stress or poor decision-making.

Credit checks are particularly important for employers in financial institutions, accounting firms, and other organizations where employees are entrusted with managing company finances or dealing with customer accounts.

At the same time, employers should be cautious about how they interpret credit reports. While financial issues like bankruptcies or overdue debts might be a red flag, it is important to assess each situation on a case-by-case basis to avoid discrimination.

Comparing Credit Report Check Services: RapidhireSolutions vs. Competitors

When conducting credit report checks for hiring, choosing the right background check provider can make a significant difference. It’s not just about getting access to a report—it’s about getting a comprehensive, accurate, and timely service that ensures compliance with regulations and helps mitigate hiring risks. In this section, we’ll compare RapidhireSolutions with a leading competitor, such as HireRight or Checkr, focusing on the quality of credit report checks and the services they offer.

RapidhireSolutions Services: A Quick Overview

RapidhireSolutions specializes in background checks, including credit reports, to help businesses make informed hiring decisions. The company prides itself on providing fast, reliable, and compliant credit report checks that meet industry standards. With a focus on accuracy and efficiency, RapidhireSolutions ensures that businesses get the information they need to assess financial responsibility and minimize risks.

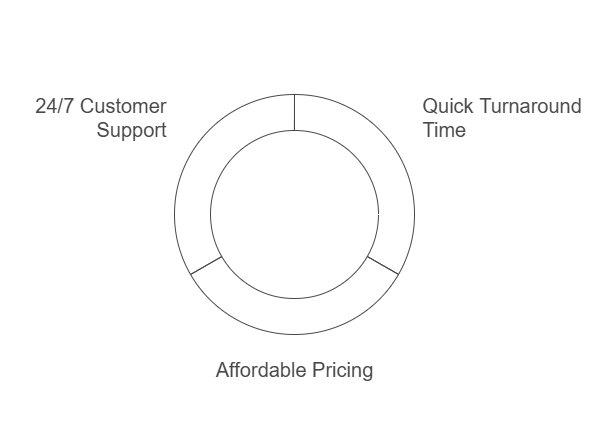

What sets RapidhireSolutions apart is its commitment to providing quick turnaround times, with credit report checks typically completed within 24 hours. This quick processing allows employers to make faster decisions without unnecessary delays. Additionally, RapidhireSolutions offers affordable pricing with no hidden fees, making it an attractive choice for businesses looking for cost-effective background screening solutions.

One of the company’s core strengths is its adherence to compliance standards. RapidhireSolutions ensures that all credit report checks are conducted following the Fair Credit Reporting Act (FCRA) and other relevant regulations, safeguarding both the business and the candidate’s rights during the hiring process.

Pros and Cons Comparison: RapidhireSolutions vs. Other Competitors

When comparing credit report check services, it’s essential to consider factors such as turnaround time, accuracy, cost, and customer support. Below is a pros and cons comparison of RapidhireSolutions and Other Competitors based on these factors.

| Feature/Service | RapidhireSolutions (✔) | Other Competitors (❌) |

|---|---|---|

| Turnaround Time | ✔ 1 day (24 hours) | ❌ 15-20 days |

| Cost | ✔ Affordable | ❌ Higher fees |

| Accuracy | ✔ High accuracy | ❌ Inconsistent results |

| Customer Support | ✔ 24/7 availability | ❌ Limited support hours |

Let’s Dive into a Proper Analysis

The table above highlights the differences between RapidhireSolutions and Other Competitors. RapidhireSolutions stands out in terms of turnaround time, offering credit report checks within just 24 hours, compared to Other Competitors 15-20 day processing period. For businesses looking to make quick decisions during the hiring process, RapidhireSolutions’ speed is a critical advantage.

In addition to faster processing, RapidhireSolutions provides an affordable pricing structure with no hidden fees, which makes it a more cost-effective option compared to HireRight, which tends to charge higher fees for similar services.

When it comes to accuracy, RapidhireSolutions ensures that credit report checks are reliable, helping businesses get a clear and precise picture of a candidate’s financial history. Other Competitors, on the other hand, has been noted for occasional inconsistencies in its reports, which could lead to confusion or incorrect hiring decisions.

Another strength of RapidhireSolutions is its customer support. With 24/7 availability, businesses can always reach out for assistance, ensuring smooth service throughout the background check process. Other Competitors, however, offers limited customer support hours, which may be a challenge for businesses in need of immediate help.

Detailed Pros and Cons of RapidhireSolutions vs. Other Competitors

Pros (RapidhireSolutions):

- Fast turnaround times (1-day processing), ensuring that employers receive timely results.

- Affordable pricing with no hidden charges, making it a cost-effective solution.

- Accurate, reliable credit reports that help businesses make informed hiring decisions.

- 24/7 customer support to ensure employers can access assistance whenever needed.

Cons (Other Competitors):

- Slow processing times (15-20 days), which can delay hiring decisions.

- Higher costs compared to competitors, potentially putting a strain on business budgets.

- Occasional inaccuracies in credit reports, leading to less reliable information.

- Limited customer support hours, which can cause delays when immediate assistance is required.

Why Businesses Should Choose RapidhireSolutions for Credit Report Checks

Choosing RapidhireSolutions for credit report checks brings several benefits that directly impact the quality and speed of the hiring process. The company’s quick turnaround time ensures that employers can move forward with hiring decisions without unnecessary delays, which is essential in a competitive job market.

Moreover, RapidhireSolutions offers affordable pricing without compromising on the accuracy or quality of the reports, making it a smart choice for businesses looking to minimize costs while still obtaining reliable results. The 24/7 customer support further enhances the experience, ensuring that businesses can get help whenever needed.

With all of these advantages, RapidhireSolutions provides businesses with a comprehensive and efficient solution for conducting credit report checks as part of their hiring process.

Legal Considerations for Using Credit Reports in Hiring

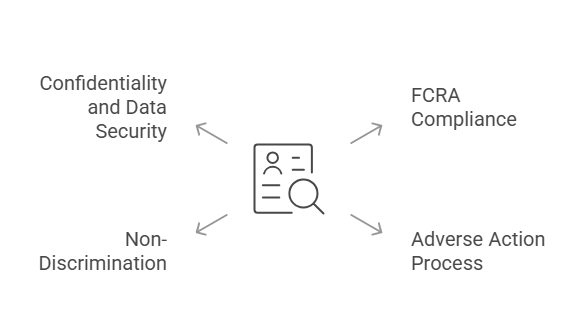

When employers use credit reports as part of their hiring process, they must comply with various legal regulations to ensure fairness and protect candidate privacy. The primary law governing the use of credit reports in hiring is the Fair Credit Reporting Act (FCRA), which ensures that employers use credit reports in a transparent, non-discriminatory, and fair manner.

- FCRA Compliance: The FCRA requires that employers obtain written consent from the applicant before accessing their credit report. This consent must be clear and separate from the job application to ensure transparency. Employers are also required to inform applicants if a decision is made based on the information in their credit report.

- Adverse Action Process: If an employer decides not to hire a candidate based on their credit report, they must follow the adverse action process. This process includes notifying the candidate of the decision, providing a copy of the credit report used, and informing them of their right to dispute any inaccuracies in the report. Employers must also allow a certain time frame for the applicant to respond before finalizing the decision.

- Non-Discrimination: Employers must ensure that credit reports do not contribute to discriminatory hiring practices. The Equal Employment Opportunity Commission (EEOC) has guidelines to prevent discrimination based on factors such as race, gender, and ethnicity. It’s crucial for employers to use credit reports only when relevant to the job role and avoid applying blanket policies that unfairly impact certain groups.

- Confidentiality and Data Security: Handling sensitive information such as credit reports requires strict adherence to data protection laws. Employers must ensure that all credit report data is securely stored and that only authorized personnel have access to it. Failure to protect this data could result in legal consequences and damage to the company’s reputation.

How RapidhireSolutions Ensures Legal Compliance

RapidhireSolutions helps employers navigate these legal requirements by ensuring full compliance with the FCRA and other applicable laws. They provide businesses with a seamless process for obtaining credit reports, ensuring that candidates are notified properly, and all sensitive information is handled securely. This not only protects candidates’ rights but also shields employers from potential legal risks.

Frequently Asked Questions (FAQs)

Why do employers ask for credit reports during hiring?

Employers use credit reports to assess an applicant's financial responsibility and trustworthiness, particularly for positions involving financial duties or access to sensitive company information. A poor credit report may indicate a higher risk for fraudulent behavior or irresponsibility, which can be critical in some job roles.

Can poor credit prevent me from getting hired?

Poor credit doesn’t automatically disqualify a candidate, but it may influence the hiring decision, especially if the role involves financial responsibility or handling company funds. Employers must consider the context of the credit report and any mitigating factors, such as past financial difficulties.

How does a credit report impact hiring decisions?

A credit report can influence hiring decisions by providing employers with insights into an applicant’s financial behavior, which is especially important for positions involving money management, customer relations, or senior-level responsibilities. However, employers are required to consider the full context and follow legal guidelines to avoid discrimination.

How does RapidhireSolutions ensure compliance with credit report laws?

RapidhireSolutions complies with all FCRA guidelines by obtaining written consent from candidates before accessing their credit reports, informing candidates of any adverse decisions based on the report, and maintaining the confidentiality of all sensitive data throughout the process.

Is it legal for an employer to check my credit score?

Yes, employers can legally check your credit report, but only with your consent and for specific job roles where financial responsibility is a factor. Employers must follow all legal guidelines outlined in the FCRA when using credit reports during the hiring process.

Conclusion

Reviewing credit reports is an essential step in the hiring process for certain roles, particularly those requiring a high level of financial responsibility. While these reports provide valuable insight into a candidate’s financial behavior and trustworthiness, employers must adhere to strict legal guidelines to ensure fairness and compliance. By partnering with a reliable background check provider like RapidhireSolutions, businesses can streamline their hiring process while remaining compliant with legal requirements and protecting both employers and candidates.

Choosing the right service provider ensures that credit report checks are accurate, legally compliant, and help businesses make informed hiring decisions. With RapidhireSolutions, employers benefit from fast, accurate, and cost-effective services that enhance the hiring process and minimize legal risks.